U.S. stocks traded mixed midway through trading, with the Nasdaq Composite gaining more than 1% on Monday.

The Dow traded down 0.19% to 37,396.28 while the NASDAQ rose 1.20% to 14,698.88. The S&P 500 also rose, gaining, 0.55% to 4,722.93.

Check This Out: Don’t Miss These 3 Consumer Stocks With Over 3% Dividend Yields From Wall Street’s Most Accurate Analysts

Market Movement

Information technology shares jumped by 2% on Monday.

In contrast, energy shares fell by 2.2% on the same day.

Top Business News

Commercial Metals Company CMC posted upbeat earnings for its first quarter on Monday.

Commercial Metals reported adjusted earnings of $1.63 per share, surpassing market estimates of $1.45 per share. The company’s quarterly sales came in at $2.00 billion versus estimates of $1.89 billion.

Stocks On The Rise

Harpoon Therapeutics, Inc. HARP shares shot up 112% to $22.40 after Merck announced it will acquire the company for $23 per share in cash.

Shares of Ambrx Biopharma Inc. AMAM got a boost, surging 100% to $27.32 after Johnson & Johnson announced it will acquire the company in an all-cash merger for a total equity value of approximately $2 billion.

Spectaire Holdings Inc. SPEC shares were also up, gaining 43% to $2.41.

Stocks On The Decline

LumiraDx Limited LMDX shares dropped 43% to $0.0195. LumiraDx announced its securities will be suspended from trading on Nasdaq at the open of business on Jan. 9th.

Shares of Dada Nexus Limited DADA were down 37% to $1.9999. Dada Nexus said in the course of its routine internal audit, certain suspicious practices were identified that may cast doubt on certain revenues from the company’s online advertising and marketing services in 2023.

Solo Brands, Inc. DTC was down, falling 38% to $3.6850 after the company lowered full year 2023 revenue guidance below estimates.

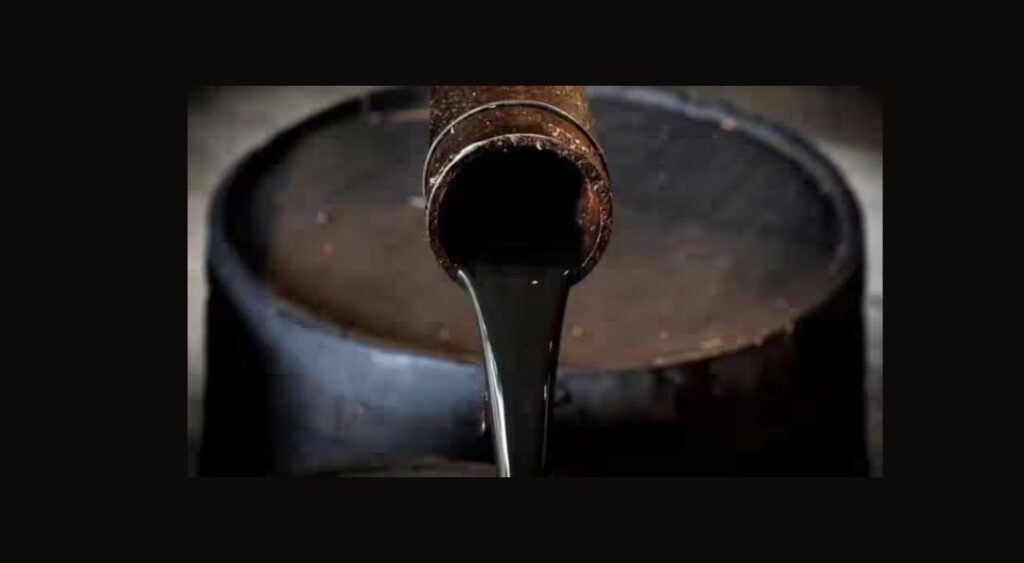

Commodity Trends

In commodity news, oil traded down 4.9% to $70.23 while gold traded down 0.6% at $2,038.30.

Silver traded up 0.3% to $23.38 on Monday while copper rose 0.3% to $3.8190.

European Market Update

European shares were mostly higher today. The Eurozone’s STOXX 600 rose 0.38%, London’s FTSE 100 rose 0.06% while Spain’s IBEX 35 Index rose 0.44%. The German DAX rose 0.74%, French CAC 40 rose 0.40% while Italy’s FTSE MIB Index rose 0.42%.

The consumer confidence indicator in the Eurozone increased by 1.9 points from the prior month to -15 in December, while economic sentiment indicator climbed to 96.4 in December from the revised reading of 94.0 in the earlier month. Retail sales in the Eurozone fell by 0.3% from the prior month in November versus a revised 0.4% increase in October. Factory orders in Germany increased by 0.3% month-over-month in November, while Germany’s trade surplus widened to EUR 20.4 billion in November versus a revised EUR 17.7 billion in the prior month.

Asia Pacific Market Recap

Asian markets closed lower on Monday, with Hong Kong’s Hang Seng Index falling 1.88% and China’s Shanghai Composite Index falling 1.42%. India’s S&P BSE Sensex, meanwhile, fell 0.93%.

Chinese foreign exchange reserves increased to $3.238 trillion in December from $3.172 billion in the prior month.

Economic Indicators

Data on consumer credit for November will be released at 3:00 p.m. ET.

Now Read This: How To Earn $500 A Month From Acuity Brands Stock Ahead Of First-Quarter Earnings Report