In a resounding affirmation of the resilience of investment banking, Goldman Sachs GS reported robust first-quarter results earlier this week. The stellar performance not only underscores the firm’s strength but also mirrors the success seen by peers like JPMorgan JPM and Morgan Stanley MS.

Goldman Sachs’ stellar Q1 report has sparked excitement among investors, prompting them to ponder the opportune moment to acquire shares in this financial powerhouse.

A Closer Look at Q1 Performance

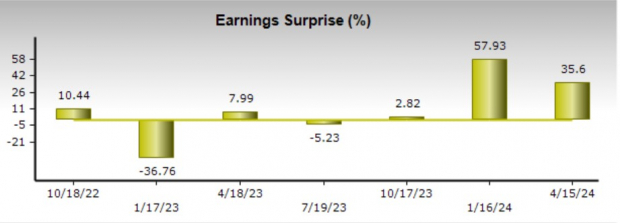

Amid a thriving Zacks Financial-Investment Bank Industry, Goldman Sachs has flourished, witnessing a notable $36 billion surge in assets under supervision during Q1, reaching a record $2.85 trillion. The quarter’s earnings of $11.58 per share trounced the Zacks Consensus estimate by 35%, with an impressive 32% rise from the previous year. Moreover, Q1 sales of $14.21 billion surged 16% annually and surpassed expectations by 10%. Noteworthy achievements also include Goldman Sachs holding the global top spot for announced and completed mergers in the current year.

CEO David Solomon’s insights on Artificial Intelligence (AI) are equally promising. As AI transitions from a phase of anticipation to implementation by 2024, Solomon expressed optimism during the earnings call about AI’s potential to enhance the bank’s efficiency and drive increased business volume through AI-enabled corporate investments.

Projected Growth & Future Outlook

Analysts anticipate Goldman Sachs achieving a 43% bottom-line expansion in fiscal 2024, with EPS projected to reach $32.76 compared to last year’s $22.87 per share. Further growth is predicted for fiscal 2025, with sales expected to climb by 9% in FY24 and an additional 4% in FY25, with revenue reaching $52.37 billion.

While Goldman Sachs stock has lagged behind some peers in recent performance, its current valuation is attractive at 12.2X forward earnings, representing a discount compared to the industry average. This positions Goldman Sachs favorably against direct competitors like Morgan Stanley.

Key Takeaways

Goldman Sachs stock currently holds a Zacks Rank #3 (Hold) and boasts a generous 2.74% annual dividend, making it an appealing option for long-term investors. With its strong position as a global investment banking leader, coupled with optimistic earnings estimate revisions on the horizon, a potential uptrend in buy ratings could be anticipated.

In a landscape where the U.S. infrastructure awaits a significant overhaul, savvy investors may find exciting opportunities in Goldman Sachs and similar firms poised to benefit from the impending national rejuvenation.