Back in 2018, Apple made history by becoming the first company to achieve a $1 trillion market cap, followed shortly by Microsoft in the next year. Fast forward to today, where companies hitting the thirteen-figure milestone don’t quite turn heads the way they used to. With both Apple and Microsoft now valued at over $3 trillion each, investors are hungry for the next big contender.

Enter Walmart – the unexpected dark horse inching closer to the trillion-dollar finish line more rapidly than most would imagine.

The Size Advantage

While other companies may appear closer to the trillion-dollar goalpost, like Eli Lilly with a market cap exceeding $800 billion, Walmart’s potential for growth is nothing short of astounding. With a sprawling empire of over 10,500 stores globally, including 4,600 in the US alone, and 600 Sam’s Club outlets, Walmart’s dominance in the retail arena is unquestionable.

Size doesn’t always matter, but in this case, it’s a game-changer. Walmart not only fends off competitors through its sheer presence but also commands the attention of a vast customer base, with the average American making regular visits to their stores and spending thousands annually.

Rising to the Challenge

Beyond its expansive reach, Walmart excels in leveraging its scale for strategic advantages. As a key distributor for many suppliers, the retail giant wields significant bargaining power, allowing it to offer competitive prices – especially appealing during times of surging inflation. Recognizing evolving consumer needs, Walmart is transforming its in-store experience to include high-end brands, expanding its appeal across various demographics.

Embracing the digital age, Walmart is ramping up its e-commerce initiatives. While still trailing Amazon, Walmart’s recent online sales growth outpaced its rival, fueled by hefty investments in automation technology. Additionally, Walmart is capitalizing on its e-commerce platform as an advertising space, with revenues climbing steadily.

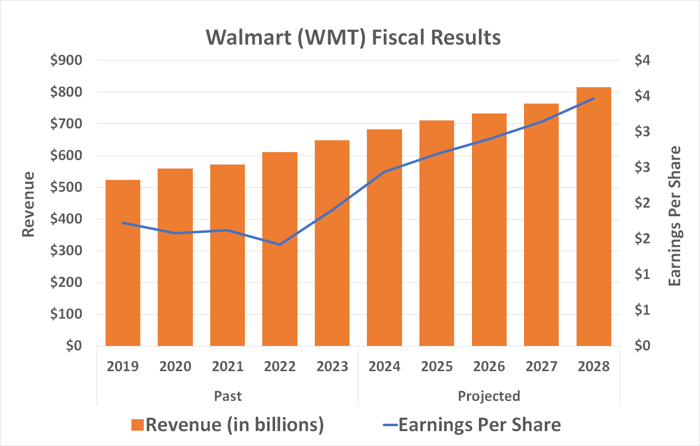

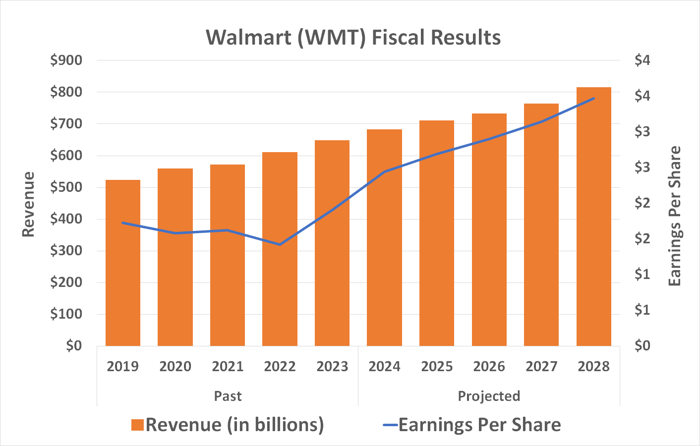

With a projected revenue of over $800 billion by 2028, analysts foresee Walmart’s continued growth trajectory, anticipating annual revenue surging past $900 billion by 2030, with per-share earnings nearing $4.

Data source: StockAnalysis.com. Chart by author.

The Trillion-Dollar Question

Will Walmart’s current market cap of $535 billion skyrocket to $1 trillion by 2030? While there’s no magic crystal ball for stock predictions, Walmart’s stretched valuation and key metrics suggest that achieving this milestone within the next decade might be a stretch.

However, with a forward-thinking approach and sustained growth, hitting the trillion-dollar mark by 2032 appears not only plausible but probable. Such a feat would solidify Walmart’s status as a retail powerhouse, reshaping the landscape for years to come.

The Rise of Walmart: A Giant’s Trillion-Dollar Dream

Is Walmart on the Path to Trillion-Dollar Glory?

Much buzz surrounds Walmart as it gears up to potentially break into the exclusive club of trillion-dollar companies, a realm mostly dominated by tech giants.

The Long Game for Walmart Investors

While Walmart may not hit the trillion-dollar mark in the near future, its stock remains a compelling choice for investors looking for steady growth opportunities.

Considering an Investment in Walmart

Before diving into Walmart stock, it’s essential to weigh the pros and cons of this retail behemoth.

The Motley Fool Stock Advisor analyst team recently highlighted some top stocks for investment, with Walmart not making the cut. However, history shows that unexpected stocks can skyrocket in value over time.

Reflect on the case of Nvidia, which was not initially featured on the list back in April 2005. Those who invested $1,000 based on the recommendation would now be sitting on a remarkable $808,105.

The Stock Advisor service, known for its strong track record, has significantly outperformed the S&P 500 since its inception in 2002, offering valuable insights and stock picks to subscribers.

If you are curious about the potential stocks that could outperform the market, it might be worth checking out the top picks highlighted by financial experts.

*Stock Advisor returns as of June 10, 2024