I have always been fascinated by successful investors and their strategies, especially when they have a proven track record. That's why I was excited to learn about investment guru Timothy Stabosz and his winning strategies in the world of finance.

Stabosz has made some impressive calls on companies like Cato Corp and Emmis Communications, recognizing their undervalued assets and potential for turnaround.

His approach focuses on deep value and contrarian investing, with a primary emphasis on the low price/book ratio as a measure of a company's potential.

In this article, we will delve into Stabosz's investment strategy, exploring his use of the price/book metric, his valuation methods, and his outlook on potential returns.

By understanding Stabosz's winning strategies, we can gain invaluable insights for our own investment decisions.

Key Takeaways

- Timothy Stabosz specializes in deep value and contrarian investing, focusing on low price/book as the primary investment criteria.

- He looks for insider open market buying as a positive indicator and focuses on sectors that are highly out of favor in the market.

- Stabosz emphasizes the use of the price/book metric to provide a margin of safety and downside protection.

- He believes in the potential for undervalued companies to experience a turnaround and revert to their mean stock price, citing examples such as Chipotle, Netflix, and Tesla.

Timothy Stabosz's Investment Approach

In my investment approach, I focus on deep value and contrarian investing, emphasizing low price/book as my primary investment criteria. This is because the price/book metric provides a margin of safety and downside protection. I believe that companies selling for less than 1x book, coupled with insider open-market buying, present undervalued opportunities. This metric helps me determine the minimum value and downside potential of a company.

However, it's important to balance price/book with leverage and earnings recovery prospects. While the price/book metric is my favorite, I also consider other factors such as historical earnings and stock price, as they provide insights into turnaround potential.

Successful Calls on Cato Corp. and Emmis Communications

Continuing my successful investment approach, I made notable calls on Cato Corp. and Emmis Communications.

- Cato Corp: The company's previous merchandising strategy caused a decline in sales, but management is reverting back to successful buying methods. Signs of a turnaround are expected in the coming months.

- Emmis Communications: The company sold its St. Louis radio station cluster for $60 million, reducing debt and increasing asset value. The CEO has also signaled the possibility of a dividend or stock buyback, which would increase value for shareholders.

- Both companies present opportunities for investors due to their respective strategies and potential for growth.

Cato Corp's merchandising strategy and turnaround potential, as well as Emmis Communications' asset value and potential dividend or stock buyback, make them compelling investment choices.

Importance of the Price/Book Metric

The significance of the Price/Book metric lies in its ability to provide a margin of safety and downside protection for investors, allowing them to assess the minimum value and potential risks of a company. This metric is particularly important to Timothy Stabosz, as he believes companies selling for less than 1x book with insider open-market buying present attractive investment opportunities.

Stabosz also focuses on exploiting structural inefficiencies to find undervalued stocks. By using the Price/Book metric, investors can determine the minimum value of a company and evaluate its potential risks. Stabosz balances this metric with leverage and earnings recovery prospects, recognizing that it's crucial in identifying undervalued opportunities in the market.

Ultimately, the Price/Book metric plays a vital role in Stabosz's investment strategy, providing him with valuable insights into a company's valuation and potential for turnaround.

Valuation and Turnaround Potential

As an investor, I place great importance on the valuation and turnaround potential of companies. When evaluating troubled companies like Sears Hometown and Outlet Stores, I find the valuation based on price/book and discount to net current assets to be compelling.

Additionally, I look for stabilization in financial results as this can lead to a reversion to the mean in stock price. Historical earnings and stock price also provide insights into the potential for a turnaround.

While the price-to-earnings ratio is important, as a deep value investor, I prioritize the price/book metric. Companies like Chipotle, Netflix, and Tesla have demonstrated dramatic changes in valuation, highlighting the significance of these factors in determining turnaround potential.

Role of Historical Earnings and Stock Price

I prioritize the significant role that historical earnings and stock price play in my investment strategy. By analyzing a company's historical earnings, I gain insights into its financial performance over time, which helps me assess its stability and growth potential. Historical earnings provide valuable information about a company's ability to generate profits and its overall financial health. Additionally, I closely examine the impact of historical earnings on stock price. A company with consistently increasing earnings is likely to have a positive effect on its stock price, indicating investor confidence and potential for future growth. On the other hand, declining or inconsistent earnings can negatively affect stock price, leading to a decrease in investor interest. It is crucial to understand the relationship between historical earnings and stock price when making investment decisions.

| Role of Historical Earnings | Impact on Stock Price |

|---|---|

| Insights into financial performance | Indicates stability and growth potential |

| Assessing profitability and financial health | Reflects investor confidence |

| Positive effect on stock price with increasing earnings | Decrease in investor interest with declining earnings |

| Crucial information for investment decisions | Understanding relationship between earnings and stock price |

Outlook for Cato Corp's Potential Returns

Cato Corp's potential returns look promising based on Timothy Stabosz's investment strategy. Here are three key points to consider:

- Cato Corp's EPS projection: Stabosz expects the company to return to an EPS of $2.00-2.50 within a few years. This suggests potential growth in earnings, which could positively impact the stock price.

