In 2023, a stampede of investors strutted their way to the financial watering hole, driving technology company NVIDIA Corporation NVDA to a market capitalization of $1 trillion, joining an exclusive club with glee.

On Thursday, a former member resurrected itself and outran one of its rivals.

Battle of Giants: Early in 2024, a majestic duel between technology moguls Microsoft Corporation MSFT and Apple Inc AAPL has witnessed the ebb and flow of the title “most valuable public company in the world.”

While the titans, Microsoft and Apple, grapple for the crown with market capitalizations surpassing $3 trillion each, a separate contest has already crowned its victor.

Amid companies that neared a market capitalization of $1 trillion were Meta Platforms META and Tesla Inc TSLA when NVIDIA hit the milestone.

On Thursday, Meta Platforms galloped to a market capitalization of $1 trillion, rejoining the elite club from which it had once departed.

Presently, seven companies bask in the radiance of $1 trillion or more:

- Apple: $3.03 trillion

- Microsoft: $3.02 trillion

- Saudi Aramco: $2.04 trillion

- Alphabet Inc GOOGGOOGL: $1.91 trillion

- Amazon.com Inc AMZN: $1.63 trillion

- Nvidia: $1.53 trillion

- Meta Platforms: $1.01 trillion

Beyond the $1 trillion level are companies such as Berkshire Hathaway Inc, Taiwan Semiconductor, Eli Lilly and Broadcom.

As of the time of writing, Tesla has tumbled to 12th place with a market capitalization of $575.31 billion, with shares down 13% on Thursday after disclosing fourth quarter financial results post-market closing on Wednesday.

Related Link: Trading Strategies For Tesla Stock Post Q3 Earnings Miss

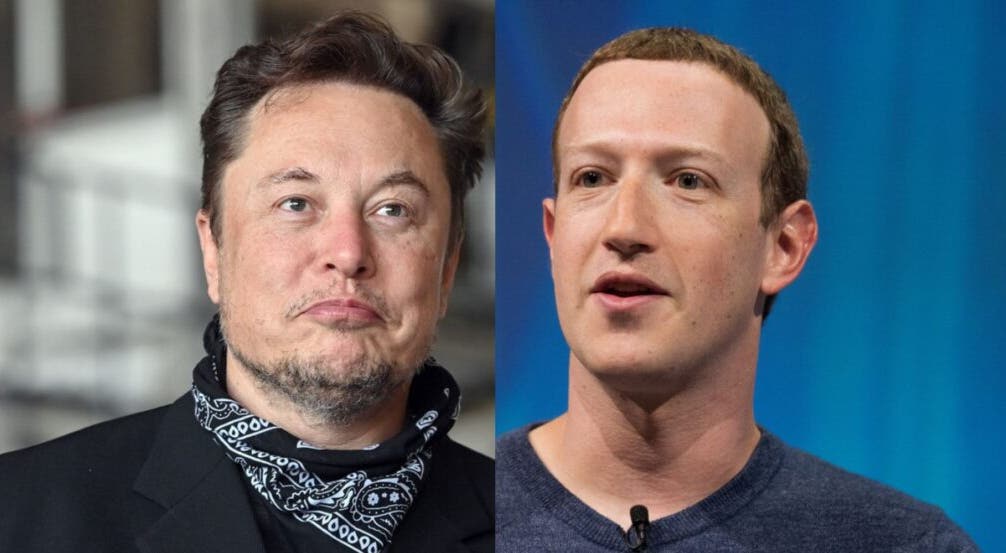

Significance: While Tesla and Meta Platforms aren’t direct rivals in most businesses, both companies’ CEOs have been embroiled in a burgeoning rivalry.

Tesla’s CEO, Elon Musk, and Meta’s CEO, Mark Zuckerberg, were poised to step into the ring for a cage match that was on the cards for several months, before talks seem to have fizzled out. Musk has often ribbed Zuckerberg and relished in the missteps of Meta Platforms.

Zuckerberg was accused of imitating features of Twitter, now named X, a social media platform owned by Musk.

When Nvidia ascended to the $1 trillion club, Benzinga polled its Twitter users to predict the company that might follow suit. The outcomes at the time (May 2023) were:

- Berkshire Hathaway Inc: 12.9%

- Meta Platforms: 15%

- Tesla: 53.8%

- Taiwan Semiconductor: +18.2%

In 2023, Meta shares outpaced Tesla with returns of about 194% contrasted with a 101% gain for Tesla stock. While both stocks outstripped the S&P 500 return of 24% in 2023, it is Meta and Zuckerberg who are currently leading the race.

Musk seized the title of the wealthiest person in the world in 2023 with a year-end valuation of $229 billion, according to Bloomberg. The billionaire bolstered his wealth by $92.0 billion in 2023. Meanwhile, Zuckerberg was the sixth-richest person worldwide in 2023, valued at $141 billion, amassing $82.5 billion in wealth during that year.

Before the drop in Tesla’s value on Thursday, Musk was valued at $216 billion. Zuckerberg, as of Wednesday, holds the fifth position with a worth of $141 billion. So far in 2024, the fortunes of the billionaires have swayed, with Musk shedding $12.9 billion and Zuckerberg amassing a comparable $12.9 billion.

With Tesla’s valuation plummeting on Thursday, Musk’s wealth will be dented, perpetuating his declines since the beginning of the year and inching him closer to second place Jeff Bezos.

Read Next: Here’s How Much $1,000 Invested In Tesla Stock Will Be Worth If Cathie Wood’s Price Target For 2027 Comes True

Photo: Shutterstock