Recent market turbulence seems to be giving way to brighter days ahead. Fresh ‘Goldilocks’ jobs data has invigorated investor sentiment, propelling expectations of a significant summer rally.

A Promising Trio Emerges

The confluence of robust earnings, a dovish stance from the Federal Reserve, and soft economic indicators paints a rosy picture for an imminent stock market surge.

The market has been on a tear in response, with triple-digit gains becoming the new norm. The resurgence in stock prices signals a renewed vitality in the equities arena.

As we progress through May, the momentum is expected to continue with upbeat earnings driving estimates higher. Additionally, softer inflation data on the horizon, coupled with a cooling labor market, may pave the way for serious Fed rate cut deliberations.

This unfolding scenario could culminate in a rate cut by the Fed in July, potentially triggering a massive upswing in stock prices.

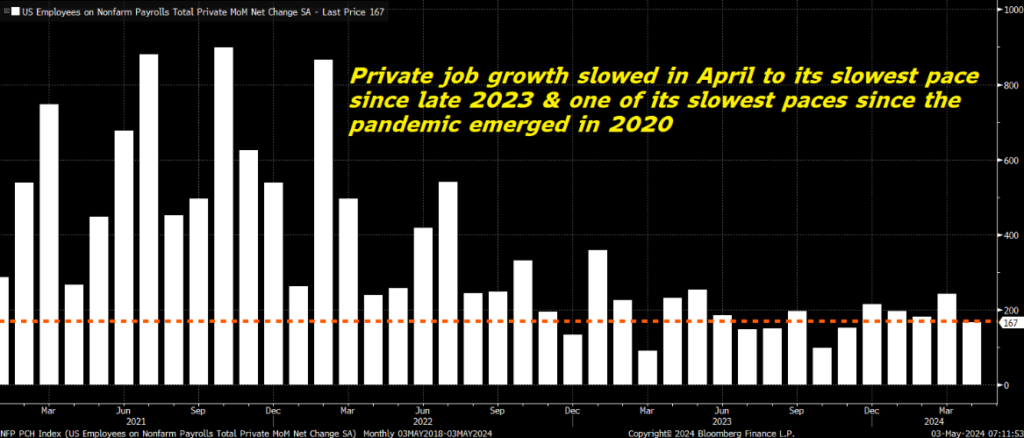

Assessment of April’s Jobs Data

Overall, the outlook appears positive for stocks in the coming months as anticipation builds around the Fed’s impending rate decision, likely fueling the market rally even further.

On the whole, the sentiment is undeniably bullish. This optimism reflects in recent buying activities geared towards positioning portfolios for the anticipated market upsurge.

With newfound enthusiasm in the air, the envisioned growth of selected stocks appears poised for takeoff.

Curious about the specific stocks being targeted for this anticipated surge? Dive into the details to stay ahead of the curve!

On the date of publication, there were no disclosed positions in the securities referenced.

P.S. For more of Luke’s market insights, check out the latest issue available on Innovation Investor or Early Stage Investor subscriber sites.