Coca-Cola: A Time-Tested Staple

Coca-Cola (NYSE: KO) has been a staple in Berkshire Hathaway’s portfolio since its first investment in 1988. Since then, Berkshire Hathaway has accumulated 400 million Coca-Cola shares, representing around 9% of the company’s shares.

In the U.S., Coca-Cola had a 46% market share in the carbonated soft drink market at the end of 2022, far outpacing its biggest competitor, PepsiCo. Regardless of Coca-Cola’s market dominance over the decades, I appreciate how it has yet to get complacent and continues prioritizing innovation and adapting to consumers’ ever-changing preferences. A testament to this has been Coca-Cola’s Transformational Innovation Team, whose sole purpose is driving product development and exploring new market trends.

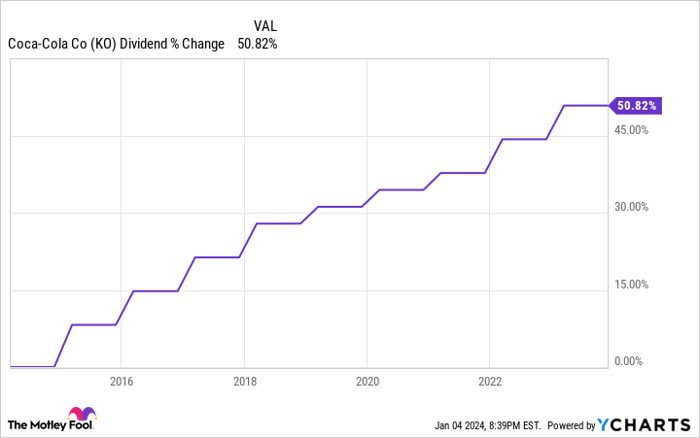

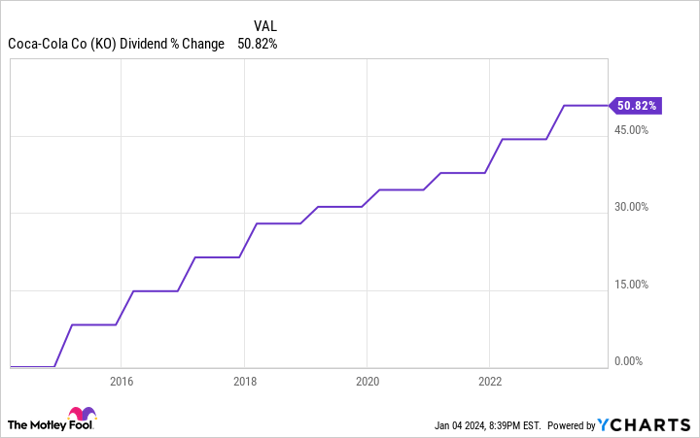

Coca-Cola’s stock price has underperformed against the S&P 500 over the past decade, but its dividend is what generally attracts investors. Coca-Cola’s quarterly dividend is $0.46, with a trailing 12-month yield of around 3%. Arguably more impressive is that it has increased its yearly dividend for 61 consecutive years, giving it the esteemed title of Dividend King. In the past 10 years alone, Coca-Cola’s quarterly dividend has increased by over 50%.

KO Dividend data by YCharts

Coca-Cola isn’t a growth stock that’ll consistently return double-digit percentages year in and year out, but it can provide investors with as reliable a dividend as you’ll find on the stock market.

Visa: The Ace in the Digital Payments Sector

Visa (NYSE: V) is the global leader in digital payments, with a vast, constantly expanding reach. It operates in over 200 countries, has over $4.3 billion cards in circulation, and is accepted by over 130 million merchant locations.

Visa’s reach is its key competitive advantage, mostly because of the network effect. Imagine you’re a retailer and have to choose which cards you’ll accept. Chances are high that you’ll go with Visa because you understand your customers will likely have a Visa card over other options. Not accepting Visa cards could mean missing out on sales. The same applies to consumers looking to get a card. Many prefer a Visa card because businesses that accept cards are very likely to accept Visa.

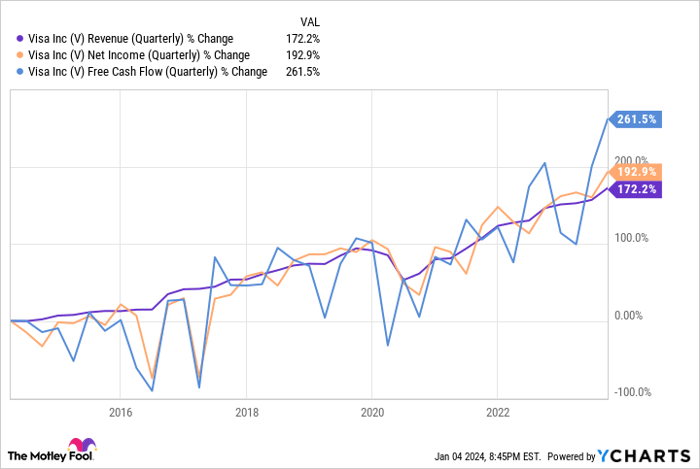

Visa’s recent growth has translated well to its financials as well. Over the past decade, its revenue is up 172%, but its net income and free cash flow have grown faster, signaling the company is operating more efficiently.

