Michael M. Santiago/Getty Images News

The S&P 500 (SP500) concluded Monday with its deepest decline in over a year, presenting an uneasy scene as few constituents managed to salvage gains amidst investor anxiety concerning a looming recession in the American economy.

Finishing down 3% at 5,186.33, the S&P 500 experienced its most significant downturn since September 2022, marking its lowest close since May 6. Only 22 of the index’s constituents closed higher as the benchmark reported its third consecutive loss. Concurrently, the Nasdaq Composite (COMP:IND) and the Dow Jones Industrial Average (DJI) also endured a third successive day of decline.

The release of the July U.S. payrolls report last Friday triggered apprehensions regarding a potential recession in the world’s largest economy. This unease has been compounded by the Federal Reserve’s hesitance to reduce the fed funds rate from its current 5.25% after a series of aggressive rate hikes throughout 2022 and 2023.

Top 5 S&P 500 Decliners in Monday’s Session

- Caesars (NASDAQ:CZR) – Daily loss: -6.9%

- Walgreens Boots (NASDAQ:WBA) – Daily loss: -6.62%

- Etsy (NASDAQ:ETSY) – Daily loss: -6.6%

- Intel (NASDAQ:INTC) – Daily loss: -6.4%

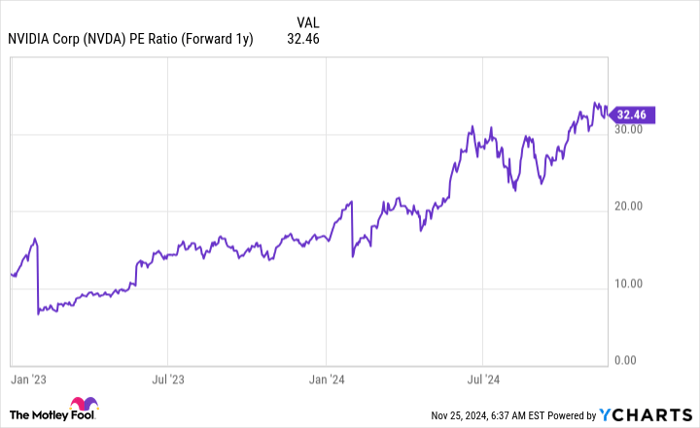

- Nvidia (NASDAQ:NVDA) – Daily loss: -6.36%

Top 5 S&P 500 Gainers in Monday’s Session

- Kellanova (NYSE:K) – Daily advance: +16.2%

- Tyson Foods (NYSE:TSN) – Daily advance: +2.1%

- CrowdStrike (NASDAQ:CRWD) – Daily advance: +1.9%

- Advanced Micro Devices (NASDAQ:AMD) – Daily advance: +1.8%

- Constellation Energy (NASDAQ:CEG) – Daily advance: +1.7%

Exchange-traded funds (ETFs) that mirror the S&P 500 include (SPY), (VOO), (IVV), (UPRO), and (SDS).