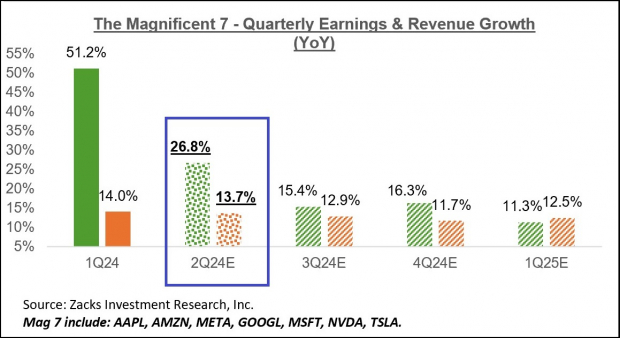

The index level aggregate earnings growth for the year has shown remarkable resilience, declining only to +8.4% on an ex-Finance basis. This demonstrates the financial robustness of the market amidst challenging economic conditions.

Analyzing the Earnings Trends

For a detailed look at the overall earnings picture and expectations for the coming periods, exploring the weekly Earnings Trends report can provide valuable insights into the trajectory of earnings growth.

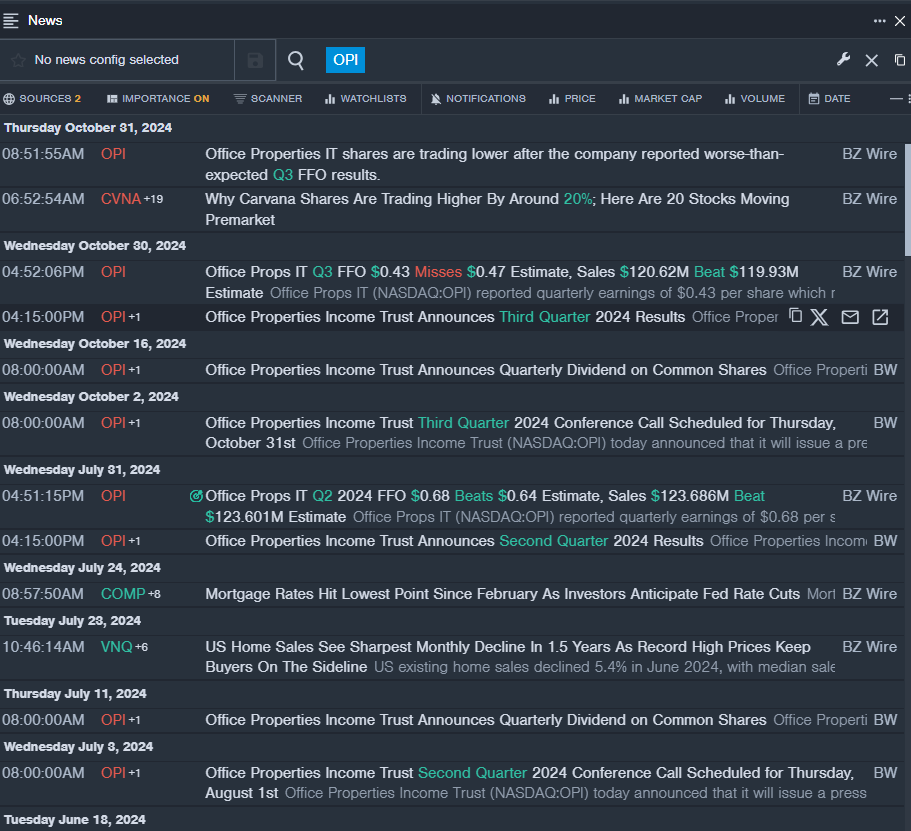

Whisper Stocks Poised to Stun Wall Street

Analysts may be underestimating certain stocks in the market, potentially leading to significant jumps in value when earnings are announced. These “Whisper” stocks are positioned to surprise and outperform, offering exciting opportunities for investors.

Stock Recommendations and Analysis

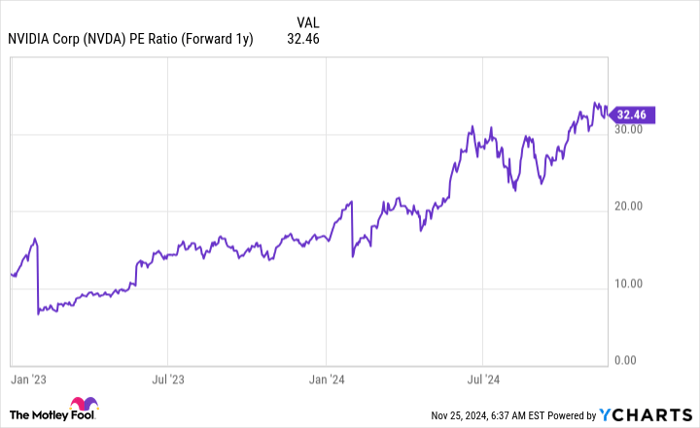

For the latest recommendations from Zacks Investment Research, considering the top stock picks can provide valuable guidance for investors seeking to optimize their portfolios. Companies like Amazon.com, Inc. (AMZN), Apple Inc. (AAPL), Microsoft Corporation (MSFT), Tesla, Inc. (TSLA), Alphabet Inc. (GOOGL), and Meta Platforms, Inc. (META) are worth exploring for insightful stock analysis and recommendations.

Exploring the in-depth analysis of these companies can offer a comprehensive understanding of their financial performance and growth potential, aiding investors in making informed decisions.

Insightful Analysis on Earnings Breakdown

For further analysis on breaking down the magnificent 7 earnings and understanding the nuances of earnings growth and performance, reading the detailed article on Zacks.com can provide investors with valuable context and insights.