Johnson & Johnson (NYSE: JNJ) is undeniably one of the most secure dividend stocks globally. The healthcare giant boasts robust cash flow and an impregnable balance sheet, laying a rock-solid foundation for its 3.4%-yielding dividend.

For those seeking a reliable income stream, look no further than the allure of Johnson & Johnson.

Fortress-Like Financial Backing

Backed by the full faith and credit of Johnson & Johnson, the company secures a prestigious AAA bond rating from multiple credit agencies—the mark of financial strength matched only by corporate titan Microsoft. Surpassing the U.S. federal government’s creditworthiness, Johnson & Johnson proves its unparalleled ability to fulfill its financial commitments.

Ending the first quarter with $26 billion in cash and securities against $34 billion in debt, the healthcare giant maintains a mere $7 billion in net debt, translating to an exceptionally low leverage ratio. With a robust free cash flow of $18 billion last year, doubling its net debt coverage, the company solidifies its financial fortitude.

Fueled by its resilient free cash flow, Johnson & Johnson not only covers its $11.8 billion dividend outlay but also reinvests heavily in its operations. By allocating $15.1 billion to research and development, the company further bolsters its strong balance sheet and rewards shareholders with $2.5 billion in stock repurchases.

Reigning Champion of Dividend Stocks

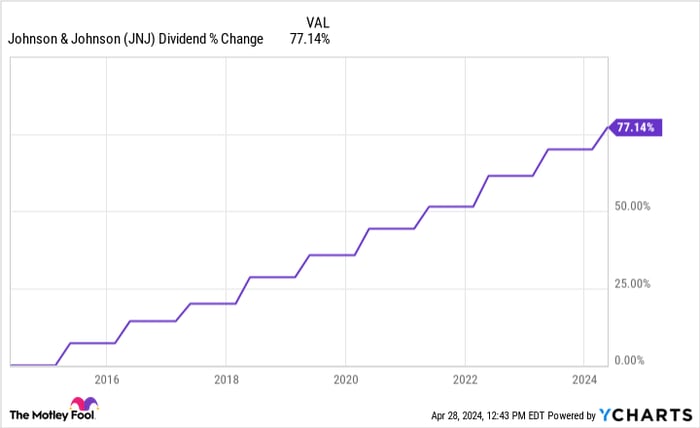

Johnson & Johnson’s financial resilience allows for a sustainable and growing dividend. With a recent 4.2% dividend increase marking its 62nd consecutive year of payout growth, the company cements its status among the coveted Dividend Kings—firms with over 50 years of uninterrupted dividend growth.

Over the past decade, Johnson & Johnson has consistently delivered mid-single-digit annual dividend growth, offering investors a reliable income stream amid market fluctuations.

Notably, Johnson & Johnson’s dividend yield stands at a substantial 3.4%, more than double the S&P 500’s current yield of 1.4%. With an annual dividend income of approximately $34 for every $1,000 invested in its stock, the company provides investors with a lucrative opportunity for long-term wealth accumulation.

Steady Income Outlook

Driven by its long-term growth forecast, Johnson & Johnson anticipates operational sales growth of 5% to 7% annually through 2030. This projection is poised to propel adjusted operational earnings-per-share growth of over 7% annually, supported by organic growth, strategic R&D investments, and accretive acquisitions—a testament to the company’s commitment to sustained profitability.

In a volatile market landscape, Johnson & Johnson shines as a beacon of dividend safety and financial stability, offering investors a bankable income stream while exhibiting a steadfast commitment to shareholder value.