A New Gamechanger in the Affirm Narrative

Shares of the buy now, pay later (BNPL) leader Affirm saw a meteoric 17% rise over two trading sessions after unveiling a groundbreaking partnership with tech giant Apple. The news signifies that Affirm’s BNPL service will seamlessly integrate with Apple Pay, enabling users to pay for purchases over time directly through the payment platform.

Analysts Engage in Affirm’s Apple Odyssey

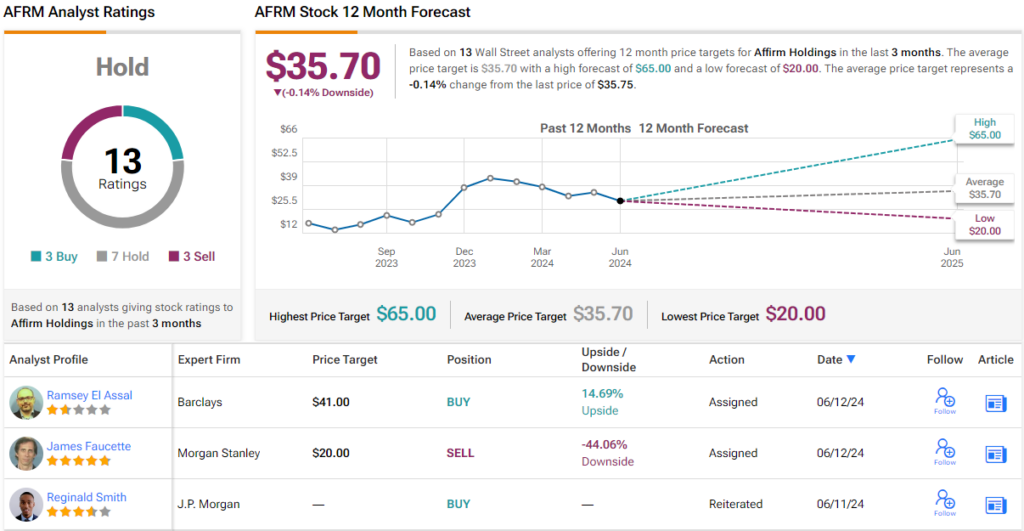

Barclays analyst Ramsey El-Assal highlighted that the partnership positions Affirm as the exclusive BNPL player on Apple Pay, while also allowing the company to collaborate with other checkout providers. The versatility extends to Apple users who won’t require an Affirm Card to access BNPL services on Apple Pay. According to El-Assal, this integration is slated to commence with Apple’s iOS 17 rollout in September 2024.

The Long-Term Apple-Affirm Tandem Potential

Despite signaling a lack of material impact on revenue for fiscal year 2025, the partnership sparked a significant stock surge. El-Assal views the collaboration as a stepping stone toward potential expansion into multiple geographies and finance offerings. In contrast, BTIG analyst Andrew Harte, whilst acknowledging the partnership’s importance, remains cautiously optimistic and maintains a Neutral rating on Affirm.

A Dash of Realism Amidst The Buzz

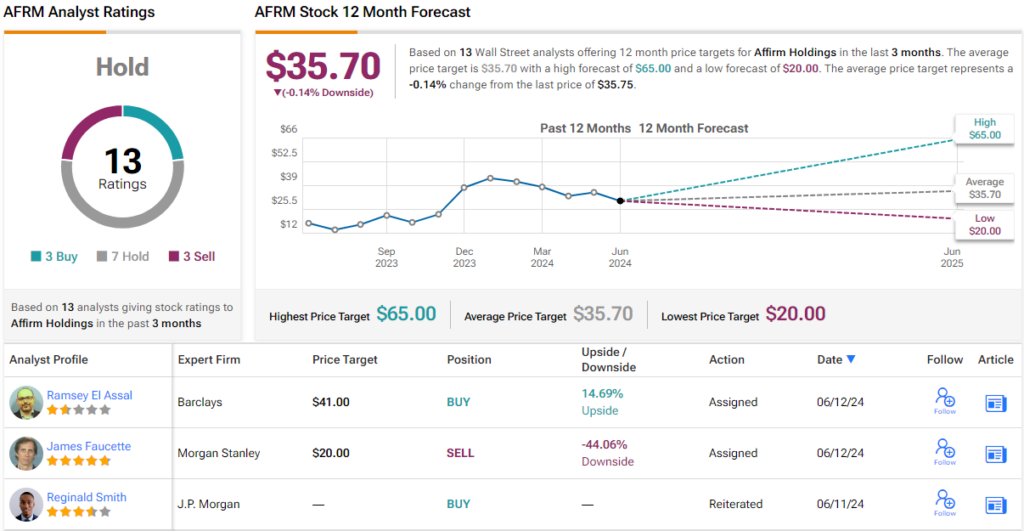

Consequently, Affirm’s future may seem lackluster according to Wall Street, as indicated by a Hold consensus from analysts. Currently trading at $35.75, the stock aligns closely with the average price target of $35.70, alluding to its fully valued status.

To explore undervalued stock offerings, investors can leverage TipRanks’ Best Stocks to Buy tool, amalgamating all of TipRanks’ equity insights.

Disclaimer: The expressed opinions in this piece are solely those of the analysts mentioned. This content should serve informational purposes solely. Always conduct your analysis before investing.