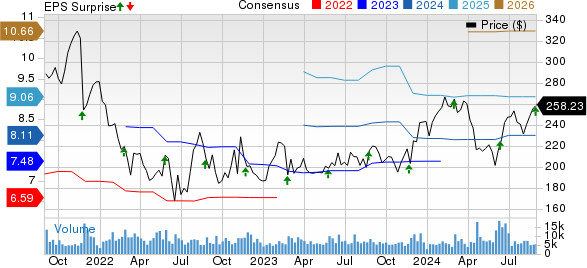

Autodesk ADSK unveiled its second-quarter fiscal 2025 results soaring beyond

expectations. The software company reported non-GAAP earnings of $2.15 per share, surpassing estimates by a

significant 7.5% and posting a remarkable 12.6% year-over-year growth.

The revenue front was equally spectacular with Autodesk reporting $1.5 billion in revenues, beating the

consensus mark by 1.54% and marking an impressive 11.9% increase from the previous year. The company’s

success was bolstered by widespread growth across products and regions in Architecture, Engineering,

Construction, and manufacturing, albeit counterbalanced by some softness in media and entertainment due to

residual effects of the Hollywood strike.

Revenue Breakdown

Autodesk’s subscription revenues, which accounted for 93.6% of total revenues, surged by 10.9% from the

previous year to $1.4 billion. Meanwhile, maintenance revenues witnessed a decline of 21.4% to $11 million,

and other revenues jumped by 41% to $86 million in the reported quarter.

Recurring revenues continued to dominate Autodesk’s fiscal landscape, composing 97% of the total revenues,

with stable net revenue retention rates falling within the company’s 100-110% targeted range in constant

currency terms.

Geographically, revenues in the Americas, EMEA, and Asia-Pacific painted a rosy picture with growth rates of

12.4%, 12.6%, and 9.2%, respectively. Billings for the quarter reached $1.24 billion, marking a 13% rise

year over year.

Product Portfolio Performance

With a focus on four core product families — Architecture, Engineering, and Construction; AutoCAD and

AutoCAD LT; Manufacturing; and Media and Entertainment — Autodesk experienced notable growth across the

board. AEC led the pack with an impressive 13.7% revenue growth, followed by AutoCAD and AutoCAD LT at

6.9%, MFG at 15.6%, and M&E at 4.1%.

Operational Highlights

Autodesk’s non-GAAP operating income reached $560 million, a substantial 14.5% jump from the previous year,

while the operating margin expanded to 37%, marking a 1 percentage point increase.

Financial Fortitude

On the financial front, Autodesk closed the quarter with cash and cash equivalents of $1.87 billion, albeit

lower than the previous quarter. Deferred revenues dipped by 13% to $3.69 billion, while unbilled deferred

revenues stood at $2.17 billion, showcasing a significant increase from the year-ago period. Remaining

performance obligations (RPO) and current RPO also showed healthy growth rates of 12% and 11%, respectively.

Operating cash flow surged to $212 million, a notable $77 million increase compared to the previous year,

while free cash flow soared to $203 million, reflecting a substantial jump of $75 million.

Guidance for Fiscal 2025

Autodesk is optimistic about the future, forecasting revenues between $6.08 billion and $6.13 billion for

fiscal 2025, suggesting an 11% growth trajectory. Billings are estimated to reach $5.88-$5.98 billion, with

an expected increase of 13-15% year over year. Non-GAAP earnings per share are projected to fall between

$8.18 and $8.31, and a non-GAAP operating margin between 35% and 36%.

Free cash flow is anticipated to fall within the $1.45-$1.5 billion range, while for the upcoming third

quarter, Autodesk foresees revenues in the ballpark of $1.555 billion and $1.57 billion. Non-GAAP earnings

are expected to land between $2.08 and $2.14 per share.

Market Outlook

Despite its recent triumph, Autodesk currently holds a Zacks Rank #3 (Hold). However, the company’s shares

have still managed to provide investors with a respectable 6.1% return year to date, demonstrating a

promising outlook.

Other strong contenders in the Computer and Technology sector include Arista Networks with

a Zacks Rank #1 (Strong Buy), Badger Meter, and Audioeye, each portraying

a stellar performance.

Arista Networks has witnessed a solid 46.8% rally this year, Badger Meter’s shares surged by 32.5%, and

Audioeye skyrocketed with an impressive 342.6% growth. These companies are poised for success with their

long-term earnings growth rates painting a rosy picture for investors.

Click here to dive deeper into the world of Autodesk on Zacks.com.