Nvidia (NASDAQ: NVDA) proved to be the quintessential stock to capitalize on the burgeoning demand for artificial intelligence (AI) computing throughout 2023. The company, a leader in graphics processing units (GPUs), witnessed an unprecedented surge in growth, with an astonishing 206% year-over-year increase in revenue in the fiscal third quarter, propelling the stock by a staggering 238% over the year. Such meteoric rise is a rarity for a behemoth like Nvidia with billions in annual revenue. The soaring demand for AI chips undoubtedly fueled this extraordinary growth, sparking inquiries among prospective investors about the remaining potential for upward movement in 2024, particularly as Nvidia’s guidance points to a deceleration in growth.

Assessment of Key Risk Factors for 2024

While the bulk of Nvidia’s stock appreciation occurred in the first half of the year, the latter half, since the end of June, has seen a modest 16% increase. Looking ahead to 2024, several factors could weigh on the stock moving forward.

The imposition of chip export constraints to China and other nations by the U.S. government has injected uncertainty into Nvidia’s near-term momentum. Recently expanded to include Vietnam and other countries where up to a quarter of Nvidia’s data center business had been concentrated, these restrictions pose a palpable challenge. However, management remains optimistic about countering this headwind with robust growth in alternative regions in the short run.

Furthermore, the constrained supply of AI chips, coupled with rival tech companies’ efforts to develop their own processors, presents another risk. Companies such as Alphabet, Microsoft, and Intel have introduced their own chips boasting superior price-performance ratios compared to Nvidia’s expensive H100 and H200 GPUs. Yet, none of these alternatives have managed to match the sheer power offered by Nvidia’s data center chips, which have become the benchmark for all major cloud service providers.

A potential near-term threat could emanate from Advanced Micro Devices (AMD), which has recently launched new data center GPUs tailored for AI workloads. Nevertheless, AMD’s projected revenue of $2 billion from these GPUs in 2024 pales in comparison to Nvidia’s prowess.

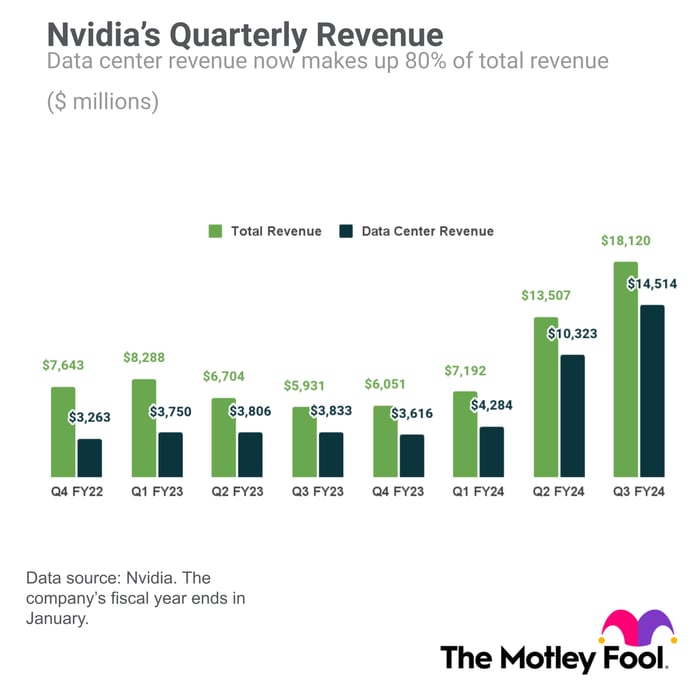

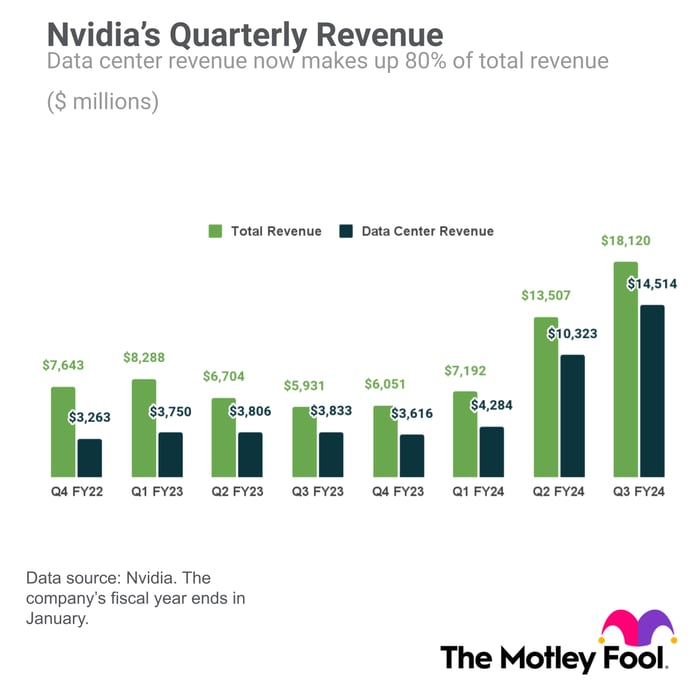

Nvidia’s data center revenue reached over $14 billion in the fiscal third quarter alone, translating to an annualized rate of $56 billion.

Nvidia anticipates total revenue of approximately $20 billion in fiscal Q4, a substantial leap from just $6 billion in the year-ago quarter. This momentous surge in revenue has undeniably been a boon for the company’s profits – a factor that alone could justify further gains for the stock in 2024.

Evaluating Growth and Valuation in 2024

While Nvidia’s guidance indicates a reduced growth rate compared to the previous quarter, the market foresees a deceleration in growth in the year ahead. Nevertheless, the stock’s valuation remains compelling, considering Nvidia’s profit expansion.

Advanced AI chips yield higher margins than other chip sales, thus fueling Nvidia’s bottom line, with earnings per share skyrocketing by a staggering 1,274% year over year in the last quarter.

Currently trading at merely 25 times forward earnings estimates, Nvidia’s forward P/E ratio represents a bargain for a company serving a rapidly expanding AI market.

AI stands as one of the most colossal growth opportunities in recent history, permeating products and services that consumers use on a daily basis. Nvidia stands out as a premier AI stock that every investor should contemplate adding to their nest egg.

Should one consider investing $1,000 in Nvidia at this juncture?

Before delving into Nvidia stock, ponder this:

The Motley Fool Stock Advisor analyst team has identified what they believe to be the 10 best stocks to buy now… and Nvidia didn’t make the cut. The 10 stocks in question hold the potential to deliver substantial returns in the years to come.

Stock Advisor furnishes investors with an accessible blueprint for success, including guidance on portfolio construction, regular analyst updates, and two fresh stock picks each month. Since 2002, the Stock Advisor service has surpassed the S&P 500’s return by more than threefold*.

*Stock Advisor returns as of December 18, 2023