Wall Street Views on Alibaba (BABA)

When considering investment decisions, investors often look to analyst recommendations as a guiding light. Media coverage of rating modifications by these sell-side analysts can significantly impact a stock’s price. But how much credence should investors place on these recommendations?

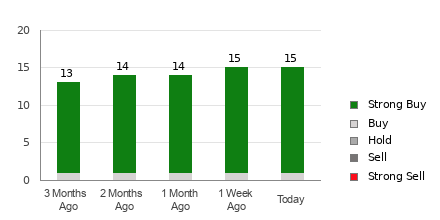

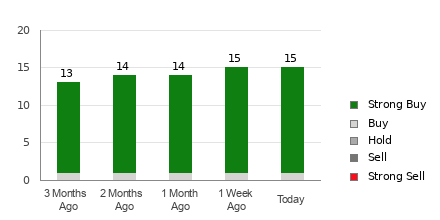

Alibaba (BABA) currently holds an average brokerage recommendation (ABR) of 1.27, falling between Strong Buy and Buy on a scale of 1 to 5, based on the actual recommendations of 15 brokerage firms. Notably, 13 out of these 15 recommendations tag Alibaba as a Strong Buy, accounting for a substantial 86.7%.

Brokerage Recommendation Trends for BABA

While the ABR indicates a buy recommendation for Alibaba, it’s imperative for investors to be cautious when solely relying on this data. Multiple studies have revealed the limited efficacy of brokerage recommendations in identifying stocks with the highest price increase potential.

One pertinent reason for this is the inherent positive bias that brokerage firms have towards stocks they cover. Research indicates that for every “Strong Sell” recommendation, analysts often assign five “Strong Buy” ratings, suggesting that their interests aren’t always aligned with those of everyday investors, diminishing their predictive value.

Amidst this backdrop, the Zacks Rank, a tool with a noteworthy audited track record, classifies stocks into five categories, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), offering a reliable indicator of a stock’s near-term performance when used in conjunction with the ABR.

Understanding Zacks Rank and ABR

While both utilize a 1-5 scale, the Zacks Rank and ABR are distinct measures. Brokerage recommendations form the basis of ABR and are typically displayed in decimals, whereas the Zacks Rank hinges on earnings estimate revisions and is represented in whole numbers.

Brokerage analysts, due to their employers’ vested interests, tend to issue overly optimistic recommendations, often misleading investors. In contrast, the Zacks Rank, being driven by earnings estimate revisions, has demonstrated a strong correlation with short-term stock price movements, offering a more reliable assessment.

Moreover, the Zacks Rank is consistently applied to all stocks with current-year earnings estimates from brokerage analysts, ensuring balanced categorization. It also excels in offering timely forecasts, given that analysts are prompt in revising their earnings estimates to reflect changing business trends.

Is Alibaba (BABA) A Viable Investment?

Notably, the Zacks Consensus Estimate for Alibaba’s current-year earnings has remained unchanged at $9.12 over the past month, reflecting analysts’ unwavering views on the company’s earnings prospects. Consequently, Alibaba presently holds a Zacks Rank #3 (Hold), suggesting it could perform in line with the broader market in the near future.

Considering these factors, it may be judicious for investors to exercise caution with Alibaba, despite the Buy-equivalent ABR.

Zacks Names #1 Semiconductor Stock

While theoretically appealing, the ABR may not always reflect the full picture when it comes to investment decisions. Therefore, it’s crucial for investors to integrate additional robust tools like the Zacks Rank to make informed choices.