Traders often explore complex strategies, such as a short straddle, to capitalize on a stock trading within a narrow range, but the risks can be deceptive.

With a short straddle, traders sell both a call and a put, propping two premiums upfront and capping their potential gain.

Nevertheless, while the strategy entices novice traders, the uncovered exposure to unlimited loss—especially around market-moving events like earnings announcements—requires prudent caution.

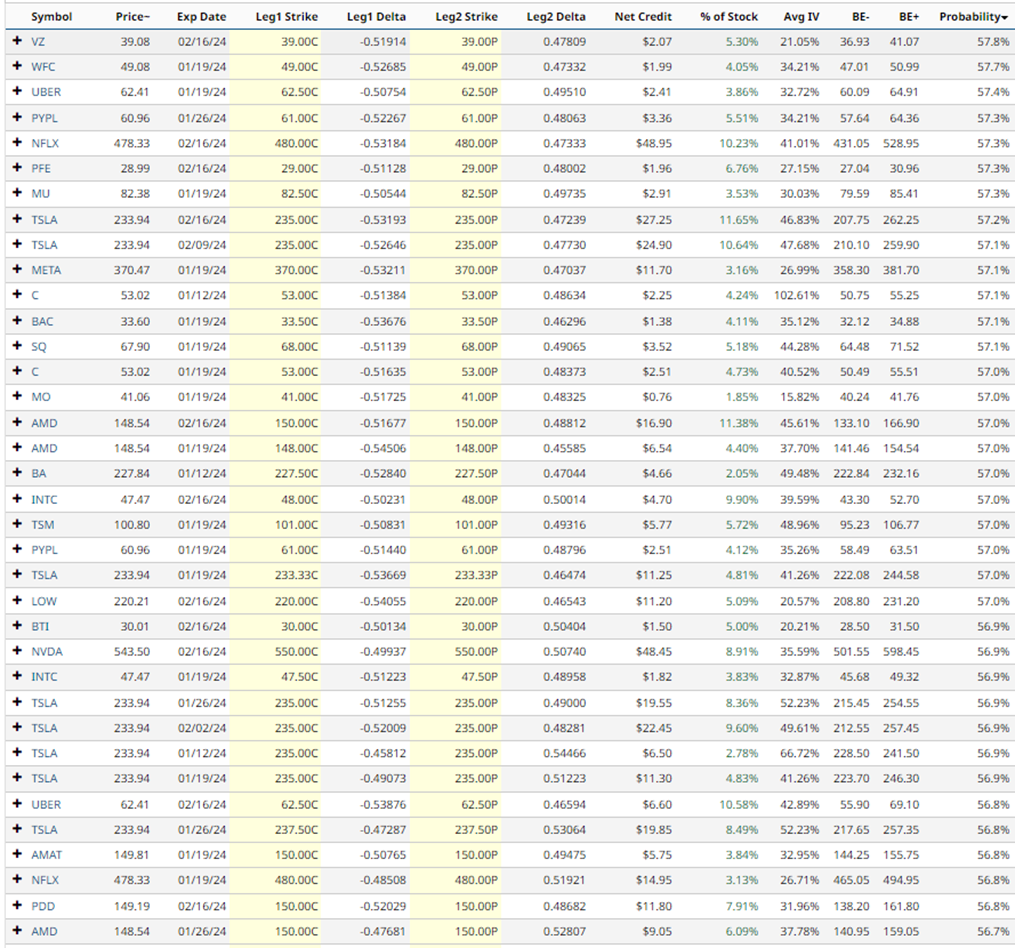

Let’s delve into Barchart’s Short Straddle Screener for January 11th.

Here’s an overview of a couple of short straddle trades on popular stocks.

Verizon Short Straddle Example

For instance, the short straddle on Verizon, using the February 16 expiry, involves selling the $39 strike call and the $39 strike put. The premium received for the trade is $207, equal to the maximum profit but with theoretically unlimited loss. The Barchart Technical Opinion rating stands at 88% Buy with an Average short-term outlook on maintaining the current direction.

Wells Fargo Short Straddle Example

Looking at the short straddle on Wells Fargo, using the January 19 expiry, traders would sell the $49 strike call and the $49 strike put, yielding a $199 premium, equating to the maximum profit but carrying theoretically unlimited loss potential. The Barchart Technical Opinion rating also registers at 88% Buy with an Average short-term outlook on maintaining the current direction.

UBER Short Straddle Example

Another example is the short straddle using UBER, involving the January 19 expiry and the sale of the $62.50 strike call and put, yielding a $241 premium, equating to the maximum profit but carrying theoretically unlimited loss potential. The Barchart Technical Opinion rating boasts a 100% Buy with the strongest short-term outlook on maintaining the current direction.

Mitigating Risk

It is crucial to note that short straddles involve naked options and are highly risky. Therefore, they are not recommended for novice traders.

Prudent position sizing is vital to avoid a substantial loss exceeding 1-2% of the total portfolio value.

Additionally, traders should remain vigilant as the short straddle nears expiration to mitigate early assignment risk. Moreover, stay attuned to earnings dates as stocks can make substantial moves following announcements.

It is imperative to remember that options are inherently risky, and investors can potentially lose their entire investment.

As a disclaimer, this article is for educational purposes only and not a trade recommendation. Traders are advised to conduct due diligence and consult a financial advisor before making any investment decisions.