Titan Machinery Inc. TITN has solidified its footprint in South Dakota through the acquisition of Scott Supply, Co. The purchase encompasses the assets of one full-line combined Case IH and New Holland Agriculture dealership located in Mitchell, SD. Featuring a rich history since its establishment in 1915, Scott Supply is known for its exceptional customer service and boasts an adept and seasoned team of employees.

The acquisition aligns with Titan Machinery’s goal to expand its operations and strengthen its presence in key markets. Scott Supply reported revenues of approximately $40 million in the fiscal year ending Dec 31, 2023. This strategic move is expected to fortify Titan Machinery’s existing position in this fertile region of eastern South Dakota, enabling the company to carry forward Scott Supply’s legacy and build on it, thus leveraging the potential of this burgeoning market.

The completion of the transaction on Jan 10, 2024, marks a significant advancement for Titan Machinery, underscoring the company’s pursuit of growth and market leadership. The financial details of the acquisition have yet to be disclosed, leaving observers eagerly anticipating to gauge its potential impact on Titan Machinery’s financial performance and market positioning.

While the recent acquisition has fueled optimism about Titan Machinery’s prospects, its recent financial performance has reflected mixed results. While the company reported a record $694 million in total revenues in the third quarter of fiscal 2024 (ended Oct 31, 2023), marking a 4% increase from the year-ago quarter, its earnings per share (EPS) of $1.32 missed the Zacks Consensus Estimate of $1.51. The bottom line also observed a 27% decline from the previous year’s third-quarter EPS of $1.82.

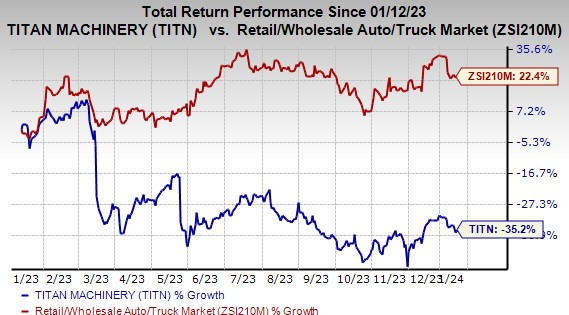

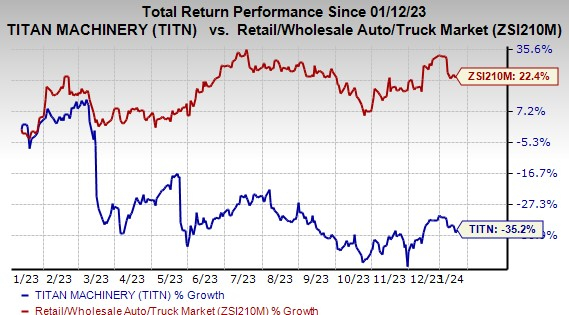

Share Price Performance

Despite the strategic acquisition, Titan Machinery has faced challenges in the stock market. Over the past year, the company’s shares have plummeted by 35.2%, contrasting with the automotive retail and wholesale industry’s 22.4% growth, indicating the uncertainty and volatility surrounding the company’s stock performance amid broader market dynamics.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

As per the Zacks Rank, Titan Machinery currently carries a Zacks Rank #5 (Strong Sell). Amid the challenging scenario, investors are eyeing comparable companies in the Retail – Wholesale sector that bear better-ranked stocks, offering potential opportunities for investment growth.

Some of the notable alternatives in this sector include Abercrombie & Fitch (Zacks Rank #1 – Strong Buy), Amazon.com, Inc. (Zacks Rank #2 – Buy), and American Eagle Outfitters (Zacks Rank #2 – Buy). These companies are resonating positively with investors owing to their strong market positioning and growth potential. Their track records and growth projections underpin the basis for a deeper exploration of their investment prospects, offering investors an enticing array of choices in the current market landscape.

Amid challenges, Titan Machinery’s acquisition of Scott Supply signifies the company’s resolve to navigate through headwinds and capitalize on growth opportunities. The historical performance and potential of similar companies further emphasize the investment climate’s complexities and underline the importance of informed investment decisions amid the volatility and uncertainty that characterize the current market dynamics.

The acquisition underscores Titan Machinery’s intent to harness market opportunities and augment its market presence, riding on the potential synergies of the combined entities. The company’s strategic move not only reflects its commitment to growth but also underscores its adaptability to navigate through dynamic market conditions and leverage expansion opportunities, despite the challenging market environment that clouds its stock performance.