Amidst the ethereal domain of Wall Street, NVIDIA Corporation NVDA recently unveiled its fiscal second-quarter results, which left a bittersweet aftertaste as its shares took a dip. Does this downturn signal a loss of shine for NVIDIA against its competitors Advanced Micro Devices, Inc. AMD and Intel Corporation INTC within the semiconductor realm? Or, does it possess the latent power to augment shareholders’ wealth in the near future? Let’s delve deeper into the realm of silicon valleys –

Post Earnings Blues for NVIDIA Stock

NVIDIA recently stunned the market with its second-quarter fiscal 2025 figures, effortlessly outclassing analysts’ anticipations. The quarter ending on July 28, 2024, saw the chipmaker record earnings per share of $0.68, ascending by 11% from the previous quarter and soaring by 152% on a yearly basis.

Netting a total revenue of $30 billion, a 15% rise over the preceding quarter and a staggering 122% surge year-on-year, NVIDIA witnessed growth across all segments – spanning data centers, gaming, professional visualization, and robotics.

The robust demand for existing Hopper chips along with the imminent launch of next-gen Blackwell artificial intelligence (AI) chips towards the year-end bolstered NVIDIA’s quarterly showings.

Alas, amidst such promising quarterly feats, NVIDIA’s shares encountered a 6.4% plunge during Thursday’s trading session, coupled with a 2.1% dip on Wednesday. Exceedingly high performance anticipations considerably fueled this descent, especially as NVIDIA currently reigns supreme as the S&P 500’s top performer for the year.

The Valiant Defense of NVIDIA Stock

The present share price downturn is but a minor glitch in NVIDIA’s saga. A broader panorama reveals that with the Federal Reserve prepped to trim interest rates in the upcoming September policy meet, NVIDIA’s capital outlays on AI-related infrastructures are primed for an upsurge.

The realm of AI is expanding swiftly, set to balloon from $214.6 billion this year to a whopping $1,339.1 billion by 2030 as stated by MarketsandMarkets.

While the impending Blackwell AI chip launch promises NVIDIA a competitive edge over its contenders, their gaming GPU line, GeForce, is pegged to fuel NVIDIA’s penetration into the burgeoning gaming sector. NVIDIA’s strategic foray into the industrial metaverse domain alongside Siemens further uplifts the company’s prospects.

Growth Concerns Loom Over AMD Stock

Parallel to NVIDIA, Advanced Micro Devices acts in the semiconductor arena and harbors aspirations of venturing into gaming. Nonetheless, NVIDIA vastly overshadows Advanced Micro Devices, whose recent quarterly revenue hike pales in comparison to NVIDIA’s colossal strides. In the latest reported quarter, Advanced Micro Devices saw a mere 9% year-on-year revenue surge.

While Advanced Micro Devices delves into AI investments, they remain a step behind NVIDIA. Unfurling the returns of any AI investment is a time-intensive journey. Moreover, the lag in injecting funds into essential AI infrastructure may prove to be a stumbling block for Advanced Micro Devices in the long haul.

Regardless, the battle tilts decisively in NVIDIA’s favor. Data by Jon Peddie Research reflects a stark downturn for Advanced Micro Devices, with their GPU market share plummeting from 35% to 12% over the past decade whereas NVIDIA witnessed an upsurge from 65% to 88%.

INTC Stock – A Faint Flicker in the Battle

Within the realm of microprocessing, as NVIDIA reigns supreme, Intel grapples with the challenge of governing Advanced Micro Devices who have made notable strides in high-performance processing apparatuses.

Intel stares down a perilous path post their sluggish stride in the foundry domain. Intel failed to harness the burgeoning AI applications sector, where most peers have thrived.

Intel’s server and networking segment faces disruptions from Arm Holdings plc ARM. Several of ARM’s microserver designs have been embraced by Intel’s competitors. Intel’s shares, since the dot-com bubble burst, have never fully recouped and presently hold a Zacks Rank #4 (Sell).

Fundamentals Speak Volumes: NVIDIA Stock’s Reign

NVIDIA has outstripped Advanced Micro Devices and Intel in profit generation. NVIDIA flaunts a return on equity (ROE) of 124.6%, overshadowing Advanced Micro Devices’ 6% and Intel’s 1.8%. Any reading over 20% is regarded as exemplary.

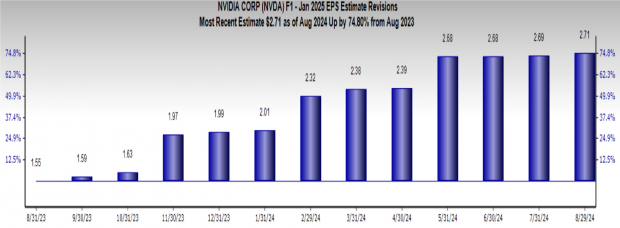

A towering net profit margin of 55% for NVIDIA far surpasses Advanced Micro Devices and Intel’s 5.8% and 1.8% correspondingly. A reading over the 20% threshold denotes adept cost management and profitable sales generation. Hence, the $2.71 Zacks Consensus Estimate for NVIDIA’s earnings per share marks a 74.8% year-on-year ascent.

Image Source: Zacks Investment Research

NVIDIA Stock Outshines: Trading Above 200DMA

Technically, NVIDIA’s stock has spent the entirety of this year trading above its 200-day moving average (DMA), signaling a steadfast long-term uptrend.

Image Source: Zacks Investment Research

Conversely, Advanced Micro Devices and Intel witnessed their prices plummet below the 200 DMA this year, a glaring indicator of an enduring downtrend.

Image Source: Zacks Investment Research

Robust Uptrend Predicted for NVIDIA Stock

Draped in the attire of a bullish trend, NVIDIA’s shares gleam brighter than their Advanced Micro Devices and Intel counterparts within the AI sphere and beyond. Renowned brokers have bolstered the average short-term price target of NVDA by 13.5% from the stock’s closing price of $125.61. The market analysts’ zenith price target looms at $200.

Image Source: Zacks Investment Research

Therefore, despite recent turbulent waters, discerning investors ought to tread the waters of potential with

The Future of AI Investments: Why NVIDIA Trumps AMD and Intel

AI Market Projection

As the digital landscape continues to evolve, the importance of Artificial Intelligence (AI) is becoming increasingly evident. With promises of enhanced efficiency, improved decision-making processes, and groundbreaking technological advancements, the AI industry is a realm investors can’t afford to overlook.

Standing Out in the AI Crowd

When considering investments in the AI sector, it’s essential to distinguish the frontrunners from the followers. While Advanced Micro Devices (AMD) and Intel have made their mark in the semiconductor industry, NVIDIA stands tall as a titan in the realm of AI.

Embodying the epitome of innovation, NVIDIA’s cutting-edge technologies have positioned the company as a beacon of success in the AI space. The company’s relentless pursuit of excellence, coupled with its unwavering commitment to pushing the boundaries of what’s possible, sets it apart from its competitors.

The Enduring Value of NVIDIA

Investors looking to capitalize on the AI revolution should take heed of NVIDIA’s steadfast presence in the market. As AI solidifies its position as a transformative force across industries, NVIDIA’s stock emerges as a beacon of stability and growth potential.

Looking Beyond the Competition

While Advanced Micro Devices and Intel have undoubtedly made strides in the semiconductor sector, NVIDIA’s specialized focus on AI technologies places it in a league of its own. With a track record of innovation and a forward-looking approach, NVIDIA is primed to capitalize on the burgeoning AI market.