Professional gamblers will tell you that chasing losses can lead to financial ruin. Basically, chasing losses happens when someone tries to recoup losses quickly by making increasingly larger bets, assuming that “luck” must eventually change. The same theory applies to investing. Sometimes, investors continue to put money into the same stock as it falls, assuming it must eventually rebound. Many never do. Although still dicey, this strategy is better suited to the highest-quality companies, for example, Microsoft (NASDAQ: MSFT). Doing it with the real estate investment trust (REIT) Medical Properties Trust (NYSE: MPW) is perilous.

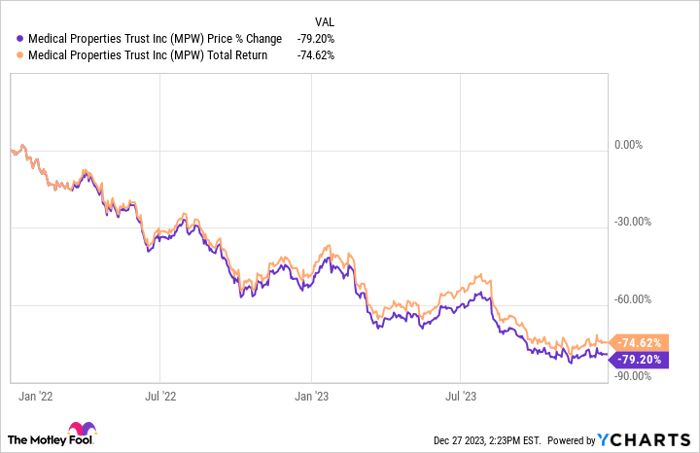

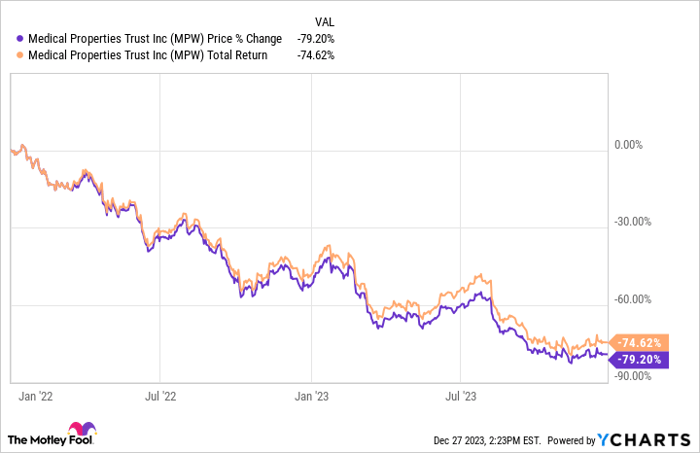

Medical Properties Trust is hugely popular with retail investors and heavily covered by analysts that cater to this crowd. Part of the allure is its high yield, currently almost 18%. But, as I have written in detail here, dividend growth is often much better for investors than high yields. Stocks often have high yields because they are lower quality or riskier. This causes the stock price to drop, and the market demands a yield much higher than average to own it. As shown below, Medical Properties Trust has lost 75% of investors’ money since the beginning of 2022, even when the massive yield is included.

The problems with this REIT are many, including reliance on a few tenants, a major tenant with financial issues, and needing to sell off assets to service its debt. The dividend was cut nearly in half in August.

There are better dividend options. Here are two to consider.

Why Vici Properties is a Wiser Investment

Some of the most famous properties in the world line the Las Vegas Strip, like Caesars Palace, MGM Grand, The Venetian, Mandalay Bay, and many more. Companies such as Caesars Entertainment (NASDAQ: CZR) and MGM Resorts (NYSE: MGM) don’t own them. Instead, the real estate investment trust Vici Properties (NYSE: VICI) does. Vici also owns other famous properties, like Chelsea Piers in New York. It holds 92 properties in 26 states and one Canadian province.

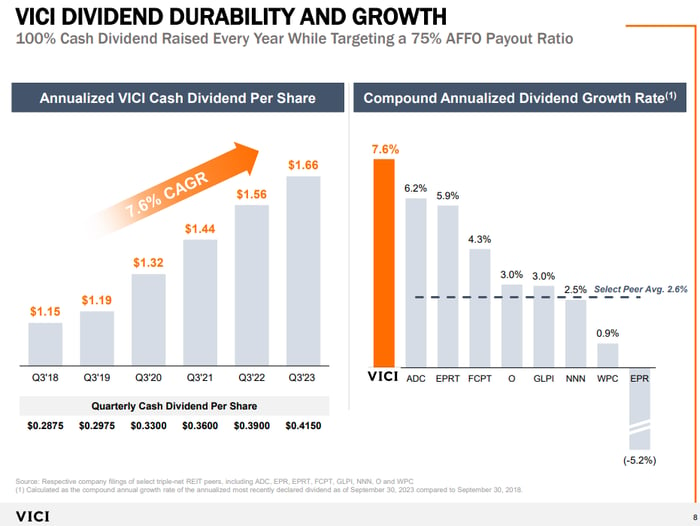

One advantage to being the landlord is that revenue is consistent despite economic challenges. Vici collected 100% of rents while many casinos were closed during the pandemic of 2020. It even raised the dividend during this time. The dividend has been increased every year since the trust’s inception in 2018 and yields more than 5% now. Its recent growth rate tops many in the industry, as shown below.

