The Q3 reporting cycle has officially ended for the Mag 7 group following the release of Nvidia’s quarterly results yesterday. The group posted strong growth, though post-earnings reactions weren’t favorable for all.

But reports from Tesla TSLA and Amazon AMZN did spark post-earnings positivity, with shares of each seeing positive price action following their releases.

But what was there to like in each respective release? Let’s take a closer look.

Amazon’s AWS Results Impress

Concerning headline figures in Amazon’s quarterly release, the company exceeded both consensus EPS and sales expectations handily. EPS grew a sizable 70% year-over-year, whereas sales of $60 billion reflected an 11% climb from the year-ago period.

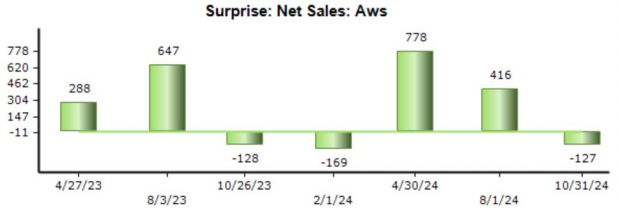

However, the real highlight of the results was the AWS results. AWS sales jumped 19% year-over-year to $27.5 billion, matching the same growth pace we saw last quarter. While the growth pace didn’t reflect an acceleration, the results overall confirm underlying momentum.

Further, the profitability picture for AWS jumped higher, with operating income of $9.3 billion well above the $5.4 billion mark in the year-ago period. Below is a chart illustrating the company’s AWS results against our consensus expectations, with the recent $27.5 billion print falling $127 million short.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

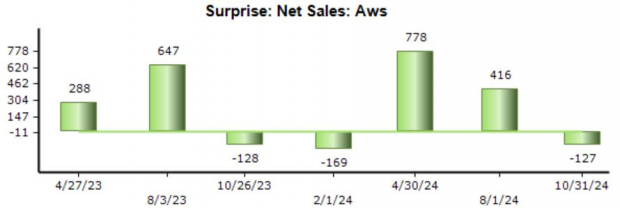

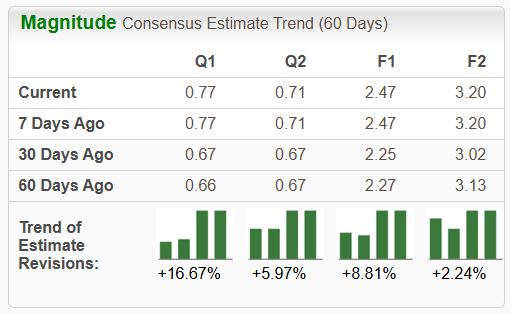

Like Tesla, analysts raised their earnings expectations for Amazon following the favorable release, with the stock boasting a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Overall, the company’s dominant stance in the cloud paints a bright outlook for the company, particularly in the midst of this AI frenzy that we’ve all become accustomed to. AWS is the dominant player in the cloud computing market, flexing a significant market share globally. It provides various services, including computing power, storage, databases, and AI/ML tools.

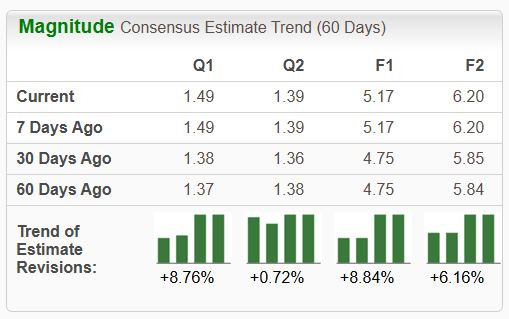

Tesla Sees Higher Profitability

While EV delivery/production numbers were important, the real highlight of the release that caused shares to perk up was margin expansion, with the company’s gross margin expanding nicely to 19.8% vs. a 17.9% print in the same period last year.

Please note that the chart’s values are calculated on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

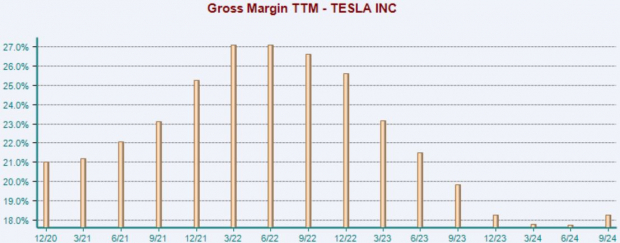

Notably, Tesla reported its lowest-ever level of cost of goods sold (COGS) per vehicle throughout the period, which bodes favorably for upcoming periods as well. Analysts have raised their EPS expectations across the board following the release, with the stock now holding the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The stock’s current momentum is undeniable, partly boosted by the recent U.S. election. Growth is expected to resume in its next fiscal year, with our consensus FY25 expectations suggesting 30% EPS growth on 16% higher sales.

Bottom Line

With Nvidia’s quarterly release finally out of the way, the Q3 reporting cycle for the broader Mag 7 group has ended. The group overall posted strong growth, though Amazon AMZN and Tesla TSLA were among the few to see post-earnings momentum.

A notable boost in profitability helped vault Tesla shares higher, with the stock also benefiting from the recent U.S. election. The company overall remains the prime selection for EV exposure, with growth expected to return in a big way during its next fiscal year.

A strong showing from AWS in Amazon’s release aided the bullish action post-earnings, with the results reflecting underlying momentum. The company remains a solid pick for the AI frenzy given its dominant cloud computing stance, with an upcoming holiday season also potentially providing near-term tailwinds.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report