As Americans grapple with the challenge of saving for retirement, the grim reality persists that the average American has just $87,000 stowed away in IRA and 401(k) accounts. Fidelity’s prudent guidelines advise amassing a retirement corpus equivalent to 10 times one’s annual salary by age 67. This benchmark further underscores the glaring shortfall in most Americans’ retirement savings. Such prevailing insufficiency has left investors seeking to pad their retirement nest eggs with stocks that offer both growth and a measure of safety. As retirement looms closer, preservation of existing meager savings becomes paramount, making high-risk stocks a less attractive proposition.

To satiate the need for stable yet growth-potential investments, stocks such as Apple, T-Mobile, and Alphabet emerge as viable contenders. Each of these options stands well-suited to support individuals in bolstering their retirement savings.

Apple: Durable Brand and Solid Liquidity

Apple, a quintessential household brand, enjoys fervent customer loyalty owing to its user-friendly, cutting-edge product offerings. Its groundbreaking foray into the smartphone sector with the iPhone remains pivotal, constituting a significant fraction of its overall revenue. Furthermore, its ventures into artificial intelligence fortify its position as an innovative powerhouse.

Despite recent modest revenue growth and profitability, Apple’s substantial liquidity of approximately $162 billion affords it significant stability and strategic flexibility, elevating investor confidence. This robust financial footing facilitated a 45% surge in the stock price over the past year. With a price-to-earnings (P/E) ratio of 30, Apple seemingly aligns closely with post-pandemic P/E averages, making it a stalwart contender for prospective retirees aiming to shore up their wealth.

T-Mobile: Market Share Dominance and Impressive Free Cash Flow

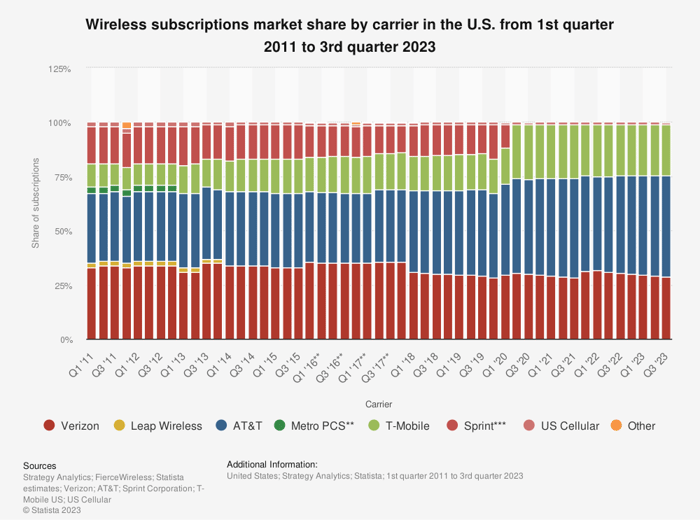

Amid the race for a nationwide 5G mobile provider, T-Mobile emerges as a standout choice, largely unburdened by the legacy costs weighing down its key competitors. Its strategic prowess in cost containment and acquisitions has enabled it to incrementally seize market share within the 5G wireless sphere, outpacing its erstwhile obstacles. The aftermath of its Sprint acquisition paved the way for substantial market share gains, catapulting its share of the U.S. wireless market to 24%.

Such astute strategic acumen has positioned T-Mobile as a stock outperformer, with the company yielding approximately $5.5 billion in free cash flow within nine months, enabling it to initiate dividend payouts, a testament to its financial mettle. Despite offering a marginally lower dividend yield compared to its peers, T-Mobile’s robust stock performance significantly outweighs any potential discrepancy in cash return. With a 25 P/E ratio near historic lows, T-Mobile seems poised to maintain its dominance within the U.S. telecom market as it capitalizes on its growth trajectory within the 5G domain.

Alphabet: Grounded in AI Leadership and Financial Prudence

Entrenched as Google’s parent company, Alphabet stands as a beacon, navigating the confluence of safety and growth harmoniously in its operations. Alphabet’s strategic pivot towards an “AI-first” approach in 2016 underscores its prescience in integrating advanced technologies across its product suite, reinforcing its industry foothold.

Alphabet’s pivot into generative AI with Gemini, propelled in response to competitive pressures, underscores its resilience in the face of technological advancements, solidifying its AI leadership. The recuperation of the advertising sector, a core revenue driver, coupled with its third-place ranking in cloud computing market share, further fortify Alphabet’s financial resilience. The company’s possession of $120 billion in liquidity, along with a near 60% stock price leap over the past year, reflects investor confidence in its ability to straddle the line between stability and growth.

Alphabet Continues to Shine: An Investment Perspective

Valuation and Performance

Trading at a P/E ratio of 26, Alphabet stock presents an intriguing proposition for investors. In comparison to the “Magnificent Seven” stocks, its valuation appears quite reasonable, indicating strong potential for future growth.

Business Diversification and AI

Alphabet’s robust presence across various business verticals, coupled with its cutting-edge AI technology, positions the company for sustained outperformance. Amidst the evolving market dynamics, Alphabet’s diverse revenue streams offer a shield against market volatility, providing investors a sense of security.

Investment Consideration

Before venturing into other investments, should Alphabet be the stock to captivate your investment dollars? The team at Motley Fool Stock Advisor has discerned a list of the 10 best stocks for investors, and Alphabet has not only made the cut, but also stands as one of the most promising choices.

Perspective on Apple Stock

While the future of Apple stock appears uncertain, the undeniable appeal of Alphabet’s trajectory continues to capture investor attention. In the world of investments, compelling options abound, yet Alphabet seemingly retains a competitive edge.

Expert Insights and Endorsements

The Motley Fool’s endorsement of Alphabet, in light of the invaluable guidance offered by its Stock Advisor service, warrants notable attention. This service has consistently surpassed the return of the S&P 500 since 2002, underscoring the potential Alphabet holds.

Ultimately, the decision to invest involves careful considerations, and an informed approach is vital. It is evident that Alphabet holds a persuasive allure as a prominent investment option, deserving of substantive reflection.

* Stock Advisor returns as of December 18, 2023