Understanding Wall Street’s views on a company like Leidos (LDOS) can be akin to interpreting the whispers of a capricious oracle. Investors often turn to brokerage recommendations for guidance, but should these opinions be the sole compass for your investment journey?

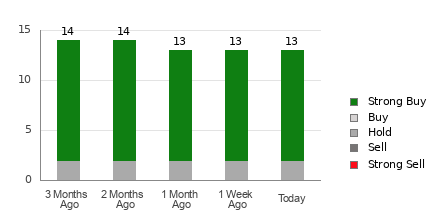

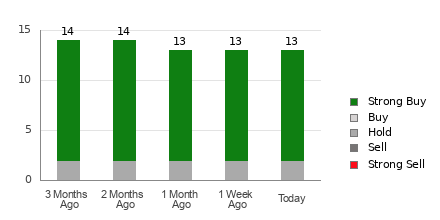

At first glance, Leidos boasts an average brokerage recommendation (ABR) of 1.31, hovering between the realms of a Strong Buy and a Buy, aggregated from inputs of 13 brokerage firms. The majority of these recommendations, precisely 84.6%, lean towards a resounding endorsement of Strong Buy.

Deciphering the Rollercoaster of Brokerage Rating Trends for LDOS

The symphony of numbers may suggest a harmonious melody, but beware the siren song of these recommendations. Studies unveil that brokerage opinions, drenched in the vested interests of firms, might not always steer investors towards the shores of profitability. For every whisper of “Strong Sell,” five raucous cries of “Strong Buy” pierce the market atmosphere, clouding the true trajectory of a stock.

Enter the Zacks Rank, a luminary cutting through the mist of speculation. Standing stoically, this proprietary tool dissects stocks into five illustrious categories from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), offering a beacon of hope amidst the murky sea of predictions.

Navigating Through the Murky Waters: ABR vs. Zacks Rank

While both the ABR and Zacks Rank flaunt a scale of 1-5, their paths diverge drastically.

The ABR, a tale spun from brokerage whispers, conceals its figures in decimals, embodying the subjective nature of human judgment. Counter to this, the Zacks Rank wields the quantitative sword of earnings estimate revisions, displaying its veracity through whole numbers from 1 to 5.

Brokerage analysts, ever-cast in the hue of optimism, often weave narratives more vivid than the underlying data suggests, ushering investors down mirage-laden paths. Conversely, the Zacks Rank finds solace in empirical truths, where the rhythm of earnings estimate revisions dances a tango with stock prices.

Unlike the stagnant waters of ABR, the Zacks Rank flows like a mighty river, weaving through the ebbs and flows of earnings trends with timely precision, offering a portent of future movements in stock prices.

Should You Brave the Investment Waters with LDOS?

Casting our gaze upon Leidos, the Zacks Consensus Estimate for the current year stands steadfast at $8.96, a beacon of hope in the ever-changing tides of the market.

The winds of change blow favorably for Leidos, as analysts unfurl a canvas of optimism, etching higher EPS estimates upon the shifting sands of financial forecasts. These winds, alongside other market forces, herald a Zacks Rank #2 (Buy) for the company, a promising omen of what lies ahead.

Thus, the siren call of the Buy-equivalent ABR for Leidos may guide intrepid investors in their quest for profitable shores.

Zacks Uncovers a Hidden Gem in Semiconductors

A diamond in the rough, this semiconductor stock looms large on the horizon, promising growth far beyond its minuscule size compared to behemoths like NVIDIA. With a landscape ripe for innovation, this stock stands poised to ride the wave of Artificial Intelligence and Machine Learning, propelling the semiconductor industry into uncharted territories of growth. Within this evolving landscape, global semiconductor revenues are slated to surge, painting a bright future for this hidden gem.