Source: Vici Properties

The lease agreements between Vici and its tenants are long, with an average of 42 years, so it doesn’t have the same worries about occupancy that a typical office building or shopping center REIT might. Most leases are also tied to inflation; rents increase along with the consumer price index (CPI). This is critical for keeping up with rising prices and providing investors with an increasing dividend.

Unlike MPW, Vici isn’t selling assets. It is buying more and expanding outside gaming to include golf resorts, bowling alleys, lodging, and international opportunities. The expansion adds to Vici’s revenue and boosts its ability to continue its industry-leading dividend growth rate. Vici is an excellent option for dividend investors.

The Case for Investing in Booking Holdings

Perhaps you aren’t a dividend investor, or you are but want to diversify a bit. Booking Holdings (NASDAQ: BKNG) deserves a look. Booking is highly profitable and produces tons of free cash flow (FCF) — or cash flow after business investments and capital expenditures — but it uses it differently than dividend stocks.

Booking is the world’s largest online travel booking service and owns brands like Booking.com, Priceline, KAYAK, and OpenTable. It also competes with Airbnb (NASDAQ: ABNB) for short-term rental bookings. However, Booking focuses on rentals available through property managers rather than individual hosts.

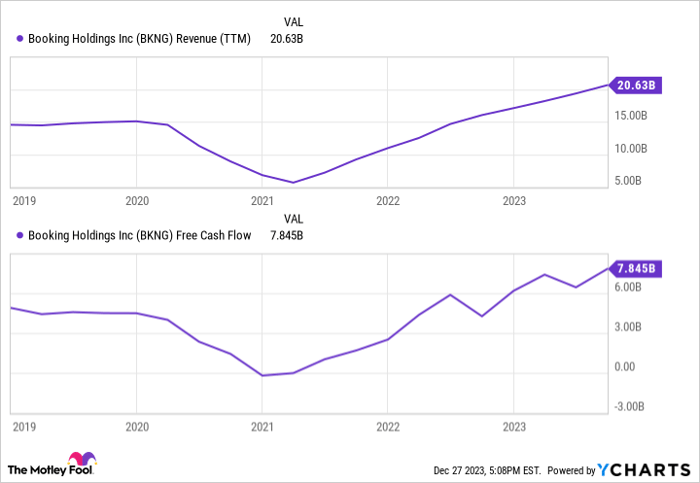

Booking’s revenue and free cash flow dipped during the pandemic due to the travel slowdown but rebounded to record levels, as shown below.

BKNG Revenue (TTM) data by YCharts

Booking can generate this huge 38% FCF margin because the business is very capital-light, meaning it doesn’t spend much capital on property and equipment (capital expenditures, also known as capex). Capex doesn’t appear on the income statement as an expense, but it reduces the cash available to issue dividends, invest in growth, or repurchase stock.

Through the third quarter of 2023, only $251 million, or 1.5% of revenue, was used for capex. This frees up money that the company is using to repurchase its stock. Many investors (including me!) prefer it when companies repurchase stock.

The Impressive Climb of Booking Holdings’ Stock Buyback Program

Boosting Shareholder Value

Booking Holdings is making waves in the financial world with its staggering buyback program, which is proving to be a bonanza for shareholders. By opting for stock repurchases over dividends, the company is effectively reducing the number of shares available in the market. This strategic move not only bolsters the value of the remaining outstanding shares but also positions the company for favorable long-term growth.

A Decisive Fiscal Maneuver

Since January 2022, Booking Holdings has committed a whopping $14.5 billion to buybacks, resulting in a remarkable 13% reduction in the shares count. Such a substantial decrease is indicative of the company’s confidence in the sustained upward trajectory of its stock.

Fair Valuations and Prudent Investment

Despite the fluctuating price-to-earnings (P/E) ratio brought on by the pandemic, Booking’s current P/E ratio of 25 is notable. Comparatively lower than Expedia and higher than Airbnb, the valuation is reasonable considering Booking’s strong profitability, escalating revenue, and exceptional free cash flow. However, amidst the market’s meteoric rise, employing a dollar-cost averaging strategy is advised to navigate near-record levels.

Cautious Investment Considerations

Conversely, Medical Properties Trust has not been favorable to investors, prompting a call for alternatives such as Vici Properties and Booking Holdings as prospective investment avenues.

Timely Investment Insights

Considering a potential investment in Vici Properties warrants careful consideration, especially in light of advice from the Motley Fool Stock Advisor analyst team. It is important to note that while Vici Properties did not feature among their top picks, the Stock Advisor service provides invaluable guidance on portfolio construction and delivers consistent updates from analysts, potentially offering investors a competitive edge.

*Stock Advisor returns as of December 18, 2023

Final Thoughts

In conclusion, amidst the dynamic investment landscape, Booking Holdings’ robust buyback program exudes a sense of fiscal prudence and investor-centric focus, positioning the company favorably for sustained growth and shareholder value ascension.