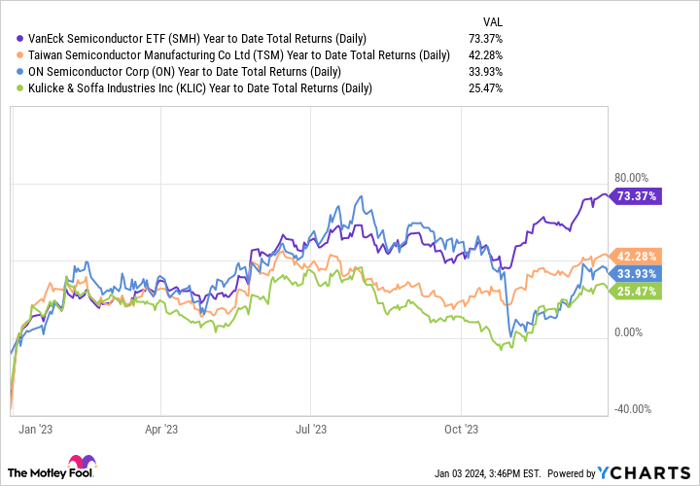

To declare that 2023 stood as a banner year for semiconductor stocks would be a gross understatement. The sector, as delineated by the VanEck Semiconductor ETF (NASDAQ: SMH), catapulted an astounding 73.4% over the year! If you had steered clear of this mercurial yet critical segment of the market, you would have unwittingly forfeited a chunk of the most prodigious gains of the year.

The rise witnessed in 2023 can, to a large extent, be attributed to the artificial intelligence (AI) revolution, which propelled some of the most prominent names in the domain, such as Nvidia and Advanced Micro Devices, to escalate by 239% and 128%, respectively.

Untapped Potential: Taiwan Semiconductor Manufacturing

Despite the meteoric sector-wide surge, Taiwan Semiconductor Manufacturing (NYSE: TSM) experienced a comparatively modest 42.3% uptick during 2023, including its 1.9% dividend. This left the stock trading at a mere 18 times trailing earnings and less than 16 times this year’s earnings estimates. A fairly modest price to pay for the world’s largest foundry, responsible for manufacturing virtually all of the world’s pivotal chips, ranging from Nvidia’s H100 accelerators to AMD’s Instinct MI300 and Apple’s M-series and A-series processors.

The year 2023 witnessed a sag in several pivotal semiconductor markets, including PCs and smartphones, continuing to dominate the chip end markets. TSMC incurred investor disillusionment after the second-quarter earnings, when AI chips manufactured by Nvidia accounted for only a mid-single-digit percentage of the overall industry. This revelation appeared to catch some investors off guard, particularly in light of the monumental growth Nvidia achieved. However, TSMC stock recuperated toward the end of the year, with growth exceeding expectations. The company’s monthly revenue, through November, was only 4.1% shy of 2022’s 11-month revenue, significantly outperforming the anticipated 10% decline.

With the inevitable replacement of the laptops and smartphones purchased during the 2020-2021 pandemic period, most likely by higher-end chips for AI PCs and other sophisticated devices, and with AMD’s CEO Lisa Su elevating the AI chip market outlook to $400 billion by 2027, from an initial forecast of just $150 billion in June, TSMC is poised for robust growth in the ensuing year. The company anticipates AI chips to grow from a mid-single-digit percentage of its revenue to a mid-teens percentage eventually, a conservative estimate in the face of a burgeoning AI market and a revival in other markets.

Resilience Amid Adversity: On Semiconductor

On Semiconductor (NASDAQ: ON) weathered a slowdown in the electric vehicle (EV) market throughout 2023, consequently witnessing a decline in stock value during Q2 and Q3, alongside the reduction in silicon carbide leader On Semiconductor. The alleviation of supply chain shortages in 2021 and 2022, paired with higher interest rates curbing EV demand, led to the deceleration of this market. A late summer report revealed mounting EV inventories at U.S. dealerships, prompting major automakers to curtail their battery and EV manufacturing plans.

On Semiconductor’s Q3 earnings report foretold a lackluster Q4, attributing the slowdown to a significant European customer pausing certain orders. However, fears that the EV market had plateaued may be premature, given that EVs continue to outpace traditional internal combustion engine (ICE) cars in the U.S., Europe, and China. As interest rates stabilize and charging infrastructure advances, customer adoption is expected to rebound. This presents a strategic opportunity for long-term investors in On Semiconductor, given the stock’s valuation at less than 16 times earnings and the company’s prospects of enhancing margins with the optimization of its new 300mm East Fishkill plant.

The Overlooked Gem: Kulicke and Soffa

Amid the AI revolution’s emphasis on producing the fastest, most power-efficient chip at the most advanced node, investors should not dismiss chip-packaging companies such as industry leader Kulicke and Soffa (NASDAQ: KLIC). These enterprises are marginally less glamorous and utilize more standardized machines to interconnect chips on a motherboard or even with each other, often via copper wires or small copper “bumps.”

As chips become increasingly intricate, greater attention will pivot to packaging. Particularly, as power and electricity concerns come to the fore, as more potent chips necessitate greater electricity and generate more heat. AI chipmakers have even started constructing chips made of “chiplets,” which are optimized for

The Rise of ‘Superchips’: Kulicke and Soffa’s Market Position and Potential Value in 2024

Pieces of silicon stitched together, with new, advanced packaging technologies, into “superchips.” For instance, AMD’s MI300 is made out of 13 different chiplets.

A Dominant Position in Advanced Packaging Technologies

Kulicke and Soffa has a dominant market position in “legacy” ball bonder packaging equipment, demand for which fluctuates with cycles. But it has smaller revenue segments in newer up-and-coming technologies, such as thermocompression bonding for chiplets, EV battery packaging, and microLEDs — a new kind of advanced screen that is currently in high-end electronics but could one day eventually spread to smartphones.

The Rollercoaster Ride of Earnings

Not unlike TSMC, Kulicke’s mature business in ball bonding is in a downcycle, causing a massive decline in earnings over the past year, from $7.09 in 2022 to just $0.99 in 2023. But if those are the two extremes, one could argue Kulicke’s average earnings power is around $4 per share. With the stock at just $51.50 with nearly $13.40 in cash on the balance sheet with no debt, the company’s enterprise value (around $38 per share) to average earnings ($4) would be under 10. That’s a cheap stock no matter which way you cut it, making Kulicke and Soffa an under-the radar pick in 2024.

Investing in Taiwan Semiconductor Manufacturing: A Consideration

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this: The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years. Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Billy Duberstein has positions in Apple, Kulicke And Soffa Industries, and Taiwan Semiconductor Manufacturing. His clients may own shares of the companies mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends ON Semiconductor. The Motley Fool has a disclosure policy.