Have you noticed fewer “This Week in Earnings” or “Earnings Scorecard” reports in your inbox? The IBES data by Refinitiv, which supplies this information, seems to have had an off week. But let’s put that aside for now and delve into the latest data as we prepare for the upcoming period.

(It’s worth noting that the Refinitiv invoice for providing this data is more punctual than the data itself. But we press on.)

Let’s kick off 2024 with a deep dive into the S&P 500 earnings data, gearing up for potential market implications and a closer look at the economic landscape.

Reviewing S&P 500 Earnings Data

- The forward 4-quarter estimate (FFQE) ended 2023 at $234.60, compared to the $235.77 from mid-Dec ’23.

- The PE on the forward estimate is 20.3x versus the 20x from mid-December ’23.

- The S&P 500 earnings yield (EY) dropped lower, settling below 5% over the last three weeks.

- It’s noteworthy that the actual Q3 ’23 EPS estimate surpassed expectations with a growth rate of +7.5% versus the expected +1.9% on 9/29/23.

- However, the 4th quarter 21023 EPS estimate has declined, now expected to grow at +5.2% compared to an expected +12.7% on 9/29/23.

- It’s essential to recognize that Q3 actual EPS growth marked a substantial “upside surprise” for this past quarter, despite the sharp decline in the anticipated growth rate for the upcoming quarter.

What are the potential implications of the earnings yield and the anticipated Q4 ’23 earnings? A stronger-than-expected 4th quarter ’23 EPS, combined with significant “upside surprises,” could signal a robust US economy, with potential implications for Fed easing in March ’24, depending on the sector.

Let’s not overlook the historical context either. The trajectory of upside surprises in 2022 tapered off as the year progressed, particularly as the Fed raised interest rates, providing valuable insights for the current market landscape.

Insights from Economic Data

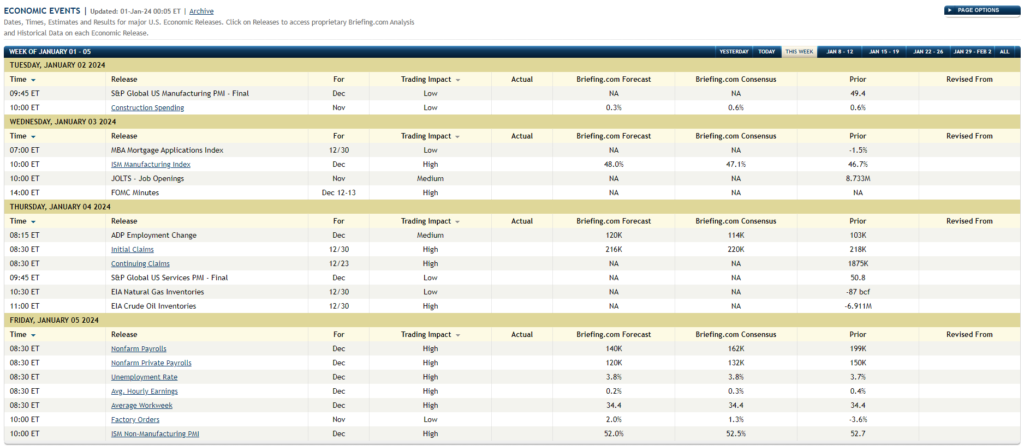

As we look ahead, the focus for the first week of the new year will revolve around employment and jobs data.

- Wednesday, Jan 3 ’24: Keep an eye out for the JOLTS update, providing valuable insights into the job market.

- Thursday, Jan 4 ’24: Expect a double dose of data with the ADP and jobless claims reports.

- Friday, Jan 5 ’24: The December ’23 nonfarm payroll report is anticipated, with significant attention on the net new jobs created and private payroll growth.

It’s fascinating to observe the evolution of US jobs data over the last few decades, offering a broader perspective on the economic landscape. However, the potential volatility associated with the initial release versus the subsequent revisions underscores the complexity of interpreting this data.

The resilience of US economic data is striking, defying the expected weakening amidst significant rate hikes.

Implications from High-Yield Credit

High-yield credit spreads have witnessed an 80 basis point tightening in the last 8 weeks. This trend bodes well for equity enthusiasts, reflecting a positive sentiment in the market, especially for below-investment-grade bonds.

For those rooted in analyzing balance sheets, this tightening of high-yield credit spreads presents an unambiguous positive, spurring enthusiasm among equity bulls.

Reflecting on the Outlook

As we await Walgreens’ (WBA) upcoming report, we brace for potential revelations, particularly with the new CEO appointment, possibly signaling a pivotal shift in dividends and guidance.

The buoyancy in the stock and bond markets early in ’24 gives pause for thought, especially amidst a robust US economy and a Federal Reserve seemingly hesitant to embrace anticipated rate cuts.

Finally, I acknowledge and appreciate the insightful discussions had with readers, particularly Seeking Alpha readers, throughout the year. It’s through such dialogues that one truly gains a broader perspective on the ever-evolving market dynamics.

***

Disclaimer: None of the information presented here constitutes advice or a recommendation. Past performance is no indication of future results, and readers are urged to exercise caution and evaluate their comfort level with portfolio volatility.

All S&P 500 earnings data is sourced from IBES data by Refinitiv, whenever it decides to make a timely appearance. Market dynamics can swiftly change, and it’s crucial for readers to stay attuned to these shifts.

Thank you for your readership.