Before making any investment decisions, investors often seek insights from the opinions of Wall Street analysts. These analysts are known for shaping the market sentiment and influencing stock prices, but how reliable are their recommendations? Let’s delve into the recent analysis by Wall Street analysts on Netflix (NFLX) and explore the reliability of such ratings in making investment decisions.

Current Brokerage Recommendations for Netflix (NFLX)

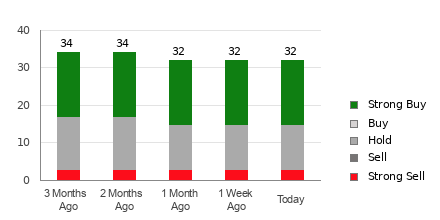

Netflix currently holds an average brokerage recommendation (ABR) of 1.90, falling between Strong Buy and Buy on the scale ranging from 1 to 5 (Strong Buy to Strong Sell). This score is derived from the assessments provided by 36 brokerage firms, with 21 Strong Buy and one Buy recommendation, collectively accounting for 61.1% of all recommendations.

Evaluating the Reliability of Brokerage Recommendations

While the ABR suggests a favorable outlook for Netflix, it’s essential to consider the limitations of relying solely on brokerage recommendations. Research indicates that brokerage recommendations may not consistently lead to optimal investment outcomes. Analysts, driven by their firms’ interests, tend to exhibit a strong positive bias in their ratings, rendering their assessments partial and potentially misleading for retail investors.

Insights from Zacks Rank

Amidst the debate about the dependability of brokerage recommendations, Zacks Rank, a proprietary stock rating tool, has gained prominence for its robust analysis of stock performance. Unlike ABR, Zacks Rank assesses stocks based on a quantitative model that integrates earnings estimate revisions, offering a more objective assessment of a stock’s potential.

Distinguishing ABR from Zacks Rank

It’s crucial to differentiate between ABR and Zacks Rank, as the two metrics operate on distinct methodologies. While ABR relies solely on brokerage recommendations, Zacks Rank leverages earnings estimate revisions to forecast stock performance, rendering it a more reliable guiding tool for investors.

Considering Earnings Estimate Revisions for Netflix

The Zacks Consensus Estimate for Netflix’s current year earnings has experienced a 0.1% increase over the past month, reflecting growing optimism among analysts regarding the company’s earnings potential. This positive trend has contributed to a Zacks Rank #2 (Buy) for Netflix, indicating a favorable near-term outlook for the stock based on earnings estimate revisions.

Hence, while ABR suggests a favorable stance on Netflix, complementing this insight with the Zacks Rank assessment could provide investors with a more comprehensive understanding of the stock’s investment potential.