In the tumultuous world of global markets, May was a month of stark contrasts. Stocks across the board surged, while commodities faced headwinds, based on a sample of ETF proxies that provide a snapshot of the investment landscape.

Stocks Shine, Commodities Suffer

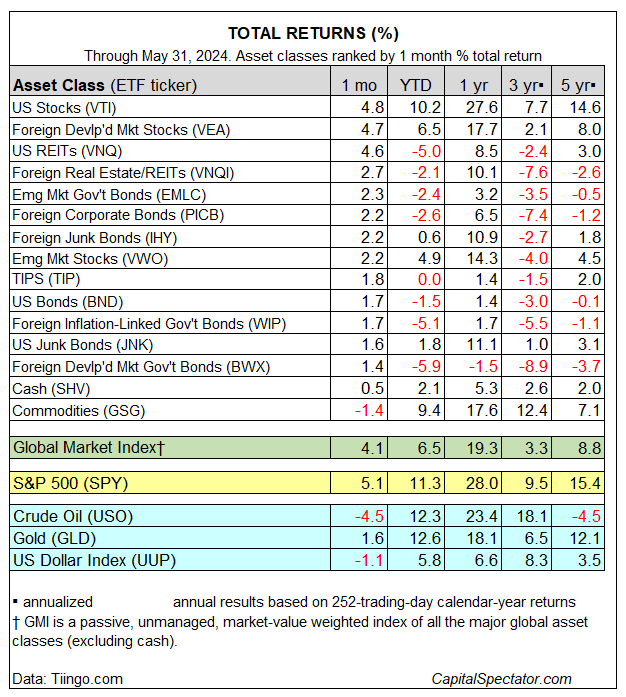

A resurgent US stock market stole the show last month, with the Vanguard Total Stock Market Index (NYSE: VTI) soaring by 4.8%. This surge marked the strongest monthly performance for American equities since February, injecting fresh optimism into market sentiment.

Moreover, developed-market stocks ex-US and US real estate investment trusts (REITs) weren’t far behind, posting commendable gains in May, further underscoring the positive momentum in equities.

On the flip side, commodities faced a tough month, evidenced by a 1.4% decline in the commodities index, marking its initial monthly retreat in the current year. The dim performance of commodities in May came as a surprise amidst the broader market fervor.

Winners and Losers

Year-to-date numbers narrate a tale of contrasting fortunes for major asset classes. US stocks (VTI) are leading the pack with an impressive 10.2% advance, underscoring the strength of the American equity market.

Commodities (GSG), although losing ground in May, still hold the second position in 2024 with a 9.4% gain. Notably, gold (GLD), a shining star, continues its meteoric rise with a 12.6% increase, making it the standout performer in the current year.

Conversely, foreign government bonds in developed markets ex-US (BWX) are deep in the red, marking a 5.9% decline in 2024. The struggles faced by foreign bonds highlight the challenges prevailing in this segment of the market.

Global Market Outlook

The Global Market Index (GMI) made a strong comeback in May, registering a robust 4.1% increase, representing the index’s best performance so far in 2024. GMI, a diverse benchmark managed by CapitalSpectator.com, covers all major asset classes (excluding cash) in market-value proportions through ETFs, making it a relevant gauge for multi-asset portfolios.

Year-to-date, GMI is up by 6.5%, with only US stocks (VTI) and commodities (GSG) exhibiting stronger rallies in 2024. Looking at a one-year horizon, GMI has delivered a solid 19.3% return, emphasizing the resilience and growth potential of the global market despite intermittent challenges.

The disparity is evident when comparing GMI’s one-year performance with the remarkable 27.6% gain of US stocks (VTI) and the modest 1.4% uptick in US bonds. This highlights the sector-specific dynamics that influence market movements and investment returns.