Wall Street analysts’ recommendations often sway investor decisions, steering them towards lucrative or perilous investment avenues. The captivating narrative spun by brokerage-firm-employed analysts can mesmerize even the most prudent investor. Yet, discerning the gem from the mirage remains a quest for many.

Deciphering the Wall Street Consensus on Dollar Tree (DLTR)

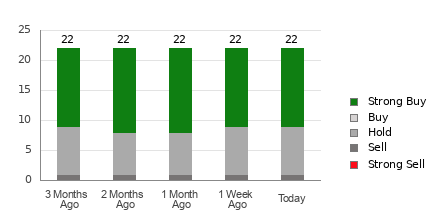

Dollar Tree, amidst its bargain bonanza, stands at a tipping point, poised for glory or gloom. A harmonized chant by 22 brokerage firms forms an average brokerage recommendation (ABR) of 1.86, nudging towards the ‘Buy’ echelon. Among this symphony, 13 firm voices resonate with the melody of ‘Strong Buy,’ painting a picture of optimism in the dark corridors of market volatility.

The Intriguing Dichotomy of Brokerage Recommendations

Brokerage recommendations, akin to sirens of the stock market sea, might not always lead ships to the port of riches. The skewed scales of ‘Strong Buy’ to ‘Strong Sell,’ where the former outweighs the latter fivefold, unveil a tale of vested interests dictating the narrative. Investors must navigate these treacherous waters with a discerning eye, lest they fall prey to the siren songs of self-serving analysts.

Unveiling the Zacks Rank: A Beacon Amidst the Storm

Enter the Zacks Rank, a beacon in the tempest-tossed sea of stock recommendations. Grounded in empirical data, this tool offers a compass calibrated by earnings estimate revisions, guiding investors towards the promised land of profitable investments. The Zacks Rank #1 shines as a lighthouse, illuminating the path to financial prosperity.

Navigating the Seas of Earnings Estimate Revisions

The shifting tides of earnings estimate revisions cast a shadow of doubt over Dollar Tree’s fate. With a 3.2% decline in the Zacks Consensus Estimate for the current year, storm clouds loom on the horizon. Analysts’ grim prophecies, echoed in a Zacks Rank #4 (Sell), forewarn of turbulent times ahead. Investors, take heed and brace yourselves for the impending tempest.

Amidst the cacophony of recommendations, tread cautiously, armed with knowledge and skepticism. Peel back the layers of brokerage biases to uncover the true essence of a stock’s potential. Let wisdom be your guide in the labyrinthine corridors of Wall Street whispers.