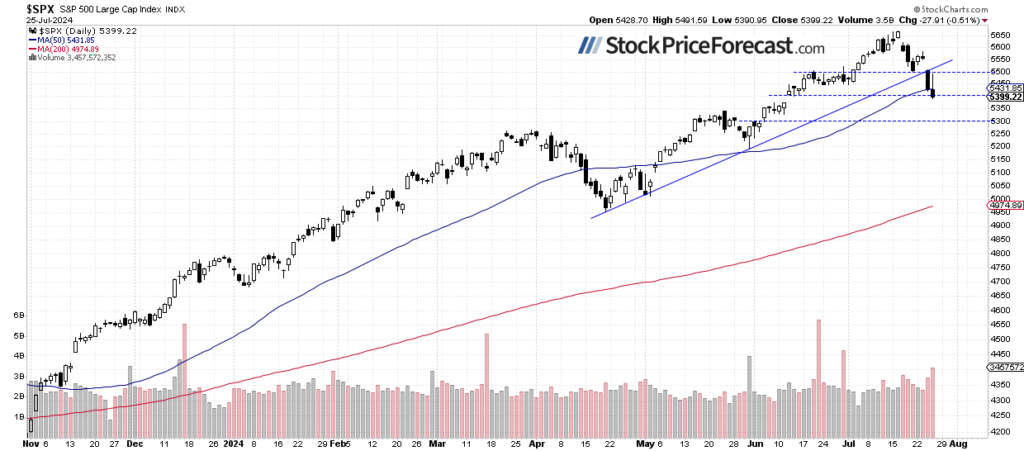

Thursday saw stocks engaging in a tumultuous dance, displaying wild swings with a trading range exceeding 100 points. The day concluded with a 0.51% dip, reflecting prevalent uncertainty and a bearish inclination. The morning light of a new day shines with the S&P 500 poised to open 0.7% higher, following the release of the Core PCE Price Index standing at +0.2% m/m – aligning with expectations.

Are we witnessing the genesis of a bottom pattern in the market? Possibility lingers, yet the discernible downtrend insinuates that recent undulations possibly signify a mere consolidation before another downward spiral. The eagerly awaited earnings report awaits us next week, alongside the pivotal FOMC Rate Decision lined up for Wednesday.

My speculative short position in the S&P 500, initiated on July 9 at 5,636, continues to reap profits.

A glimpse at investor sentiment reveals a somber narrative. Wednesday’s AAII Investor Sentiment Survey polled showed 43.2% of individual investors banking on bullish outcomes, contrasting with 31.7% leaning towards the bearish territory – a surge from last week’s 23.4%.

As previously foretold in my July stock price forecast,

“The market awaits the quarterly earnings unveiling in the latter part of the month, coupled with a series of economic data drips, including the upcoming CPI release on July 11, the Advance GDP data on July 25, and the FOMC Rate Decision scheduled for July 31.”

The S&P 500 index scraped a fresh local nadir yesterday, brushing against the crucial 5,400 mark, as palpable on the daily chart.

Nasdaq 100 Continues its Descent

The technology-centric index witnessed a 1.06% descent yesterday, trailing a significant 3.7% plunge on the previous day induced by the earnings disclosures from Alphabet and Tesla. The upcoming week anticipates more prominent tech revelations, including AAPL’s divulgence on Thursday. Despite the gloom, a semblance of a local bottom shadows the Nasdaq 100, hinting at an imminent phase of consolidation or even a resurgence.

Last Thursday’s assertion resonates loud and clear, “Signs of short-term overbought conditions suggest an impending market apex.” This forecast materialized with brutal precision in the recent market somersault and this week’s persistent sell-off.

VIX: Scaling New Heights

The VIX, the barometer of market trepidation, has oscillated around the 12-13 bracket since May. The previous week saw its uptick to 17, and in yesterday’s trading, it soared to 19.36, affirming the stocks’ downward trajectory. An intriguing historical trend emerges where a descending VIX heralds waning market jitters, intertwining with stock downturns. However, a low VIX amplifies the likelihood of a market tailspin, whereas a resurgent VIX forecasts potential market resurgence.

Futures Contract: A Symphony of Volatility

Gazing at the hourly trajectory of the S&P 500 futures contract, this morning witnessed a rebound from the 5,430 low point. The market pirouetted, dabbling around a zenith of approximately 5,533 before retracting to 5,430. This scuffle between buyers and sellers possibly signals the genesis of a transitory bottom, with the support and resistance levels anchored at 5,430-5,450 and 5,500-5,520, respectively.

Final Thoughts

Friday’s unfolding drama is poised to immerse the stock market in further suspense. The upcoming week, laden with earnings unveilings and the Federal Reserve’s much-anticipated decision on Wednesday, holds profound significance. This week’s harrowing sell-off evokes a ponderous question: Was it merely a correction, or does it mark the dawn of a descent? While historical patterns suggest a probable nadir in October, the enigmatic future rarely retraces the past. Presently, a downward trajectory seems dominant, but a flicker of an upward correction might flicker in the short term.

My speculative short position in the S&P 500 futures contract, initiated on July 9 at 5,636, now basks in more profitable waters.

Quoting from my stock price foresight for July,

“The prevailing sentiment of investors echoes the Fed’s anticipated monetary softening later this year, downplaying the likelihood of a medium-term downturn. Nonetheless, the recent skyrocketing rally raises short-term apprehensions as a retracement looms.”

For now, the somber veil of bearish outlook enshrouds the near future.

Here’s the breakdown:

- The S&P 500 index elongates its downtrend slightly, potentially fashioning a nascent bottoming pattern preceding an upward corrective phase.

- Investors eagerly anticipate the unveiling of more quarterly reports from the tech giants next week.

- In my humble assessment, the short-term forecast tilts towards the bearish spectrum.