The health care sector is currently ablaze with opportunities as oversold stocks whisper promises of undervalued gems. Historical context reminds us that such moments have often paved the way for lucrative investments.

The Relative Strength Index (RSI), hailed as a market momentum indicator, is our oracle. It delineates a stock’s strength on up vs. down days, offering a sneak peek into its near future. An RSI below 30 is the magic number that signals an oversold asset, beckoning savvy traders to the feast.

Let’s delve into the entrancing world of three health care stocks that might be poised for a spectacular rebound, with RSIs hovering tantalizingly near or below 30.

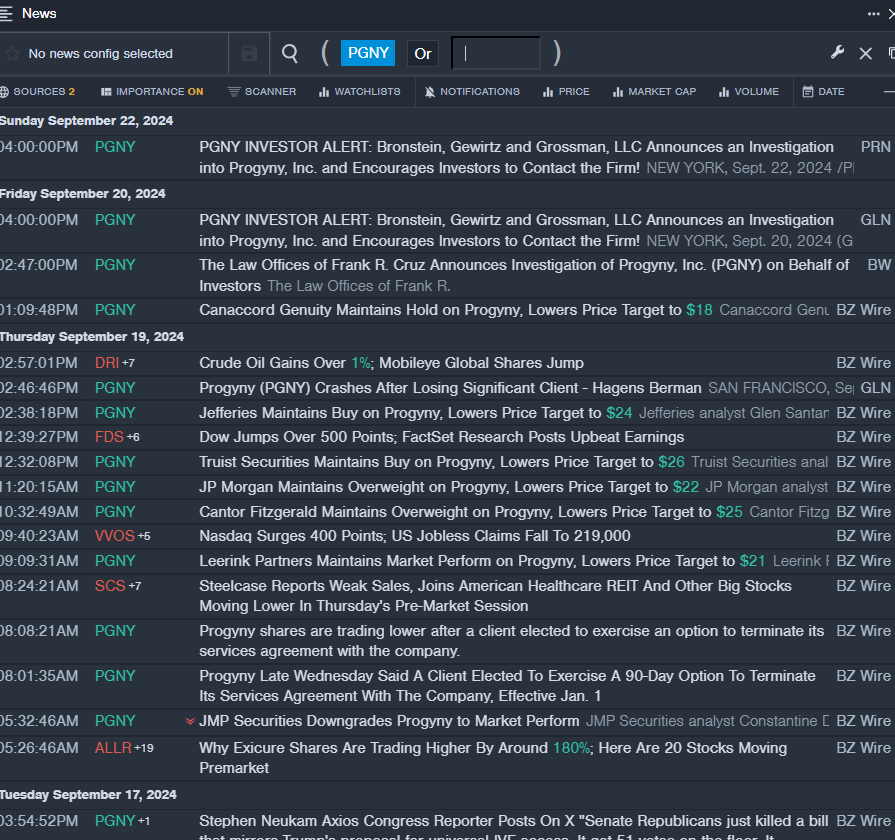

Exploring Progyny Inc (PGNY)

- Recent events shook Progyny Inc as a client chose to part ways, causing a seismic 32% tremor in the stock over five days. The company’s shares, with a 52-week low of $13.93, bear the weight of uncertainty.

- RSI Value: 26.50

- PGNY Price Action: Amid the chaos, Progyny’s stock managed a timid 1% rise, closing at $16.62 on Friday.

A Glimpse into Indivior PLC (INDV)

- Indivior PLC faced its own trials, detailing updates on Aelis Farma’s Phase 2B study amidst whispers of a 52-week low at $9.14.

- RSI Value: 25.92

- INDV Price Action: With a 2.1% descent, Indivior’s shares bid adieu at $9.48 come Friday.

Decoding Moderna Inc (MRNA)

- The tale of Moderna Inc unfolds with a dance of hope and skepticism. Health Canada’s embrace of SPIKEVAX, the COVID-19 shield, seemed to offer solace. Yet, with shares plummeting 20% in a month, clouds loom over the company, especially with a 52-week low of $62.55.

- RSI Value: 28.17

- MRNA Price Action: Despite the turmoil, Moderna’s shares witnessed a 3.4% drop, nestling at $65.69 at the week’s end.

The market is a tempest, ever-changing and unforgiving. As we gaze at these health care stocks at their lows, it is with a mix of trepidation and excitement. Will they soar like phoenixes or dwindle into obscurity? Only time will tell, but for daring investors, the allure of the oversold beckons.

Read Next:

Market News and Data brought to you by Benzinga APIs