Alibaba Group Holding BABA and its Chinese hyperscalar rivals are adapting to regulatory pressures and a lackluster economy by breaking down barriers between them.

Alibaba now permits merchants on its e-commerce platforms to utilize logistics services from competitor JD.com Inc JD to drive growth in challenging times.

JD Logistics, with its vast network of automated warehouses and extensive delivery workforce, directly competes with Alibaba’s Cainiao Smart Logistics Network.

Exploration of Options: Alibaba And Baidu Bet Big On Autonomous Driving, Back $700M Horizon Robotics IPO

JD Logistics announced that sellers on Alibaba’s prominent platforms, Taobao and Tmall, can now access a wide array of logistical services, spanning warehousing to shipping, as per SCMP reports.

Sellers have the option to select JD.com as their preferred courier service, allowing consumers to seamlessly track deliveries through Alibaba’s interfaces.

While the two companies have historically been at odds, recent regulatory scrutiny and economic headwinds are prompting China’s tech giants to rethink their strategies.

The trend towards more collaborative ecosystems is gaining traction. Tencent Holdings, for example, recently enabled direct shopping on Alibaba’s Taobao through the WeChat app. Additionally, Taobao and Tmall will soon support WeChat Pay.

China is contemplating a 6 trillion yuan fiscal stimulus (~$850 billion) through ultra-long special treasury bonds over the next three years following interest rate cuts, aimed at spurring economic growth.

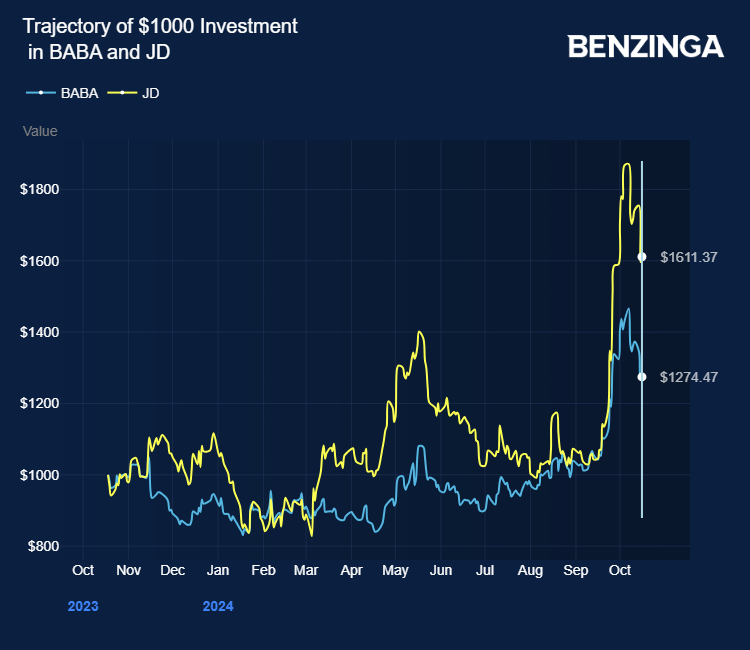

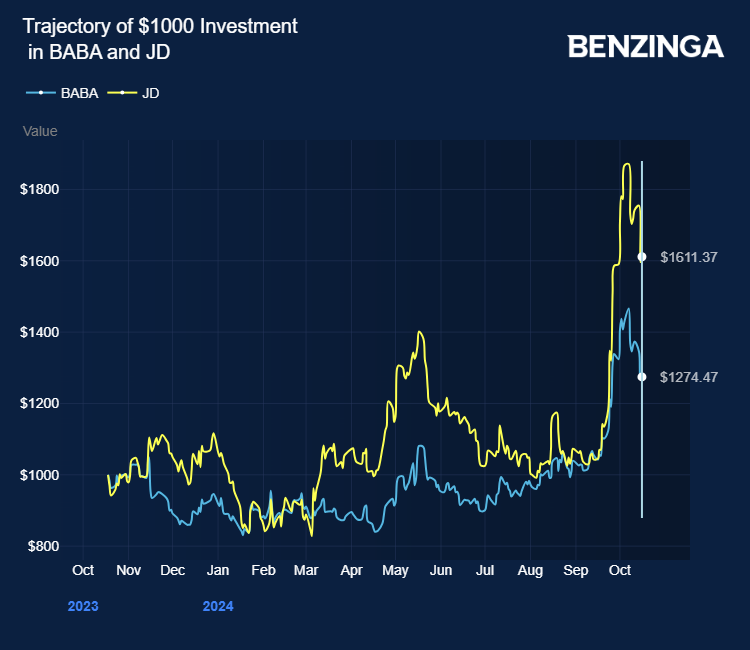

With news of stimulus initiatives, both Alibaba and JD.com stocks have surged by 21% to 51% over the past month.

Investors seeking exposure to China’s tech landscape can consider Alibaba through SPDR NYSE Technology ETF XNTK and Invesco Nasdaq Internet ETF PNQI.

Stock Performance Update: At the latest check on Thursday, BABA stock dipped by 0.86% to $101.29, while JD showed a decline of 1.95%.

Diving Deeper:

Image by Tada Images via Shutterstock

Market News and Data brought to you by Benzinga APIs