Embracing Share Buybacks

Ford Motor Company and General Motors have rivaled like storied sports teams through time, their competition echoing the intense matchups of the Yankees vs. Red Sox or Lakers vs. Celtics. Though they usually dance similar strategic tunes, Ford now faces a critical juncture: emulating its rival’s playbook on share buybacks.

The Pac-Man Approach

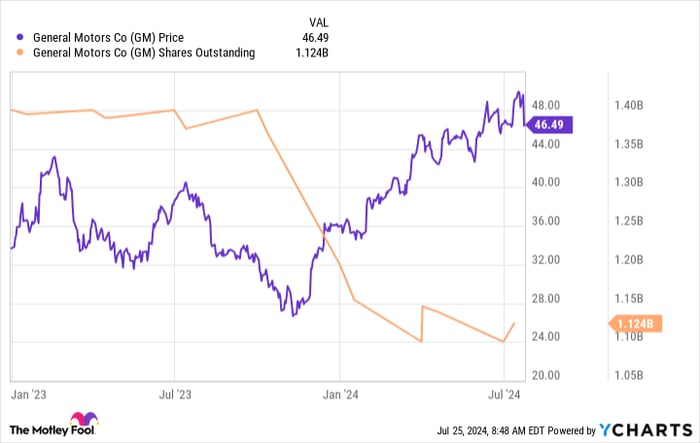

General Motors unabashedly embraced a share buyback strategy to enrich shareholders. By gobbling up its own shares from the market and canceling them, GM effectively reduced the circulating shares, elevating the value of the remaining ones. Share buybacks translated into augmented earnings per share and heightened future dividends for shareholders.

Ford’s Footwork

With a robust balance sheet boasting around $27 billion in cash and $45 billion in liquidity, Ford stands primed to mirror its crosstown competitor’s lucrative approach with share buybacks. Bolstered by upgraded healthy free cash flow projections, Ford typically targets returning 40% to 50% of adjusted free cash flow to its investors.

The Dilemma

Yet, Ford hesitates. The Ford family’s firm grip commands roughly 40% of Ford company shares. Renowned for their ardor for dividends, the family stands as a formidable barrier for Ford to leap into substantial share buybacks. The automaker’s current valuation lags behind GM, hinting that Ford’s shares might not be as tempting for repurchase. Nonetheless, not initiating a share buyback in 2022, a period when Ford’s stock generally hovered under 8 times earnings, remains perplexing.

Charting the Future

Diverging from the presumed narrative, Ford still leans towards dividends rather than share buybacks, believing it has more profitable avenues for its cash stockpile. Yet, given its financial robustness, there is ample room to authorize a substantial share buyback program while continuing its dividend distributions.

As Ford grapples with production efficiency challenges, operational complexities, losses in its Model e division, and surging warranty costs, a positive catalyst in the form of a strategic shift could steer the company towards brighter shores.

Looking Ahead

Despite the apprehension within the Ford family ranks, doubling down on shareholder value through share repurchase initiatives might be just the jolt Ford needs. With its stock currently down 23% over the last decade, a bold step towards value enhancement could offer a silver lining.