BlackRock Q4 Review

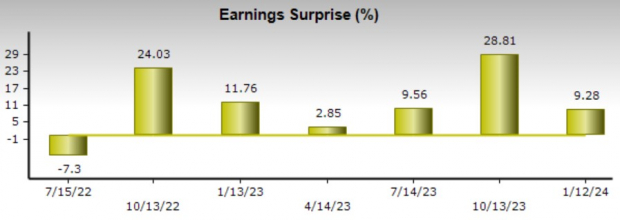

BlackRock has set the Q4 earnings bar exceedingly high, painting the town in shades of green. The financial powerhouse posted a staggering $9.66 per share, trumping the Zacks Consensus of $8.47 a share by 9%. The top line revealed Q4 sales of $4.63 billion, slightly outstripping estimates of $4.62 billion. These results in true Wall Street fashion, soared 7% from the prior-year quarter. Notably, BlackRock has been tackling earnings expectations for six consecutive quarters. Quite the hot streak!

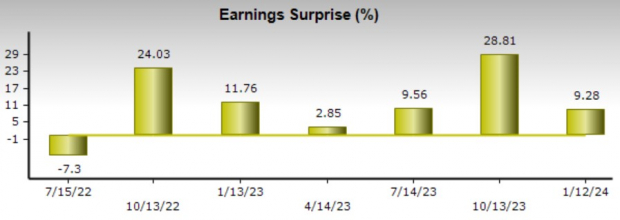

The favorable Q4 results were accompanied by the bold move to acquire Global Infrastructure Partners for a cool $12 billion. This strategic endeavor will yield a leading infrastructure platform valued at over $150 billion – music to investors’ ears. CEO Larry Fink tagged the deal as transformational, ostensibly set to tap into the fastest-growing segments of private markets. Wall Street has got a new beast in town, and it’s called BlackRock.

Goldman Sachs Q4 Preview

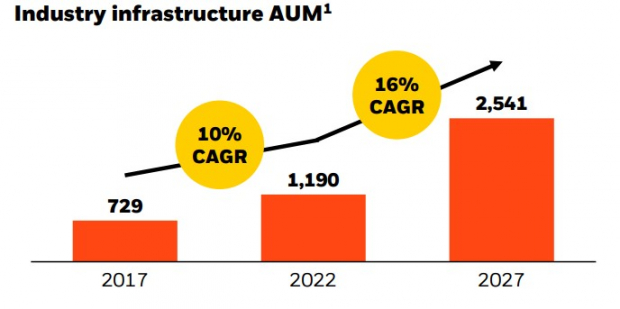

Next in the ring is none other than Goldman Sachs. The crowd watches with bated breath as this financial leviathan gears up for its Q4 earnings report. Investors are hoping for a stellar performance from the Asset & Wealth Management segment, banking on a market recovery. Zacks estimates point to a 4% uptick in Q4 earnings to $3.47 per share, with sales projected to rise 1% to $10.71 billion.

The Zacks ESP (Expected Surprise Prediction) throws its weight behind Goldman Sachs, tipping the scales in favor of meeting earnings expectations. The Most Accurate Estimate holds Q4 EPS at $3.47 per share, a promising sign. However, Goldman Sachs stands at a crossroads, having missed estimates twice in its last four quarterly reports, allocating a portion of concern to spectators in the arena.

What will Goldman Sachs deliver? Will it walk the tightrope of expectations? Or will it surprise the naysayers? Only time will tell. Watch this space for the next big financial clash!

The Battle Between BlackRock and Goldman Sachs

Stock Performance

At the moment, BlackRock’s stock sports a Zacks Rank #2 (Buy), while Goldman Sachs lands a Zacks Rank #3 (Hold). Both investment management firms are expected to sustain their robust top and bottom line figures. BlackRock stands out after beating earnings expectations for a sixth consecutive quarter, indicating a strong track record in the market.

Investment Opportunities

Despite the rankings, the market provides a unique opportunity to examine the potential of each firm. Comparing their current stock performances, including factors like earnings expectations and historical trends, creates a landscape for potential investment in either BlackRock or Goldman Sachs.

The Zacks Perspective

It’s important to consider the current evaluations of both BlackRock and Goldman Sachs through the lense of Zacks Investment Research. However, investors should conduct personal research to fully comprehend the nuances of this financial faceoff.

Past Performances

While history does not dictate future outcomes, it’s worth looking at past performances to gauge the potential resilience of BlackRock and Goldman Sachs in the market. By examining economic downturns, policy changes, and other historical contexts, a broader perspective on their future market positions can be attained.

Comparing Growth Potential

Comparing the growth potential of both investment firms in terms of earnings, market share, and strategic positioning provides insights for potential investment strategies. By delving into these factors, potential investors can make informed decisions about whether to invest in BlackRock, Goldman Sachs, or both.

To read this article on Zacks.com click here.