Revising Forecast and Foreseeing Trouble

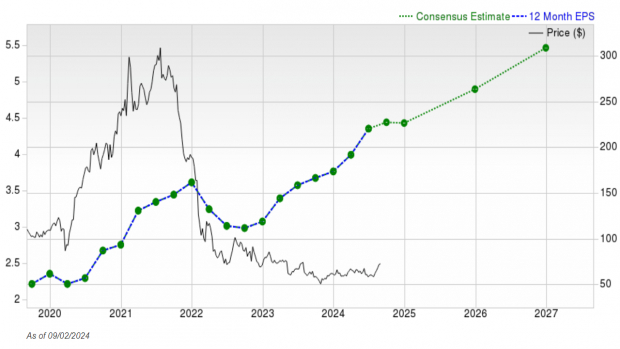

Wedbush analyst Daniel Ives maintained an Outperform rating on Tesla stock but made the bold move to reduce the price target from $315 to $300 ahead of the first-quarter deliveries update. Ives cited a perfect storm of demand and supply-side issues that have plagued Tesla in recent months.

China Dilemma and Delivery Estimates

Tesla has faced challenges in its key market, China, with rising competition and a lingering price war. Ives expressed concerns over the impact of these factors on Tesla’s delivery estimates, with projections revised downward from 475,000 units to 425,000 units for the first quarter.

A Critical Juncture for Tesla

Reflecting on the current state of affairs at Tesla, Ives noted that the narrative surrounding the company has turned increasingly negative due to sluggish growth and margin compression, especially in the wake of the China situation. He emphasized that Tesla, under the leadership of Elon Musk, is at a pivotal moment where navigating through these challenges is essential to avoid darker days ahead.

Recommendations for a Turnaround

- Provide formal guidance on margins and deliveries for 2024

- Conduct a detailed conference call addressing demand issues in China

- Host a battery/AI day to outline the roadmap for future growth

- Ensure Musk commits to leading Tesla and its AI endeavors for the next 3-5 years

- Implement a comprehensive advertising campaign

Ives expressed confidence in Tesla’s long-term prospects, especially highlighting the potential of the FSD/Autopilot strategy to drive future growth and valuation support.

The Road Ahead for Tesla

Despite the challenges and uncertainties, Ives remains optimistic about Tesla’s position in the EV market, stressing that perseverance through the current turbulent period will shape the future of the company. He noted that the upcoming period is crucial for Musk and the Tesla team to navigate effectively.

Tesla Stock Performance

On the stock market front, Tesla closed Wednesday’s session with a 1.22% increase, reaching $179.83. However, the stock has experienced a decline of nearly 28% year-to-date, reflecting the broader challenges faced by the company.

Image via photos on Shutterstock