Scrutinizing Market Declines

The recent 10% dip in the S&P 500 index has stirred up quite a storm in the financial landscape. While some attribute this descent to poor jobs data, a closer examination reveals that the market had begun its descent even before these figures surfaced. So, dismissing this as the root cause seems simplistic.

Much chatter revolves around the unwinding of the carry trade as the primary trigger for the market decline. Various articles dissecting this theory flood financial platforms, leading many investors to echo this sentiment as the indisputable rationale behind the market’s movements.

However, how many delved into the veracity of this claim? Or did the majority merely imbibe this information without scrutiny, parroting it in their social circles as an established truth?

Unveiling Misinformation

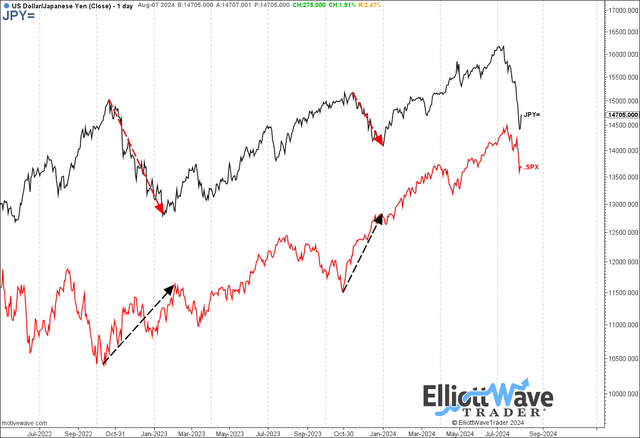

A chart contrasting the movements of the carry trade with the SPX index sheds light on the situation, showcasing three instances of notable yen declines within the past two years. Surprisingly, during two of these episodes, the SPX was actually on an upward trajectory. Consequently, can we genuinely attribute the recent decline to the unwinding of the carry trade, or is this correlation purely coincidental?

The prevalence of misinformation within financial media creates a breeding ground for inaccuracies to masquerade as facts. This misinformed narrative trickles down to casual conversations, eventually solidifying as the gospel truth regarding market dynamics.

Revisiting Prechter’s Insights

Quoting Robert Prechter from his seminal work on The Socionomic Theory of Finance, there is a poignant reminder to skeptically approach news causality within the financial realm. The tendency to mechanically link market fluctuations with external events often overlooks the subtleties of human psychology driving these movements.

Long-Term Market Outlook

Reflecting on historical trends, my longstanding projection for the bull market’s zenith hovers around the 5350-6000SPX range. Though the 2021 pullback instigated hesitancy, subsequent market dynamics steered my attention towards higher targets.

Presently, signs of a potential crash-type structure manifest in the markets. The upcoming weeks hold the key to deciphering whether we are embarking on a long-term bear market journey or if an ascent to the 5840SPX echelon awaits as the final hurrah of this protracted bull market.