The rise of artificial intelligence (AI) has been a boon for the semiconductor sector’s standout, NVIDIA Corporation (NVDA), propelling its stock to great heights in recent years. NVIDIA specializes in chip design, while outsourcing manufacturing to foundries like Taiwan Semiconductor Manufacturing Company Limited (TSM) – creating a symbiotic relationship rather than one of competition.

In comparison, TSMC has also enjoyed significant gains this year. However, recent events have put a damper on NVIDIA’s shares. This begs the question – is TSMC now a more attractive investment compared to NVIDIA?

Reasons to Consider the NVIDIA Stock

The demand for AI models is robust and enduring, spanning various sectors like cloud computing. NVIDIA’s chips play a crucial role in AI models, making their H100 graphic cards highly sought after in the AI chip market.

Furthermore, the imminent release of next-generation Blackwell AI chips is expected to give NVIDIA a competitive advantage. These chips promise greater AI throughput compared to the current Hopper platform. NVIDIA’s foray into the gaming market with GeForce and collaboration in the industrial metaverse with Siemens also bode well for the company.

CEO Jensen Huang’s statement about data centers transitioning from central processing units to graphic processing units (GPUs) indicates a significant market shift. NVIDIA’s data center revenues surged by 154% year over year in the second quarter of 2025.

Additionally, NVIDIA’s approval of a $50 billion share buyback plan signals a robust financial position.

Challenges Facing NVIDIA Stock

Despite these positives, September has brought volatility for NVIDIA. The stock experienced its worst two-day trading period in about two years after being subpoenaed by the Department of Justice in an antitrust probe.

Historically, September has been a challenging month for NVIDIA, with the stock averaging a 2.4% decline compared to the S&P 500 and Nasdaq drops of 1.2% and 0.9%, respectively.

Even after strong quarterly results, NVIDIA’s stock did not perform as expected, given its status as the best performer on the S&P 500 this year.

Advantages of the TSMC Stock

In contrast to NVIDIA, TSMC has weathered September well, showing promise for a few key reasons. The adoption of AI features in smartphones by various companies is expected to drive demand for TSMC’s chips. Notably, Apple Inc. is a major client of TSMC, and the upcoming iPhone 16 launch is anticipated to boost chip demand.

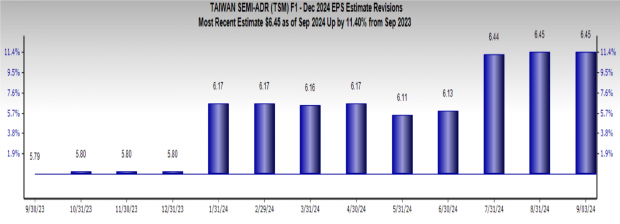

The increasing use of AI applications like Open AI’s ChatGPT and Alphabet Inc.’s Gemini underlines the growth in demand for TSMC’s chips, with a positive earnings outlook for the current year.

Comparing TSMC and NVIDIA

TSMC commands a significant share of high-end chips in the global semiconductor market, translating to considerable pricing power. This dominance allows TSMC to capitalize on soaring AI chip demand by charging premium prices, enhancing profitability.

As the exclusive manufacturer of Apple’s AI chips, TSMC stands to benefit from increased volume orders. Conversely, NVIDIA’s reliance solely on data center AI chips leaves it vulnerable to disruptions in the AI sector.

Valuation and Market Position

TSMC boasts a lower valuation than NVIDIA, offering it a competitive edge. With a lower price/earnings ratio, TSMC’s stock trades at a more attractive multiple compared to NVIDIA’s, making it a more cost-effective investment.

Final Thoughts on TSMC

Given its reasonable valuation, pricing power, strategic partnerships, diversified client base, and alignment with the expanding AI market, TSMC emerges as a superior investment choice over NVIDIA.

Leading analysts have raised TSMC’s short-term price target by 27.6%, with the highest target projecting a 55.8% upside from the current price of $160.49.

The Race for Dominance: Examining the Semiconductor Giants

The semiconductor industry, an ever-evolving landscape punctuated by fierce competition and technological innovation, is currently witnessing a titanic battle for dominance between leading giants; Taiwan Semiconductor Manufacturing Company Ltd (TSMC) and NVIDIA Corporation (NVDA). In this clash of titans, each company carries a distinct Zacks Rank – TSMC holding a Zacks Rank #1 (Strong Buy), while NVDA sports a Zacks Rank #3 (Hold).

Market Analysis: TSMC vs. NVDA

As investors scrutinize market dynamics, the rationale behind these rankings comes under sharp appraisal. TSMC, the leading semiconductor foundry, renowned for its cutting-edge manufacturing processes, stands solidly with a Strong Buy recommendation. Conversely, NVDA, a trailblazer in graphics processing units (GPUs) and artificial intelligence (AI) solutions, currently carries a Hold status, reflecting nuances in its market performance.

Unlocking Potential: TSMC’s Stellar Performance

TSMC, a paragon of semiconductor manufacturing excellence, has captured the attention of investors with its track record of success. The company’s strategic positioning in catering to millennial and Gen Z demographics, underscored by a staggering revenue of nearly $1 billion in the latest quarter, underlines its financial prowess. TSMC’s recent market adjustment presents a unique window of opportunity for prospective investors to embark on this thrilling journey as TSMC aims to further consolidate its market presence.

NVDA: Awaiting Resurgence?

Conversely, NVDA’s Hold rating prompts a deeper dive into the factors influencing its market trajectory. With a portfolio spanning GPUs, AI, and gaming, NVDA’s resilience in navigating market fluctuations is testament to its enduring value proposition. As NVDA charts its course in a competitive landscape, investors closely monitor signals that may indicate a resurgence in its market standing, marking a potential inflection point for the corporation.

A Historical Perspective

Reflection on past market trends unveils the intricate dance of market forces that have historically guided semiconductor stocks. Investors draw on historical data to glean insights into potential future trajectories, recognizing the value of informed decision-making in optimizing investment strategies. With this historical backdrop, the current positioning of TSMC and NVDA takes on added significance as investors position themselves for future growth and stability.

Conclusion

As the semiconductor industry marches forward with relentless innovation and dynamic market shifts, the narrative of TSMC versus NVDA reflects a larger saga of competition, resilience, and strategic positioning. Both companies carry distinct narratives, shaped by their unique market propositions, financial performances, and technological offerings. In this unfolding saga, investors navigate the labyrinthine world of semiconductor stocks, seeking to capture the essence of growth and success in a rapidly evolving landscape.