- Cato Corp's dividend stability: The company offers a $1.32 dividend, which has remained flat or increased for the last 25 years. This indicates a consistent and stable dividend policy, which can be attractive for income-seeking investors.

- Turnaround potential: Stabosz believes that Cato Corp is showing signs of a turnaround, with management reverting back to successful buying methods. If the company successfully implements these strategies and experiences a recovery in sales, it could lead to an increase in the stock price.

Revised Price Target for Emmis Communications

After analyzing the data, I'm pleased to reveal a revised price target for Emmis Communications. As an investment guru specializing in deep value and contrarian investing, I've determined that Emmis Communications' turnaround prospects are promising.

The stock price of Emmis Communications is currently undervalued, trading at less than one-third of its breakup value. This presents a compelling opportunity for investors seeking to capitalize on the company's potential recovery.

With the recent sale of the St. Louis radio station cluster for $60 million, Emmis Communications has reduced its debt and increased its asset value. Furthermore, the CEO has hinted at the possibility of a dividend or stock buyback, which would further enhance value for shareholders.

Based on these factors, my revised price target for Emmis Communications is in the range of $6-8 within the next 12 months.

Compelling Valuation Opportunity With Sears Hometown and Outlet Stores

There is a compelling valuation opportunity with Sears Hometown and Outlet Stores, presenting a potential for a reversion to the mean in stock price. This presents an attractive opportunity for investors seeking a turnaround potential.

Here are three key points to consider:

- Valuation Opportunity: Sears Hometown and Outlet Stores are currently undervalued based on their price/book and discount to net current assets. This suggests that the stock is trading at a significant discount to its intrinsic value, making it an attractive investment opportunity.

- Turnaround Potential: A stabilization in the company's financial results could lead to a reversion to the mean in stock price. Historical earnings and stock price trends provide insights into the potential for a turnaround in the future.

- Stock Price Reversion: Companies with compelling valuations, such as Chipotle, Netflix, and Tesla, have experienced dramatic changes in their stock prices over time. This suggests that if Sears Hometown and Outlet Stores can successfully execute their turnaround strategy, there's potential for the stock price to revert to higher levels.

Frequently Asked Questions

What Is Timothy Stabosz's Investment Track Record and Overall Performance?

Timothy Stabosz's investment track record includes successful calls on undervalued stocks like Cato Corp and Emmis Communications. He identifies insider open market buying as a positive indicator, which helps him make winning investment decisions.

How Does Timothy Stabosz Identify Insider Open Market Buying as a Positive Indicator?

When analyzing insider trading, I identify open market buying as a positive indicator. It's a valuable market signal that suggests insiders have confidence in the company's future prospects, which can be a positive boost for the stock.

Can You Provide Examples of Other Companies That Have Experienced Dramatic Valuation Changes Similar to Chipotle, Netflix, and Tesla?

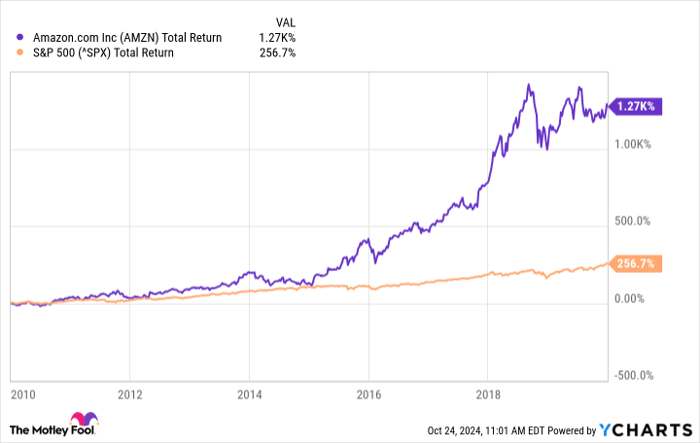

Companies like Uber and Amazon have experienced dramatic valuation changes similar to Chipotle, Netflix, and Tesla. Market trends, such as the rise of ride-sharing and e-commerce, have significantly impacted their valuations in recent years.

How Does Timothy Stabosz Determine the Minimum Value and Downside Potential of a Company Using the Price/Book Metric?

Determining value and downside potential of a company is done by assessing the price/book metric. It provides a margin of safety, downside protection, and helps determine the minimum value and downside potential of a company.

Does Timothy Stabosz Consider Any Other Metrics or Factors Besides Price/Book When Evaluating Investment Opportunities?

When evaluating investment opportunities, Timothy Stabosz considers factors beyond price/book. His investment track record shows success in spotting positive indicators like insider open market buying and analyzing dramatic valuation changes in other companies. This helps him determine the minimum value and downside potential.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Very interesting topic, regards for posting.Blog money

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/de-CH/register?ref=UM6SMJM3

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.com/join?ref=P9L9FQKY

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/en-IN/register-person?ref=UM6SMJM3

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.