Ford Motor Company (NYSE: F) recently disclosed its fourth-quarter sales data, paving the way for its fourth-quarter and full-year 2023 results. The revelation of record-breaking electric vehicle (EV) sales is accompanied by substantial losses in the near term, presenting a conundrum for investors.

However, despite the apparent setback, here’s why Ford’s foray into the EV market is actually a positive development for the company’s investors.

The Intricacies

In 2023, Ford saw a 7.1% surge in U.S. sales, with nearly 2 million vehicles hitting the roads. The remarkable sales were predominantly driven by the robust performance of the F-Series full-size trucks, commercial vehicles, and a historic year for electric vehicles.

Notably, the F-Series, Ford’s flagship product, continued to reign supreme as America’s top-selling truck for the 47th consecutive year and the best-selling vehicle for the 42nd consecutive year. Furthermore, the company’s position in the electric truck market was fortified, with the F-150 Lightning emerging as the highest-selling electric truck and the F-150 Hybrid securing the top spot among full-size hybrid trucks for the entire year. This success underscores Ford’s ability to transition its dominance in full-size gasoline-powered trucks to the burgeoning EV segment, a vital factor for bolstering its financial performance.

Exploring the EV Landscape

Another highlight of Ford’s fourth-quarter and full-year sales lies in its performance within the electric vehicle domain. The company witnessed a record surge in EV sales, propelling it to achieve unprecedented levels of success. Specifically, Ford reported the sale of nearly 26,000 EVs during the fourth quarter, marking a substantial 24% increase from the preceding quarter and culminating in an 18% upturn for the entire year.

Significantly, the impressive growth in Ford’s EV sales is primarily attributed to the exceptional performance of the F-150 Lightning, which recorded a remarkable 74% spike in sales compared to the previous year’s fourth quarter, and a 55% increase for the full year. This outstanding performance positioned Ford as the second-leading EV brand in the U.S. for 2023, a testament to its growing influence in the rapidly evolving EV market.

A Bitter Pill to Swallow

Despite the commendable progress in EV sales, the flip side of the coin is evident: Ford continues to suffer substantial losses with each EV it rolls off the production line. The company previously estimated that its EV business arm, Model e, would incur an approximate loss of $4.5 billion in 2023. Although management anticipates a reversal of fortunes by the end of 2026, with costs reduction and accelerated production set to pave the way for profitability, the immediate consequence of soaring EV sales is an adverse impact on the company’s full-year earnings.

However, amidst the prevailing adversity, there lies a glimmer of hope. Ford’s relentless pursuit of record-breaking EV sales is deemed crucial in its quest to alleviate overheads, trim costs, and eventually attain profitability. The adage “the darkest hour is just before the dawn” rings true, underscoring the notion that the short-term pain endured due to soaring EV sales will ultimately yield long-term gains for the automaker.

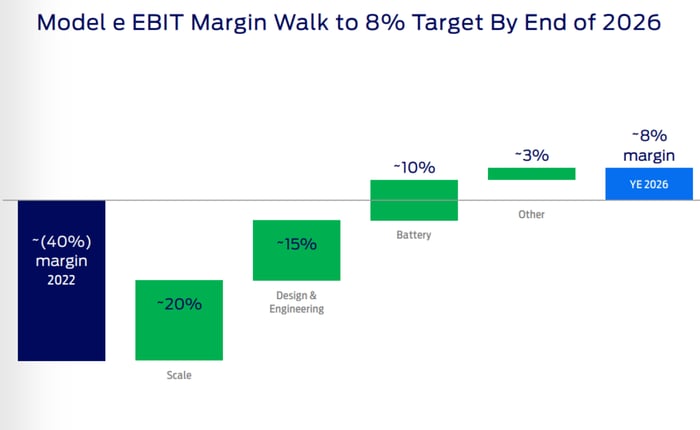

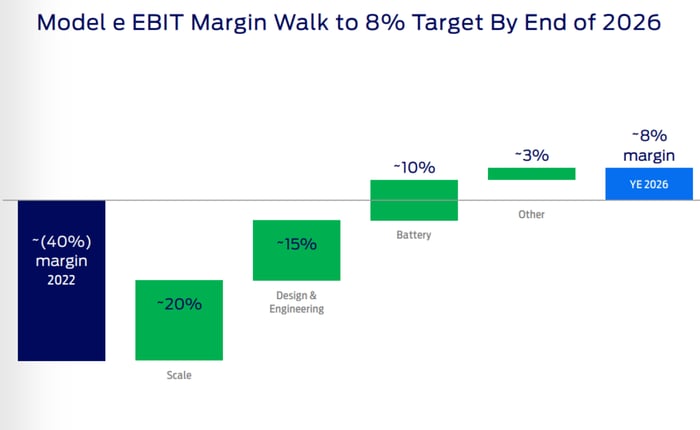

As detailed in Ford’s presentation outlining its roadmap toward achieving 8% EBIT margins by the close of 2026, a substantial portion of the margin gains hinges on scaling production and sales, complemented by a blend of design and engineering enhancements, as well as reduced battery expenditure.

Data source: Ford Motor Company presentation.

What Lies Ahead

Ford concluded the 2023 chapter with a modest surge in sales momentum, a prelude to the anticipated growth trajectory in 2024, underpinned by its robust performance in the full-size trucks and SUV segments. The company is set to unveil new iterations of F-150s, Rangers, Explorers, Expeditions, in addition to Lincoln Aviators, Navigators, and Nautiluses.

Crucially, despite the prevailing narrative spotlighting Ford’s substantial EV-related losses, the company’s relentless pursuit of unparalleled EV sales remains pivotal in expediting its journey to profitability in the foreseeable future.

While Ford’s current foray into EVs might appear to be causing significant financial hemorrhage, it is, in fact, a strategic imperative that sets the stage for the company’s resurgence in the long run.