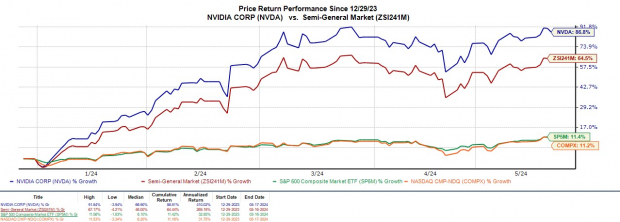

With Q1 earnings from Nvidia (NVDA) on the horizon, investors are on the edge of their seats, eagerly anticipating the company’s financial report as the broader indexes hit fresh highs, riding the wave of reassuring inflationary data in April.

If Nvidia delivers yet another quarter of staggering growth, it could be the catalyst to send markets soaring. The big question on everyone’s mind – is it the right time to snatch up stocks in this chip behemoth before its Q1 results on Wednesday, May 22?

Image Source: Zacks Investment Research

Great Expectations for Q1

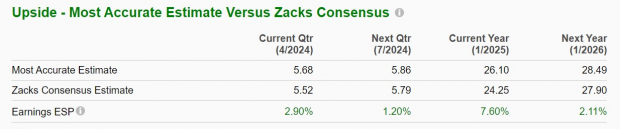

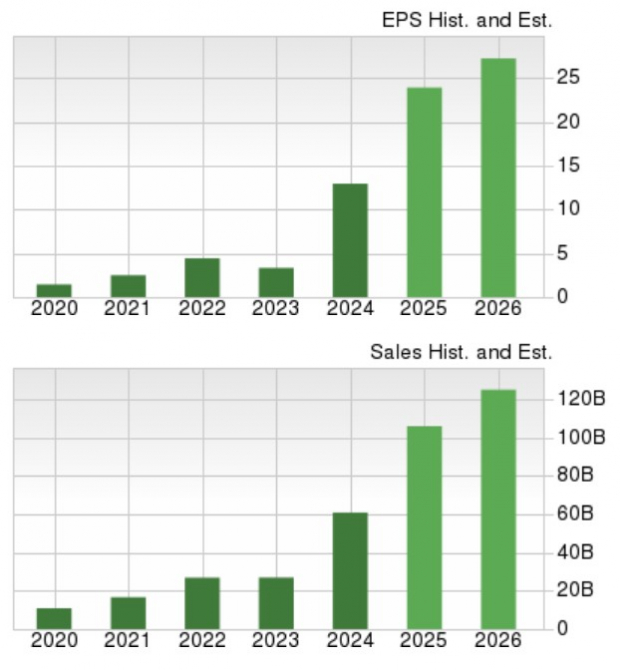

Nvidia’s growth trajectory and the demand for its artificial intelligence chips are expected to continue their meteoric rise, with Q1 EPS forecast to skyrocket over 400% to $5.52 from $1.09 per share in the same quarter last year. Impressively, the Zacks ESP hints that Nvidia might once again outperform earnings projections, with a Most Accurate Estimate of $5.68 for Q1 EPS – a 3% premium over the current Zacks Consensus.

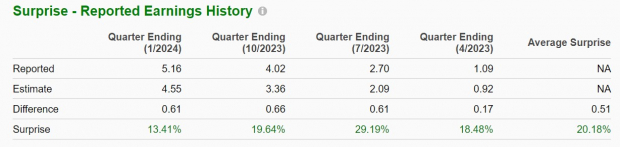

Having outperformed the Zacks Consensus by 13% in February, recording Q4 EPS at $5.16 against estimates of $4.55 per share, Nvidia has a track record of exceeding earnings expectations for five consecutive quarters, boasting an average earnings surprise of 20.18% in its last four quarterly reports.

On the revenue front, Q1 sales are anticipated to surge by 237% to $24.27 billion compared to $7.19 billion a year ago. Notably, Nvidia has outshined sales estimates for a remarkable 20 quarters in a row.

Unleashing the Blackwell GPU & Future Prospects

Watchful eyes on Wall Street are keen for updates on Nvidia’s Blackwell series of GPUs, touted to be the most high-performance AI chips in the market, surpassing the current H200 series and AMD’s MI300 series. The anticipated release of Blackwell series models, with an expected price range of $30,000 to $40,000 per GPU, likely in Q4 around October or November, is expected to solidify lofty projections of double-digit growth in both top and bottom lines for Nvidia in its fiscal 2025 and FY26.

Evaluating Nvidia’s P/E Ratio

Due to its stellar growth, Nvidia’s stock is presently trading at a considerably more reasonable valuation, sporting a forward earnings multiple of 39.4X. This valuation sits well below its five-year high of 122.1X, offering a 29% discount compared to the median of 55.6X.

Furthermore, Nvidia’s stock is priced lower than the Zacks Semiconductor-General Industry average of 43.7X and AMD’s 47.5X.

The Verdict

Nvidia’s stock flaunts a Zacks Rank #1 (Strong Buy) as it heads into its Q1 earnings announcement next week. This is primarily due to Nvidia’s attractive P/E valuation and the consistent upward trajectory of earnings estimates for both FY25 and FY26.