Semiconductor stocks are at the vanguard of the digital revolution, vital to the relentless march of tech innovation and the AI wave sweeping across the globe. According to Statista, a reputable data intelligence platform, the sector is forecasted to expand at a brisk 6.3% rate from 2024 to 2027, propelling market volume to a staggering $736.4 billion. Notably, many semiconductor companies boast robust balance sheets, consistent profitability, and alluring dividend yields, rendering them irresistible to long-term investors.

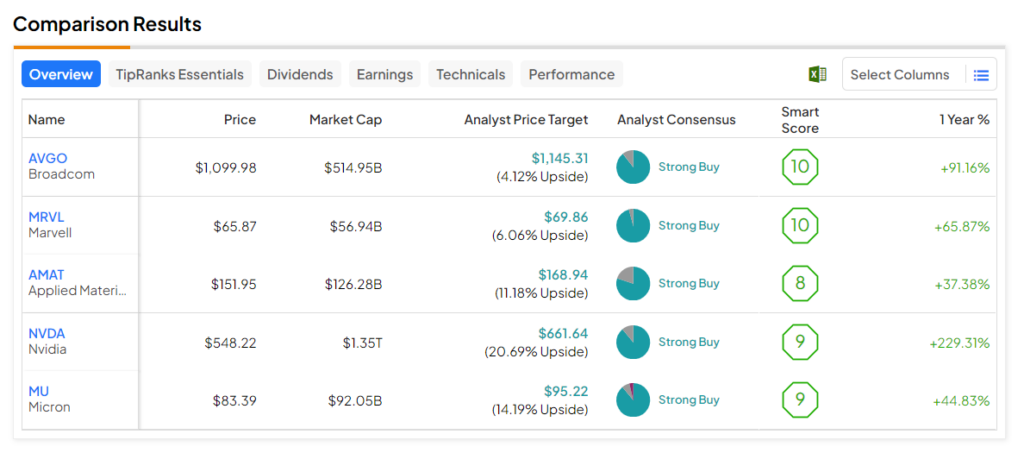

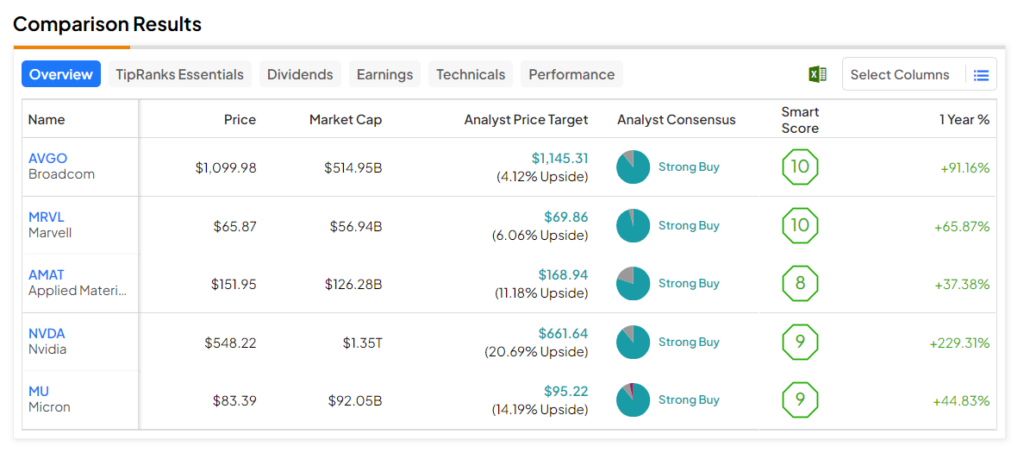

By leveraging TipRanks’ Stock Screener tool, we’ve unearthed five semiconductor stocks poised to outshine the market. These stocks have garnered an enthusiastic Strong Buy rating from Wall Street analysts and boast an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks. Furthermore, their analysts’ price targets suggest the potential for an upside from the current levels.

Top Picks for Investors

- Nvidia (NASDAQ:NVDA) – Nvidia, a leading manufacturer of computer graphics processors, chipsets, and related multimedia software, is projecting an impressive 20.7% upside potential, supported by a Smart Score of nine.

- Broadcom (NASDAQ:AVGO) – This global technology company, renowned for designing, developing, and supplying a wide range of semiconductor and infrastructure software solutions, forecasts a 4.1% upside potential with an impeccable Smart Score of “Perfect 10.”

- Marvell (NASDAQ:MRVL) – Marvell, a key global semiconductor player providing data infrastructure, storage, processing, and connectivity solutions, indicates a promising 6.1% upside potential, accompanied by a reassuring “Perfect 10” Smart Score.

- Micron (NASDAQ:MU) – Specializing in the development and production of memory and storage solutions, Micron anticipates a substantial 14.2% upside potential, boasting a Smart Score of nine for added appeal.

- Applied Materials (NASDAQ:AMAT) – A provider of manufacturing solutions for the semiconductor and display industries, Applied Materials is set to profit from an analyst consensus upside of 11.2% coupled with a commendable Smart Score of eight.

These stocks have been identified as top candidates for investors seeking well-positioned assets in the semiconductor arena.