NIO Inc. NIO, the Chinese electric vehicle manufacturer, recently hosted its ambitious Power Up 2024 event in Wuhan to showcase its plans for expanding its charging and battery swap infrastructure across China.

While the event was filled with optimism, NIO’s stock took a hit, declining over 5% due to challenges in the broader Chinese market. Concerns over stagnant interest rates and the halt of real-time data on foreign fund flows have contributed to a gloomy outlook on Chinese equities, including NIO.

This unfavorable market environment has created obstacles for NIO to fully capitalize on its infrastructure expansion initiatives. With the stock trading near its yearly low, potential investors are weighing whether NIO represents a value opportunity or a potential pitfall. Before diving into investment strategies, let’s delve into the key highlights from the NIO Power Up Event.

Significant Revelations From Power Up 2024

At the Power Up 2024 event, NIO unveiled its ambitious “Power Up Counties” initiative, with plans to deploy battery swap stations in over 2,300 counties across China by 2025. The company aims to cover 1,200 counties by 2025 and expand to more than 2,800 by 2026. NIO currently boasts 2,480 battery swap stations, 2,322 supercharging stations, and 1,627 destination charging stations across the country.

In addition, NIO announced the establishment of a new battery swap station manufacturing facility in Wuhan, targeting an annual output of over 1,000 stations. The company introduced the “Power Up Partner Plan” to foster collaborations in infrastructure development and shared profits. Furthermore, NIO showcased its cutting-edge portable car-to-car charger, highlighting its technological innovation in the EV space.

Concerns Clouding NIO’s Future

Despite the promising infrastructure plans, NIO faces significant hurdles that warrant caution from investors.

Q1 of 2024 saw NIO’s deliveries drop by 3.2% year-over-year, with revenues declining by 12.2%. This negative performance contrasts sharply with the broader Chinese EV market, which grew by 14.7% during the same period. The company’s ongoing profitability struggles and market share losses to competitors like BYD Co Ltd, Li Auto, and XPeng raise doubts about its sustainability.

The intensely competitive nature of the Chinese EV sector has forced NIO to slash prices and offer hefty incentives, resulting in dwindling profit margins. The company reported a larger-than-expected loss in Q1, marking the eleventh consecutive quarter of earnings misses. With declining cash reserves, NIO may face the need to raise additional funds, potentially leading to heightened leverage and dilution for shareholders.

Performance & Valuation Overview

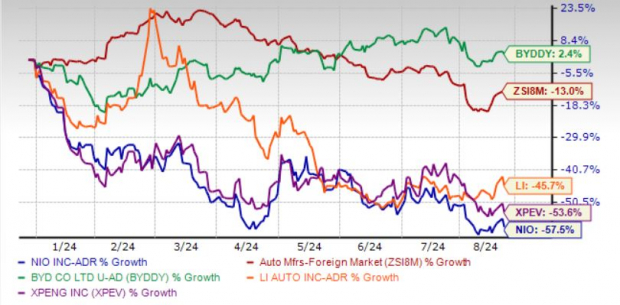

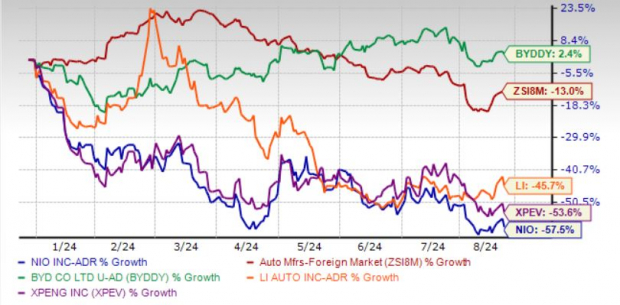

NIO’s shares have plummeted by 57.5% year-to-date, significantly underperforming industry peers like BYD Co Ltd, Li Auto, and XPeng.

Year-to-Date Stock Price Performance Comparison

Image Source: Zacks Investment Research

While NIO’s price-to-sales ratio currently sits at 0.51, well below historical highs and industry averages, the apparent undervaluation aligns with numerous warning signs. The company’s Value Score of D underscores the inherent risks tied to investing in NIO at its current valuation.

Image Source: Zacks Investment Research

Technical Indicators & Earnings Projection Trends

NIO’s stock demonstrates a bearish trend, trading below both the 50-day and 200-day moving averages.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for 2024 and 2025 loss per share has widened over the past month, reflecting deteriorating market sentiment.

Final Thoughts: A Risky Proposition

Despite NIO’s ambitious plans showcased at the Power Up 2024 event, the company’s struggle with eroding market share, diminishing profitability, and financial challenges make investing in NIO a risky endeavor. The potential need for additional capital raises may further dilute shareholder value, adding to the risks for current and prospective investors.

Given the broader economic uncertainties in China and negative technical signals for NIO, the stock does not present a favorable investment opportunity at this juncture. Until NIO demonstrates sustainable profitability and addresses its fundamental issues, investors may find it prudent to steer clear of the stock, despite its seemingly attractive valuation.

NIO currently holds a Zacks Rank #4 (Sell).