V Revenue (Quarterly) data by YCharts

The U.S. may be a leader in digital payments, but much of the world still operates in a cash economy. That gives Visa plenty of market opportunity as countries transition toward digital and electronic payments. It’s a stock I feel comfortable holding onto for the long haul.

Amazon: The Logistics Behemoth

Amazon (NASDAQ: AMZN) isn’t a company that needs much of an introduction. Its e-commerce business has made it a household name around the globe. However, it likely won’t be Amazon’s e-commerce business that drives a lot of its growth in the foreseeable future — it may be the logistics network that powers it.

Amazon recently announced “Supply Chain by Amazon,” a fully automated set of supply chain services. The service allows sellers to take advantage of Amazon’s complex logistics, warehousing, distribution, fulfillment capabilities, and transportation (including international).

Amazon has spent billions building out its logistics network, and Supply Chain by Amazon allows the company to capitalize from it outside of its core e-commerce business.

E-commerce will continue to be Amazon’s main revenue driver, and Amazon Web Services will be its main profit generator, but it’s encouraging to see other segments beginning to pull their own weight a little more. In the third quarter of 2023, Amazon’s third-party seller

The Impressive Surge of Amazon’s Services Revenue

A 20% year-over-year (YOY) growth in services revenue points to Amazon’s unwavering dominance in the tech industry. The conglomerate’s advertising segment notably spearheaded this remarkable expansion, surging by an impressive 26%. This upward trajectory indicates Amazon’s ability to leverage its multifaceted presence in high-growth sectors, ensuring bountiful returns for shareholders as it continues to extend its reach across diverse industries.

While Amazon’s far-reaching impact spans various domains, the surge in services revenue underscores the company’s agility and unrivaled ability to seize opportunities in burgeoning markets. This unprecedented growth places Amazon in a commanding position, solidifying its standing as a force to be reckoned with in the corporate landscape.

Delving deeper into the financial narrative, Amazon’s unparalleled rise in services revenue illuminates its deft maneuvering within booming sectors. The torrential surge of advertising speaks to the company’s shrewdness in capitalizing on evolving consumer trends and market dynamics, positioning it as a stalwart amid fierce competition.

Investment Prospects and Potential

Considering Amazon’s momentous strides and unyielding expansion, investors are presented with an enticing proposition. The company’s diverse revenue streams and consistent innovation underscore its resilience, portraying Amazon as a beacon of opportunity and potential growth.

Amazon’s bold foray into various industries exudes confidence and dynamism, prompting a favorable outlook for prospective investors. The company’s astute navigation of volatile economic terrains and relentless pursuit of growth positions it as a prime avenue for investment, promising substantial returns bolstered by its multifaceted endeavors.

With Amazon’s unwavering ascent and astute market acumen, its offerings appeal to investors seeking a resilient and lucrative investment avenue. As the tech juggernaut blazes a trail across industries, it presents an attractive prospect for those eyeing sustained growth and formidable returns.

The Motley Fool’s Insightful Analysis

A comprehensive analysis by the Motley Fool Stock Advisor highlights the captivating potential of Amazon’s financial trajectory. The meticulously curated insights provide a holistic view of the company’s growth, offering valuable guidance to investors seeking to capitalize on Amazon’s exceptional ascent.

Amidst the torrent of opportunities spurred by Amazon’s exponential growth, the insights from Stock Advisor serve as a beacon, guiding investors through the intricate landscape of investment possibilities. With an astute commentary on the market’s dynamic shifts, investors are equipped with the knowledge to navigate and capitalize on Amazon’s flourishing trajectory.

Against the backdrop of Amazon’s ascendancy, the analysis from Stock Advisor propels investors toward a well-informed and strategic approach, illuminating the potential for substantial returns amid the company’s resounding success.

Conclusion

Amazon’s staggering services revenue growth, bolstered by the remarkable surge in advertising, paints a resplendent picture of the company’s enduring prowess and vigorous expansion. As the tech titan magnifies its presence across diverse sectors, it beckons investors with the promise of boundless growth potential and formidable returns. The insights from Stock Advisor further underscore the captivating possibilities presented by Amazon’s financial narrative, shaping a compelling narrative for investment enthusiasts seeking to ride the wave of Amazon’s unprecedented success.