Amidst a shifting automotive terrain, Ford Motor (F) is revving into high gear with an increasing appetite for electric vehicles, driving the company towards the path of financial prosperity. Trimming operational fat and unveiling a robust financial performance, it’s no wonder that Ford is garnering attention. As the company continues to accelerate revenue growth, it’s prudent to dissect the ownership mosaic of Ford.

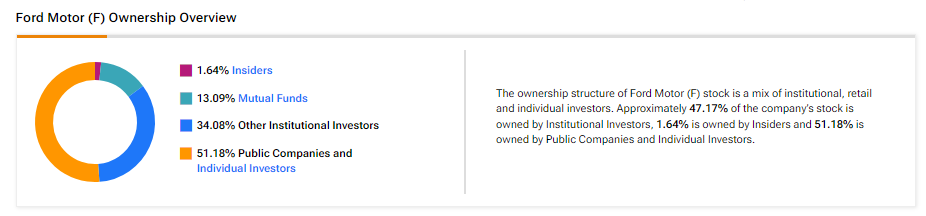

Statistical insights from TipRanks’ ownership page unveil that public companies and individual investors collectively hold 51.18% of Ford, followed by institutional investors, mutual funds, and insiders at 34.08%, 13.09%, and 1.64%, respectively.

Unveiling Ford’s Ownership Substratum

Delving deeper into the shareholder landscape, Vanguard boasts a robust 7.88% stake in Ford stock, closely trailed by Vanguard Index Funds at 6.69%.

Exemplifying contrasting sentiments, while hedge funds exhibit a highly positive stance on Ford stock, individual investors showcase a markedly negative outlook. The Hedge Fund Confidence Signal significantly sways towards Ford, with 16 hedge funds having surged their stake by 24.1 million shares in the last quarter. On the flip side, in the recent 30 days, the number of portfolios holding Ford Motor stock has dwindled by 1.7%, with a modest 2% of the 756,193 tracked portfolios investing in the stock.

Driving Analysis: Is Ford a Viable Stock Purchase?

Glancing at Wall Street sentiment, Ford currently boasts a Moderate Buy consensus rating, stemming from a blend of five Buys, nine Holds, and one Sell in the past three months. With an average price target of $13.67, analysts foresee a lucrative 28.72% upside potential for Ford Motor stock. Over the preceding six months, the stock has experienced a dip of approximately 11.72%.

Explore more F analyst ratings

A Parting Thought

TipRanks’ Ownership tool provides a nuanced peek into Ford’s ownership quilt across diverse segments, enabling investors to navigate the investment terrain with informed acumen.

To perform a comprehensive scrutiny of F stock, visit TipRank’s Stock Analysis page.

Review any pertinent disclosures here.