Amidst the tumultuous waves of the stock market, the technology sector offers a glimmer of hope for investors seeking to ride the currents of undervalued companies. These gems in the rough, characterized by their oversold status, present a unique opportunity for those willing to delve into the world of momentum indicators.

The Significance of RSI in Stock Evaluation

One such indicator is the Relative Strength Index (RSI), a metric that gauges a stock’s performance by comparing its strength on up days to that on down days. A stock is deemed oversold when its RSI falls below the 30-point mark, signaling a potential comeback story in the making.

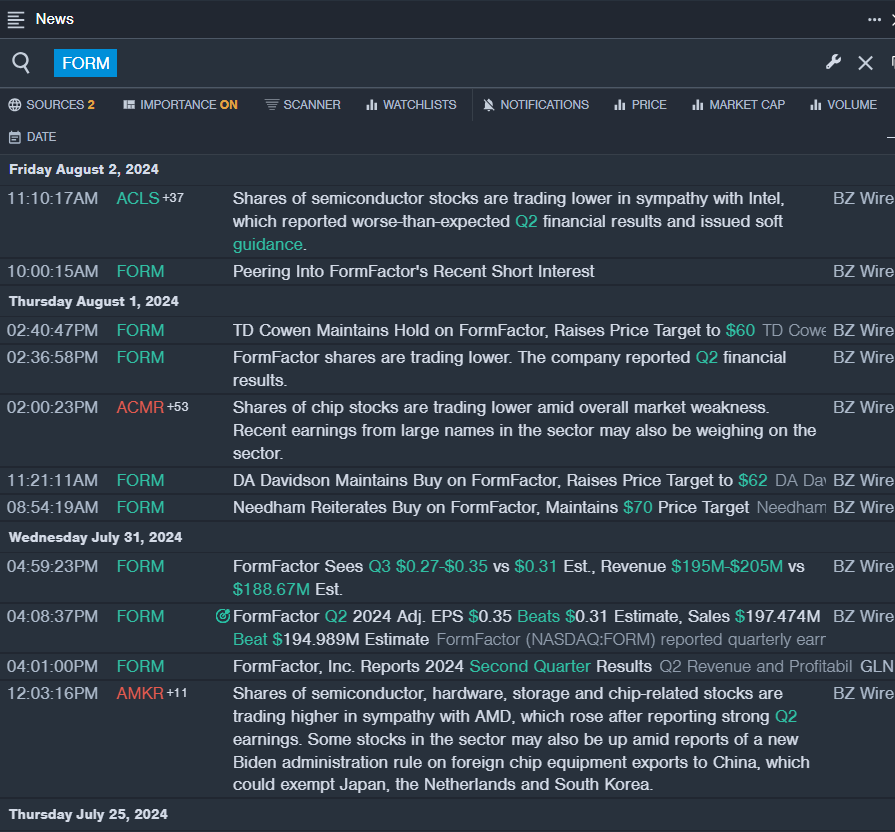

FormFactor Inc (NASDAQ: FORM)

- FormFactor Inc recently made waves with its better-than-expected quarterly earnings report. CEO Mike Slessor attributed this success to a staggering surge in DRAM probe-card revenue, a feat driven by a doubling of high-bandwidth memory revenue and consistent activity in DDR5 designs. Despite a recent tumble in stock price, with a 21% dip over the past five days, FormFactor shines with a 52-week low of $29.71.

- RSI Value: 27.73

- FORM Price Action: Despite recent setbacks, FormFactor’s stock showed resilience by inching up by 1.1%, closing at $41.36 on Monday.

Rambus Inc (NASDAQ: RMBS)

- Rambus Inc entered the fray with mixed second-quarter financial results. CEO Luc Seraphin highlighted impressive growth in product revenue and robust cash flow from operations as key highlights. Despite a recent slip in stock price, with a 21% decline over the past five days, Rambus boasts a 52-week low of $38.91.

- RSI Value: 28.71

- RMBS Price Action: Rambus Inc experienced a marginal setback, with shares retreating by 0.6%, closing at $41.84 on Monday.

Jabil Inc (NYSE: JBL)

- Jabil Inc recently declared a quarterly dividend of 8 cents per share, underscoring its commitment to shareholders. Despite a 10% decline in stock price over the past five days, Jabil stands tall with a 52-week low of $95.84.

- RSI Value: 29.02

- JBL Price Action: Jabil Inc encountered a minor setback, with shares slipping by 1.2% and closing at $98.43 on Monday.

As the market whirls with uncertainty, these tech stocks beckon like beacons of hope for investors seeking a potential uptick in their investment portfolio.