Two industry powerhouses, Synopsys, Inc. and Taiwan Semiconductor Manufacturing Co, are joining forces yet again to drive innovation in the realm of AI chip technology. The collaboration aims to deliver cutting-edge EDA and IP solutions utilizing Taiwan Semiconductor’s most advanced process and 3DFabric technologies, propelling advancements in AI and multi-die designs.

Ching San Wu, Corporate VP at MediaTek, emphasized the significance of Synopsys’ Custom Compiler and PrimeSim solutions in meeting the challenging silicon requirements of high-performance analog design on Taiwan Semiconductor’s N2 process.

Beyond EDA and IP solutions, the partnership is also focused on enhancing backside routing capabilities, showcasing the depth of their collaboration.

The electronic design automation company continues to support Taiwan Semiconductor’s A16 process within its digital design flow. This support ensures efficient power distribution and signal routing, optimizing design performance and density.

John Lee, vice president and general manager of the semiconductor, electronics, and optics business at Ansys Inc, highlighted the joint efforts of Synopsys, Taiwan Semiconductor, and other key players in driving innovation and shaping the future of AI and multi-die chip design.

Recent collaborations involving Ansys, Taiwan Semiconductor, and Microsoft Corp have further accelerated advancements, particularly in the realm of photonic chip simulations.

As the semiconductor industry experiences an upsurge driven by AI applications, recent upbeat quarterly performance by Micron Technology, Inc. has spurred positive momentum within the sector. Additionally, favorable U.S. Fed rate cuts are providing an added tailwind for semiconductor companies.

Investors seeking exposure to the semiconductor sector can explore opportunities through exchange-traded funds such as VanEck Semiconductor ETF and iShares Semiconductor ETF.

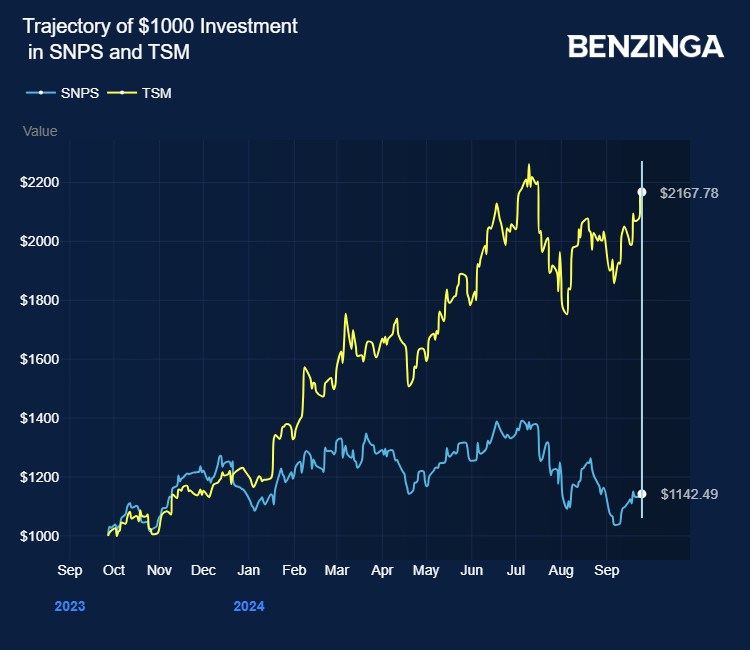

Price Actions: At the last check on Thursday, SNPS stock rose by 0.90% to $514.95, while TSM stock surged by 1.99% to $185.99.

Market News and Data brought to you by Benzinga APIs