Wyndham Marks a Milestone in South Korea

Wyndham Hotels & Resorts, Inc. recently made a significant move in South Korea with the debut of its first Trademark Collection hotel, La Vie D’or Hotel and Resort. This inaugural entry not only elevates WH’s presence in South Korea to over 30 hotels but also expands its footprint in the Asia Pacific region to almost 20 hotels.

Located in the picturesque city of Hwaseong-si, South Korea, just a brief 30-minute drive from Seoul, La Vie D’or Hotel and Resort offers a serene retreat for both business and leisure travelers. Encompassing a vast 330,000 square meters, the resort boasts a nine-hole golf course, fitness center, saunas, swimming pools, and a variety of dining options.

The strategic positioning of the hotel provides guests with easy access to key attractions including the Yungneung and Geolleung Royal Tombs, Yongjusa Temple, as well as proximity to bustling cities like Seoul and Suwon. Moreover, with conference facilities, Wi-Fi access, and its closeness to major corporations such as Samsung Electronics and Hyundai-Kia Motors, the resort caters effectively to the needs of business travelers.

South Korea, with its thriving tourism sector, has witnessed a resurgence in visitor numbers post-pandemic, welcoming around 11 million inbound travelers in 2023. The country’s travel and tourism market is projected to reach $13.66 billion by 2024. Wyndham Hotels’ latest expansion through La Vie D’or Hotel and Resort is strategically aligned with the escalating demand for both business and leisure travel in South Korea, complementing the government’s initiatives to bolster the tourism industry.

A Strategic Focus on Growth

Wyndham’s strategic focus remains on bolstering its geographic presence and enhancing its product offerings across all market segments. This strategic direction is supported by the company’s disciplined capital allocation strategy, emphasizing investments in high-return ventures through strategic partnerships and acquisitions.

In the second quarter of 2024, Wyndham opened over 18,000 rooms globally, reflecting a robust 16% year-over-year growth. As of June 30, 2024, the company’s global room count stood at 884,900, a 4% increase from the prior year. Noteworthy developments during the quarter include the inauguration of the first ECHO Suites in Spartanburg, SC, situated in one of America’s fastest-growing counties that has attracted significant economic investment.

By the end of June 2024, Wyndham’s global development pipeline comprised nearly 2,000 hotels and approximately 245,000 rooms, demonstrating a noteworthy 7% year-over-year increase. A substantial portion of this pipeline, around 58%, represents international projects.

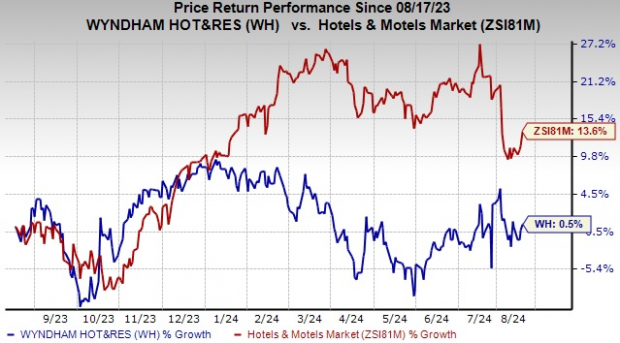

Shares of Wyndham Hotels have displayed a modest 0.5% uptick over the past year, in contrast to the Zacks Hotels and Motels industry’s growth of 13.6%. Despite lagging slightly behind industry peers, the company’s ongoing expansion endeavors are anticipated to drive growth in the foreseeable future.

Stock Analysis and Market Outlook

Wyndham Hotels currently holds a Zacks Rank #3 (Hold). In the consumer discretionary sector, some notable stock picks include:

Royal Caribbean Cruises Ltd. (Ticker: RCL), earning a Zacks Rank of 1 (Strong Buy). RCL has maintained an impressive trailing four-quarter earnings surprise averaging 18.5% and has surged 61% in the past year.

The consensus forecast for RCL anticipates a robust 18.1% growth in 2024 sales and a remarkable 69.7% increase in earnings per share compared to the previous year.

La-Z-Boy Incorporated (Ticker: LZB), boasting a Zacks Rank of 1. LZB has delivered an average trailing four-quarter earnings surprise of 15.3% and witnessed a 36% increase in stock value over the past year.

Market estimates suggest modest growth for LZB in fiscal 2025, with an expected 2.1% rise in sales and a 5% increase in earnings per share compared to the prior year.

DoubleDown Interactive Co., Ltd. (Ticker: DDI), showcasing a Zacks Rank of 1. DDI has consistently outperformed expectations with a trailing four-quarter earnings surprise of 22.1% and a notable 60.8% stock appreciation in the last year.

An optimistic market outlook projects a 12.6% rise in DDI’s 2024 sales and a substantial 15.8% growth in earnings per share compared to the previous year.