The financial sector is heating up with JP Morgan JPM, Bank of America BAC, and other big banks set to kick-start the Q4 earnings season when they report their quarterly results next Friday. However, consumer lending stocks have also been thriving, with Ally Financial ALLY and Synchrony Financial SYF standing out in particular.

Both Ally and Synchrony are hovering close to their 52-week highs and are gearing up to report Q4 results later in the month on January 19 and 23, respectively. As investors anticipate their reports, the question arises – is it a prudent moment to acquire Ally or Synchrony stocks to ride the crest?

Recent Performance Overview

Ally offers financial products and services primarily to the auto industry, while Synchrony provides a wide range of credit products through a diverse group of national and regional retailers, local merchants, and manufacturers among others.

Over the last year, Ally’s stock performance has been robust, with shares up +36% surpassing the S&P 500’s +24% gain. Synchrony’s performance has also been commendable, with shares up +17%. Notably, Synchrony hit 52-week highs of over $38 a share, and Ally is on the brink of its highs of $35.78 per share seen last February.

Image Source: Zacks Investment Research

Q4 Previews & Outlook

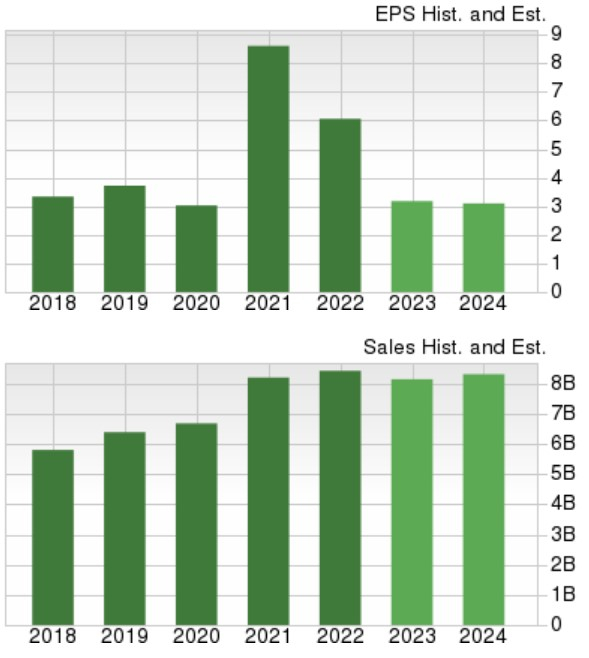

Ally and Synchrony are up against tough prior year quarters in Q4. Fourth-quarter earnings estimates for Ally are currently projected at $0.51 a share compared to $1.08 per share in Q4 2022. On the top line, Q4 sales are estimated to decline by 9% to $2 billion. However, Ally’s annual earnings for FY23 are anticipated at $3.12 per share compared to $6.06 per share in 2022. Though, FY24 earnings are forecasted to rebound and rise by 14%.

Image Source: Zacks Investment Research

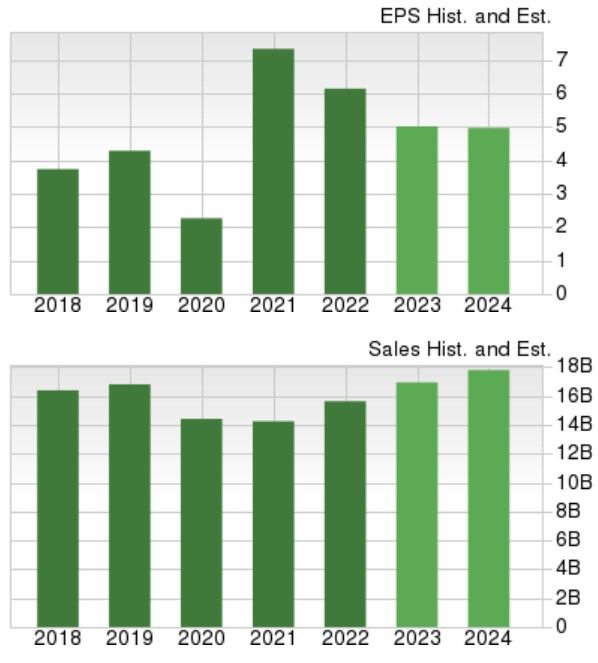

Turning to Synchrony, Q4 earnings are expected to decline by 22% to $0.98 a share versus $1.26 per share in the comparative quarter. Despite this, fourth-quarter sales are projected to rise by 8% year-on-year to $4.45 billion. Synchrony is expected to finish FY23 with EPS down by 16% to $5.13 per share, but FY24 earnings are foreseen to rebound and rise by 7% to $5.51 a share. Total sales are expected to have risen by 8% in FY23 and are forecasted to rise by another 7% this year to $18.17 billion.

Image Source: Zacks Investment Research

Strong Value

While Ally and Synchrony might seem like they are losing post-pandemic momentum in terms of bottom-line figures, their recent surge is attributable to reasonable valuations – Ally’s stock trades at a very reasonable 10.8X forward earnings multiple, and Synchrony shares trade at just 7.3X.

Image Source: Zacks Investment Research

Ally currently has a generous 3.5% annual dividend yield, while Synchrony’s 2.67% yield is above the S&P 500’s 1.4% average, offering additional value to investors.

Image Source: Zacks Investment Research

Final Thoughts

Currently, Ally Financial and Synchrony Financial are both holding a Zacks Rank #3 (Hold). The potential for higher highs may largely hinge on their Q4 results, but maintaining positions in these consumer finance leaders may continue to yield returns at their current levels.