When it comes to stock investing, the story of “The Tortoise and the Hare” offers a timeless lesson. Just like the tortoise who won the race through perseverance and consistency, successful investors often follow a deliberate and steady approach rather than chasing quick gains like the hare.

On Wall Street, there are those who embody the spirit of the hare – reacting impulsively to market movements, often succumbing to stress and anxiety. But the rare breed of investors, the tortoises, approach investing with careful planning and a focus on fundamental data rather than emotional reactions.

Seeking fundamentally superior stocks requires a patient and disciplined strategy, much like the tortoise’s approach to the race. This is where tools like Stock Grader come into play, offering a systematic method to evaluate stocks based on essential factors.

Introducing Stock Grader

Stock Grader, an upgraded version of Portfolio Grader, provides investors with a comprehensive analysis of stocks through Fundamental and Quantitative Grades. By assessing key metrics such as sales growth, operating margins, and earnings momentum, Stock Grader equips investors with the tools to make informed decisions.

Here are eight critical factors that contribute to a stock’s Fundamental Grade:

1. Sales Growth: Great companies consistently drive sales growth to enhance shareholder value.

2. Operating Margin Growth: Expanding margins indicate a company’s ability to maintain profitability.

3. Earnings Growth: Year-over-year earnings growth reflects a company’s financial strength.

4. Earnings Momentum: Rising earnings suggest potential for higher returns on investment.

5. Earnings Surprises: Beating earnings estimates can lead to significant stock price appreciation.

6. Analyst Earnings Revisions: Positive revisions signal confidence in a company’s future performance.

7. Cash Flow: Healthy cash flow demonstrates a company’s financial stability.

8. Return on Equity: Efficient use of shareholder investments is reflected in high returns on equity.

The Quantitative Grade gauges institutional buying pressure, providing insights into market sentiment towards a particular stock. By combining Fundamental and Quantitative Grades, Stock Grader offers a holistic view of a stock’s potential for long-term growth.

For investors looking to navigate the complexities of the market with a steady hand, tools like Stock Grader can be instrumental in identifying opportunities and mitigating risks. Embracing the tortoise mentality in stock investing may not lead to quick wins, but it can pave the way for sustainable and enduring success in the long run.

Unveiling the Stock Grader Tool

Effortlessly tracking the financial pulse of a stock market darling can make a skeptic swoon. For the seasoned investor and the greenhorn trader alike, the unveiling of the Stock Grader tool can feel like receiving the keys to a gleaming financial kingdom.

The Grading System

The allure of the Stock Grader tool lies in the merging of two key metrics: the Fundamental Grade and the Quantitative Grade. Blending these elements results in a Total Grade, graded from A to F. The alphabet soup translates into actionable advice for investors:

- A = Strong Buy

- B = Buy

- C = Hold

- D = Sell

- F = Strong Sell

Unlocking Insights

Picture this: a comprehensive report at your fingertips after plugging in your chosen stock. The Total Grade stands proudly at the top, with the Fundamental Grade and Quantitative Grade neatly following suit. Delve deeper, and you’ll uncover a treasure trove of insights.

Fundamental Grade Details

Beneath the snapshot overview lies the Fundamental Grade, dissected to showcase the evaluation of eight fundamental factors. The Quantitative Grade awaits further down, accompanied by an elucidation of its essence. A company profile and an engaging interactive map flank this valuable information.

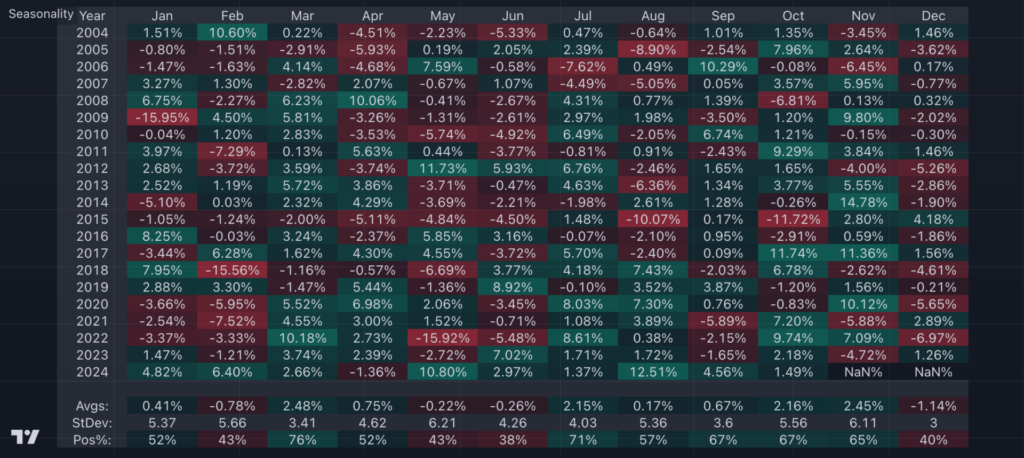

Stock Performance Visualized

Visual learners, rejoice! Behold a chart displaying the stock’s Recent Total Grades on the left, aligned with crucial stock data on the right. This visual aid paints a vivid picture of the stock’s recent performance.

Building Your Portfolio

But wait, there’s more! Stock Grader empowers users to curate a portfolio of beloved assets or prospective watchlist candidates. The process is seamless – hit the ‘Create Portfolio’ button, and a world of endless possibilities unfolds before you.

Subscription Perks

Now, fair warning: Stock Grader is a premium feature catering to esteemed subscribers. To tap into this wellspring of knowledge, a subscription to a premium service like Louis Navellier’s revered ‘Growth Investor’ is essential. Premium tools for premium investors – a match made in financial heaven.

For those yearning to elevate their investment game, the Stock Grader tool beckons. Unlock its potential, seize the reins of financial acumen. Your portfolio’s future could be brighter than the blazing sun of the stock market. Indulge your curiosity, soar to new financial heights.