Dissecting the Bearish Sentiment Towards Applied Digital

With an air of caution tightly enveloping Applied Digital (APLD), deep-pocketed investors are opting for a bearish stance that demands undivided attention. The recent unveiling of public options data by Benzinga has cast a revealing light on the ominous shadows that loom over this stock. While the identities of these investors remain concealed, the significant surge in APLD’s options activity hints at a storm brewing on the horizon.

Options Market Activity: A Closer Look

An unprecedented occurrence of 29 exceptional options activities for Applied Digital has been detected, prompting intrigue and raising eyebrows across the market. The current split in sentiment among heavyweight investors reveals a divided front, with 41% in a bullish camp and 44% contemplating a bearish future. Out of these significant options maneuvers, 4 put contracts amounting to $142,500 and 25 call contracts totaling $1,917,365 have been identified.

Insights into Projected Price Targets

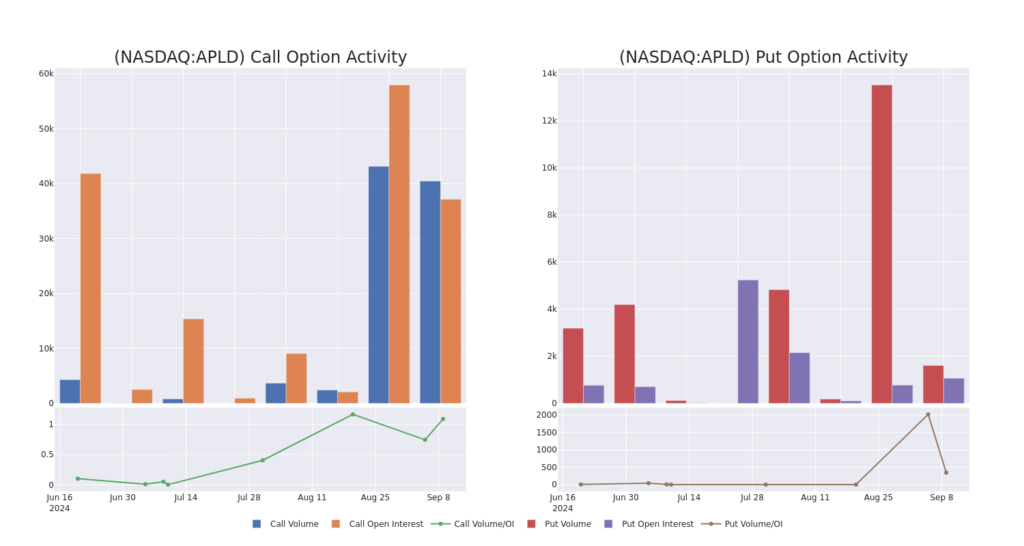

Delving into the Volume and Open Interest showcased by these contracts, it becomes apparent that whales in the market have been circling price targets ranging from $3.0 to $17.0 for Applied Digital over the past 3 months.

Tracking Volume & Open Interest Trends

Currently, the average open interest for Applied Digital options stands at 2248.41, with a robust total volume of 41,575.00. A comprehensive chart mapping the trajectory of call and put option volume and open interest for high-value trades within the $3.0 to $17.0 strike price corridor over the last 30 days provides valuable insights into market movements.

Unveiling the Striking Options Trades

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APLD | CALL | SWEEP | BEARISH | 09/20/24 | $1.0 | $0.95 | $0.95 | $5.00 | $186.7K | 11.5K | 5.1K |

| APLD | CALL | SWEEP | BEARISH | 01/17/25 | $1.8 | $1.75 | $1.75 | $4.00 | $175.0K | 3.3K | 827 |

Exploring the Realm of Applied Digital

Applied Digital Corp stands as a visionary in designing, developing, and managing next-generation digital infrastructure across North America. Catering to industries such as High-Performance Computing (HPC) and Artificial Intelligence (AI), the company operates in segments including Data Center Hosting, Cloud Services, and HPC Hosting. Its core revenue stream flows from the Data Center Hosting segment, predominantly servicing crypto mining clientele.

The Current Landscape for Applied Digital

- Trading with a voluminous churn of 42,561,819 shares, APLD’s price has ascended by a remarkable 42.64%, hinging at $6.49.

- Treading on the knife-edge, RSI indicators depict the stock in a neutral zone oscillating between overbought and oversold territories.

- An impending earnings announcement looms on the horizon, set to transpire in just 28 days.

Expert Perspectives on Applied Digital

Five industry analysts have proffered their wisdom on the stock in the last month, projecting an average target price of $9.4.

- Expressing reservations, an analyst from HC Wainwright & Co. downgrades the stock to Buy, setting a revised target of $5.

- In a stance of unwavering support, an analyst from Roth MKM sustains a Buy rating for Applied Digital, targeting a price of $10.

Trading options is akin to dancing with the devil, offering the allure of grandeur profits amidst perilous risks. Seasoned traders navigate these treacherous waters through continuous learning, strategic maneuvers, leveraging diverse indicators, and vigilantly monitoring market tides. Stay abreast of the latest options trades for Applied Digital to weather the impending storm with aplomb.