When you wade into the turbulent waters of the stock market, there is no universal formula for success. The decision to dive into a particular stock should hinge on your personal risk threshold, investment aspirations, and time constraints, all factors that can vary dramatically from one investor to another.

AI Resilience: A Bump in the Road for Alphabet

With OpenAI’s ChatGPT making waves, the tech world seems saturated with AI breakthroughs. These advancements, including generative AI tools, have cast shadows of doubt on Alphabet’s ability to monetize its own AI innovations. Despite facing setbacks like Bard’s misinformation and Gemini’s historical inaccuracies, Alphabet remains a pioneering force in AI. The company’s TensorFlow remains a foundational piece in current AI research and development.

Having amassed invaluable data from Google search, YouTube, and its conglomerate of companies, Alphabet possesses a treasure trove of information unequaled by its peers. Even though recent AI blunders may have left a dent in the company’s reputation, the underlying AI infrastructure is still robust, as reiterated in a recent earnings call by its CEO.

Revitalization in Advertising and Cloud Ventures

Alphabet’s advertising revenue stands as the bedrock of its financial empire. With Google advertising revenue surpassing $61.6 billion in the first quarter alone, up 13% from the previous year, the company has successfully diversified its revenue streams, indicating a maturing business model.

Not to be outdone, Google Cloud has displayed notable growth, boasting a 28% year-over-year revenue increase. While Alphabet may not dethrone industry giants such as Amazon Web Services and Microsoft’s Azure anytime soon, its promising momentum, especially with the integration of AI capabilities, bodes well for the future.

Delivering Value Beyond Stock Fluctuations

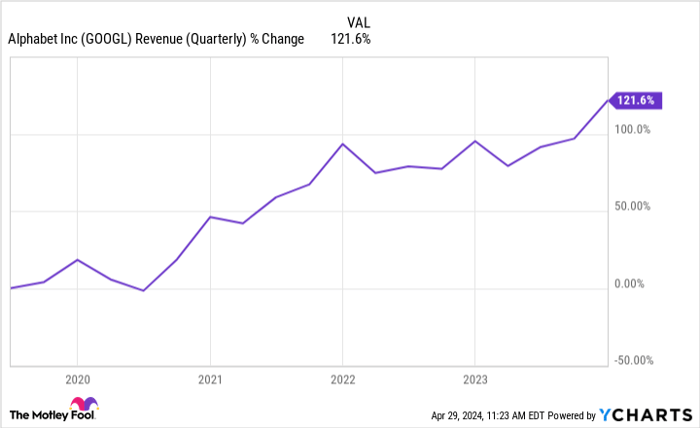

Alphabet’s commitment to shareholder value shines through its consistent buyback initiatives, averaging close to $11.5 billion quarterly over the past five years. This dedication has seen Alphabet’s earnings per share surge by over 130% during this period, with a recent $70 billion stock buyback plan reinforcing this investor-friendly approach.

Moreover, Alphabet’s foray into dividends, acknowledging income-seeking investors, echoes its peers in big tech like Microsoft, Apple, and Meta. Although the quarterly dividend yield may not be enticing for those seeking high returns, Alphabet’s robust performance, tripling the S&P 500’s returns over the last decade, signals a promising investment opportunity.

Is an Investment in Alphabet the Right Move for You?

Before diving headlong into Alphabet stock, weigh this:

The seasoned analyst team at Motley Fool Stock Advisor has pinpointed what they consider to be the next…

Unveiling the Hidden Gems: Top Stocks to Invest in Now

Redefining Investment Strategies

The allure of investing in stocks that have the potential for gargantuan returns has always been irresistible to investors hunting for hidden gems in the market. However, there are those select few recommendations that, even in hindsight, can create feelings of awe and envy among those who missed the boat.

A Blast from the Past

Let’s rewind to April 15, 2005, a day etched in the memory of smart investors. This was when Nvidia, a key player in the tech sector, graced a similar list of top stocks. For those who took the plunge and invested $1,000 based on that recommendation, today they’d be sitting on a jaw-dropping $544,015. Now, that’s what we call a return on investment!

The Stock Advisor Magic

Enter Stock Advisor, an investment service that goes beyond the mundane and offers investors a roadmap to success. Boasting a track record that speaks for itself, this service has outperformed the S&P 500 by more than four times since its inception in 2002.

Unlock the Potential

Curious to discover the next batch of promising stocks that could redefine your investment portfolio? Skip the mainstream picks and explore the unconventional choices that have the potential to surprise and delight investors. The journey of finding these hidden gems is not just about returns but also about the thrill of unearthing the next big thing in the stock market.