On January 4, 2024 at 15:27:33 ET, an unusually large $10,646.60K block of Put contracts in Alibaba Group Holding Limited – Depositary Receipt (BABA) was sold, with a strike price of $135.00 / share, expiring in 15 day(s) (on January 19, 2024). Fintel tracks all large options trades, and the premium spent on this trade was 2.06 sigmas above the mean, placing it in the 99.98th percentile of all recent large trades made in BABA options.

This trade was first picked up on Fintel’s real time Options Flow tool, where unusual option trades are highlighted.

Fund Sentiment Analysis

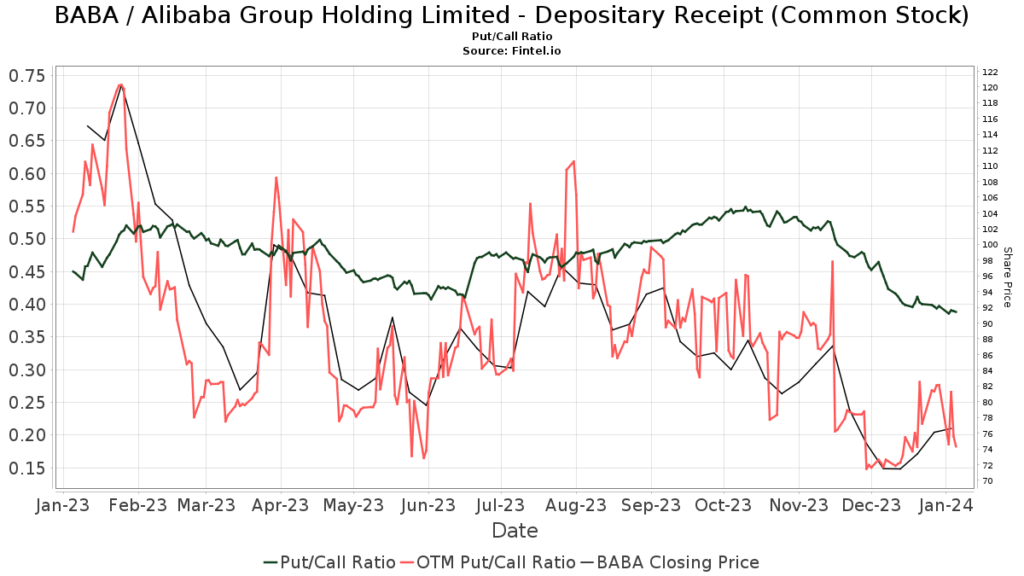

There are 1963 funds or institutions reporting positions in Alibaba Group Holding Limited – Depositary Receipt (BABA). This is an increase of 405 owner(s) or 25.99% in the last quarter. The average portfolio weight of all funds dedicated to BABA is 1.14%, an increase of 25.43%. Total shares owned by institutions increased in the last three months by 152.23% to 1,123,422K shares. The put/call ratio of BABA is 0.39, indicating a bullish outlook.

Analyst Price Forecast

As of December 16, 2023, the average one-year price target for Alibaba Group Holding Limited – Depositary Receipt (BABA) is $128.43. The forecasts range from a low of $87.87 to a high of $165.90. The average price target represents an increase of 67.69% from its latest reported closing price of $76.59.

The projected annual revenue for Alibaba Group Holding Limited – Depositary Receipt (BABA) is $991,825MM, an increase of 8.41%. The projected annual non-GAAP EPS is $62.78.

Shareholder Activity

Vanguard Emerging Markets Stock Index Fund Investor Shares holds 232,456K shares representing 9.27% ownership of the company. In its prior filing, the firm reported owning 238,289K shares, representing a decrease of 2.51%. The firm decreased its portfolio allocation in BABA by 10.93% over the last quarter.

Vanguard Total International Stock Index Fund Investor Shares holds 230,738K shares representing 9.20% ownership of the company. In its prior filing, the firm reported owning 230,804K shares, representing a decrease of 0.03%. The firm decreased its portfolio allocation in BABA by 10.59% over the last quarter.

IEMG – iShares Core MSCI Emerging Markets ETF holds 151,475K shares representing 6.04% ownership of the company. In its prior filing, the firm reported owning 136,610K shares, representing an increase of 9.81%. The firm increased its portfolio allocation in BABA by 23.91% over the last quarter.

MCHI – iShares MSCI China ETF holds 62,489K shares representing 2.49% ownership of the company. In its prior filing, the firm reported owning 59,932K shares, representing an increase of 4.09%. The firm increased its portfolio allocation in BABA by 21.61% over the last quarter.

ARTKX – Artisan International Value Fund Investor Shares holds 56,258K shares representing 2.24% ownership of the company. In its prior filing, the firm reported owning 55,446K shares, representing an increase of 1.44%. The firm increased its portfolio allocation in BABA by 7.65% over the last quarter.

Background Information on Alibaba Group Holding

Alibaba Group’s mission is to make it easy to do business anywhere. The company aims to build the future infrastructure of commerce. It envisions that its customers will meet, work and live at Alibaba, and that it will be a good company that lasts for 102 years.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds. Our data covers the world and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

Click to Learn More

This story originally appeared on Fintel.