The Story Unfolds

During its journey, Lululemon’s LULU stock has been the apple of Wall Street’s eye, basking in the limelight for its popularity and growth as a top athletic apparel retailer with a fiercely loyal customer base.

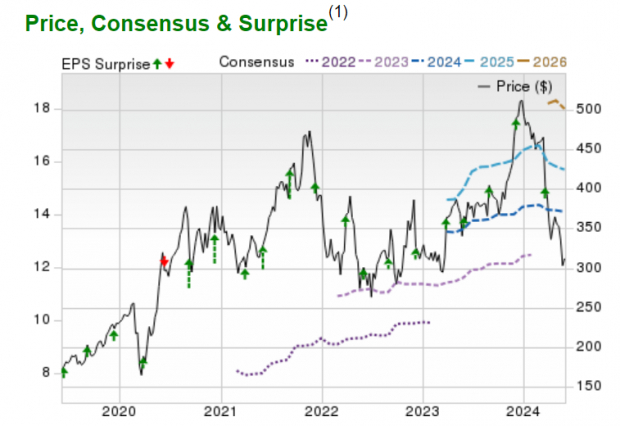

The scenario has taken a stark turn this year, with LULU plummeting by -46% year-to-date. The downfall was triggered by the company’s conservative guidance for fiscal 2024, where it anticipates a net revenue growth of 10%-11%. While commendable, this figure fell short of the grand expectations set by numerous analysts.

Setting the Stage

As the dusk of Q1 earnings descends upon us post-market hours on June 5, the compelling question emerges – is it time to make a move on Lululemon’s stock?

According to projections, Lululemon is expected to clock sales of $2.2 billion in Q1, marking a 10% uptick from the previous year’s $2 billion. Additionally, Q1 earnings are forecasted to rise by 4% to $2.38 per share.

A Walk Down Memory Lane

Delving into history unveils a riveting tale. Over the past five years, LULU has surged by a whopping +75%, showcasing tremendous gains of nearly +600% in the last decade, outshining its counterparts in the market. This phenomenal performance has outpaced the Zacks Textile-Apparel Market by an impressive margin, triumphing over the S&P 500 and even the Nasdaq.

Noteworthy is the fact that Lululemon is currently trading at its lowest forward earnings multiple since its IPO in 2007, standing at 21.7X. This valuation presents a substantial discount from its historical P/E peak of 148.3X, marking a 38% markdown from the historical median of 35.5X.

The Verdict

At first glance, the allure of investing in Lululemon’s stock at its current levels seems undeniable. The apparel giant foresees a surge in its top and bottom lines in FY24, coupled with a P/E valuation at its most attractive level to date.

However, a word of caution resonates – LULU holds a Zacks Rank #4 (Sell) due to the decline in EPS estimates for FY24 over the past quarter, with a slight drop even in the recent week.