Walmart’s WMT stock is stirring up excitement among investors as its three-to-one stock split is looming, scheduled for Monday, February 26. The split aims to enhance trading efficiency and broaden accessibility, with shares set to open at approximately $59 post-split from the current $177 per share.

Over 400,000 associates engage in Walmart’s stock purchase plan, fostering both internal and external enthusiasm. Considering Walmart’s recent price trajectory, it’s imperative to examine if the upcoming split will unveil a bargain opportunity following the company’s Q4 financial update this week.

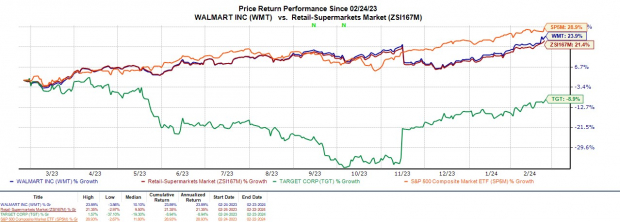

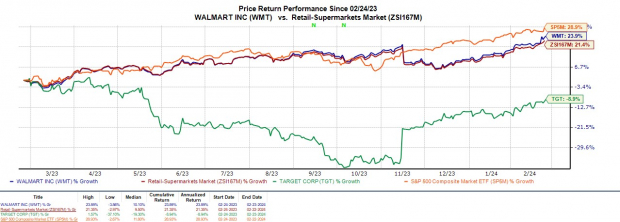

Exploring Recent Price Performance

Walmart’s stock has surged by +12% year-to-date, outperforming the S&P 500’s +6% and its omnichannel competitor, Target’s TGT, by +5%. Comparatively, over the last year, WMT shares have soared by +24%, surpassing Target’s -9% decline and notably outpacing the Zacks Retail-Supermarkets’ +10% while marginally trailing the industry benchmark.

Image Source: Zacks Investment Research

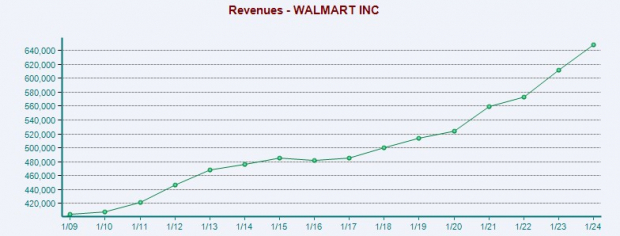

Favorable Q4 Results Fueled by E-commerce Sales

Walmart’s Q4 report, unveiled on Tuesday, displayed promising figures, setting a positive tone for the broader retail sector. Surpassing expectations, earnings of $1.80 per share outstripped the Zacks Consensus by 9%. The company witnessed a 5% year-over-year rise in Q4 earnings, accompanied by a 5% revenue surge to $173.38 billion, over 1% beyond estimates.

Image Source: Zacks Investment Research

Walmart’s robust quarter was propelled by its expanding e-commerce division, registering a notable 23% sales increment in Q4, culminating in over $100 billion in online sales for the fiscal year. Overall, the retail giant tallied a 6% increase in total sales for FY24, reaching $648.1 billion. Additionally, annual earnings climbed by 6% to $6.65 per share.

Image Source: Zacks Investment Research

EPS & Outlook Assessment

Although Walmart’s EPS is anticipated to be diluted post-split due to the increased number of shares, the company’s total earnings entity remains unchanged. Forecasts predict a 3% revenue growth for FY25, with FY26 sales estimated to rise by 4% to $698.5 billion. Annual earnings are expected to escalate by 5% in FY25 to $7.02 per share, equivalent to $2.34 per share post-split, with a projected 9% EPS growth in FY26.

Image Source: Zacks Investment Research

Key Takeaways

Presently, Walmart holds a Zacks Rank #3 (Hold) after a spirited start to the year. While a considerable part of Walmart’s year-to-date surge can be linked to anticipations of a pre-split rally, the company’s expanding e-commerce segment and long-term growth prospects remain enticing. However, investors are cautioned that post-split surges are not guaranteed, indicating that strategic purchase timings may significantly affect investment outcomes.

Before diving into investment decisions based on the impending stock split, it’s crucial to evaluate Walmart’s market positioning and potential trajectories beyond the split’s immediate effects.