Taiwan Semiconductor (TSM) reported quarterly earnings this morning and did not disappoint shareholders. Earnings came in 8.9% above analysts’ expectations and showed a 54.2% year-over-year (YoY) increase, while revenue beat estimates by 1.3% and grew an impressive 39% YoY.

Management offered encouraging comments as well, with Wendell Huang, Senior VP and Chief Financial Officer saying, “Our business in the third quarter was supported by strong smartphone and AI-related demand for our industry-leading 3nm and 5nm technologies.” And that “Moving into the fourth quarter 2024, we expect our business to continue to be supported by strong demand for our leading-edge process technologies.”

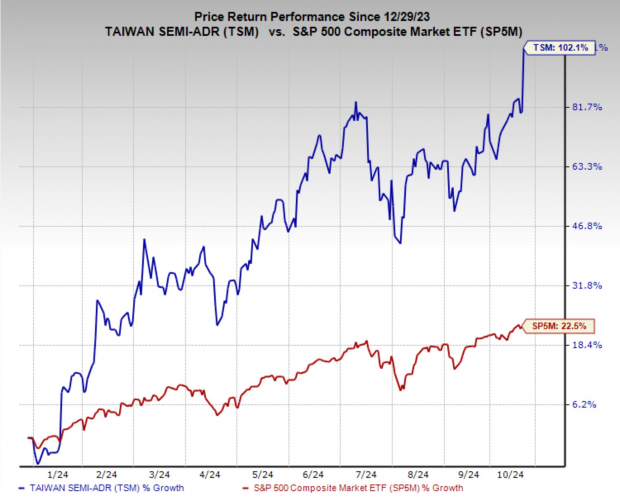

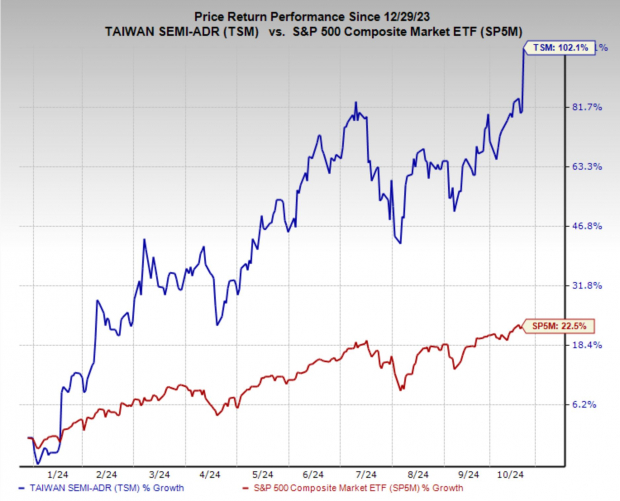

Taiwan Semiconductor stock has put on a stellar performance this year, doubling in just the last 10 months. With Nvidia (NVDA) and Apple (AAPL) as two of its largest customers, the semiconductor manufacturer has enjoyed the tailwinds of smartphone growth over the last decade and Artificial Intelligence more recently. Taiwan Semiconductor also boasts a Zacks Rank #1 (Strong Buy) rating and sits in the Top 1% (1 out of 250) of the Zacks Industry Rank, both of which improve the near-term expectations of the stock.

Reigniting the AI Trade

Artificial intelligence has been one of the primary forces driving the bull market in stocks over the last two years and many traders are constantly looking for something to end the trend. Earlier this week, ASML Holdings (ASML) reported a huge earnings miss, dragging down semiconductor stocks such as Nvidia and Broadcom. For the AI naysayers, it seemed like now may be the end of the AI trade.

But this morning’s report from Taiwan Semiconductor probably just reinvigorated the AI boom. Taking a step back, Taiwan Semiconductor and Nvidia have been two of the biggest beneficiaries of the emerging technological revolution, however trading in their stocks as well as the broader technology sector has looked weary since summer.

But with TSM and now Nvidia pushing new all-time highs again, I think we can safely say that the boom is back.

Valuations and Projections

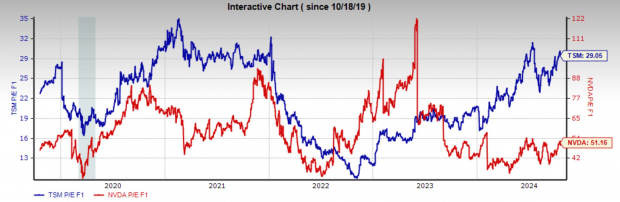

Also encouraging is that Taiwan Semiconductor and Nvidia both are trading at reasonable valuations and with strong earnings growth forecasts. TSM is currently trading at 29.1x forward earnings, which is above its five-year median of 21.3x. Analysts are forecasting earnings to grow 26.5% annually over the next three to five years, which is an incredible growth rate for such a massive company.

NVDA is trading at a one-year forward earnings multiple of 51.2x, which although seemingly high is still below its five-year median of 55.7x. Additionally, earnings are projected to grow 41.7% annually over the next three to five years, putting the high earnings multiple into context.

Investment Outlook

Taiwan Semiconductor’s strong earnings performance, coupled with optimistic guidance, signals continued growth for the company as it rides the wave of AI and smartphone demand. The results have helped reinvigorate confidence in the broader AI trade, especially after recent concerns about the sector’s sustainability following ASML Holdings’ earnings miss.

Overall, TSM remains a promising investment for those who believe in the potential of AI as well as the long-term demand for semiconductors. With the recent earnings beat and the AI trade seeming to pick up again, I think it’s likely that there is still more upside to be realized.

Conclusion

Imploring investors to keep an eye on Taiwan Semiconductor, the surge in earnings paints a promising picture for the AI ecosystem. As the semiconductor giant continues to navigate the demands of the AI and smartphone markets, opportunities for growth and market dominance remain on the horizon.